October 29, 2019

Grifols increases its revenues by 14.5% to EUR 3,738 million

- Solid third-quarter performance drives revenue growth, increases operating cash flows, reduces debt and consolidates the upward trend in its operating margins for the first nine months of the year

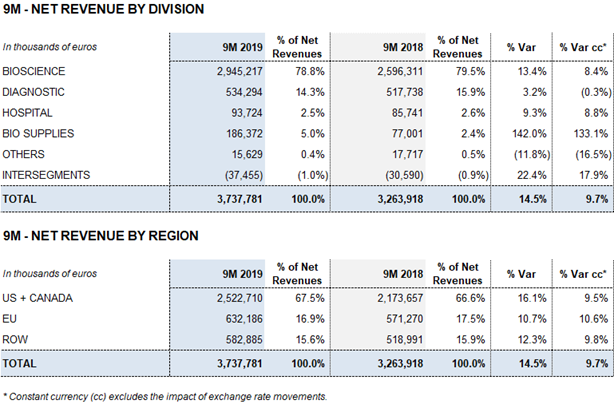

- The Bioscience Division continues to lead revenue growth, increasing by 13.4% (8.4% cc1) to EUR 2,945 million, driven by solid demand of the main plasma proteins

- Diagnostic Division sales increase to EUR 534 million (3.2%; -0.3% cc) and the Hospital Division grows by 9.3% (8.8% cc) to EUR 94 million. The Bio Supplies Division reports EUR 186 million in revenues

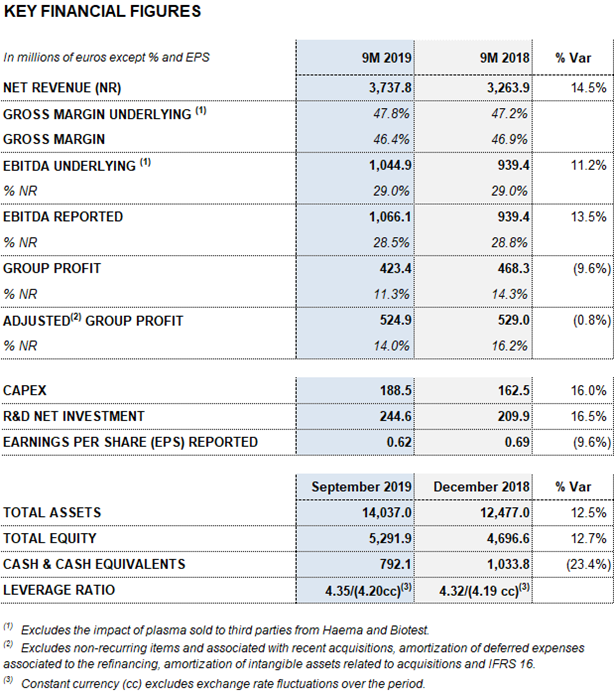

- Reported EBITDA totals EUR 1,066 million, an increase of 13.5%, representing a 28.5% margin. Net profit reaches EUR 423 million

- The net debt leverage ratio declines to 4.35x (4.20x cc)

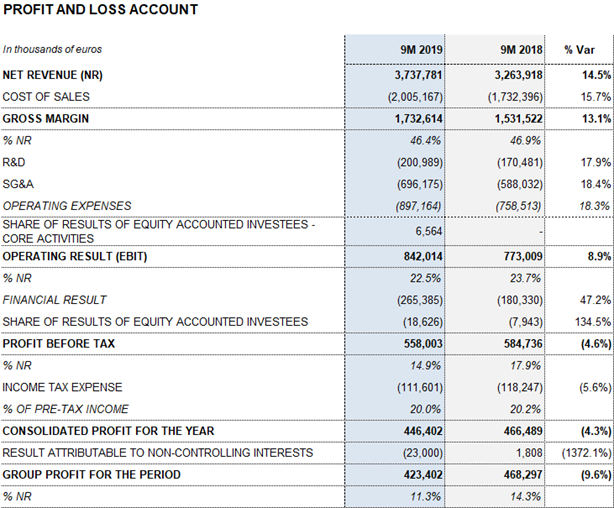

Barcelona, October 29, 2019.- Grifols (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS) reported EUR 3,737.8 million in revenues for the first nine months of 2019, growing by 14.5% and 9.7% excluding exchange rate variations for the period (cc).

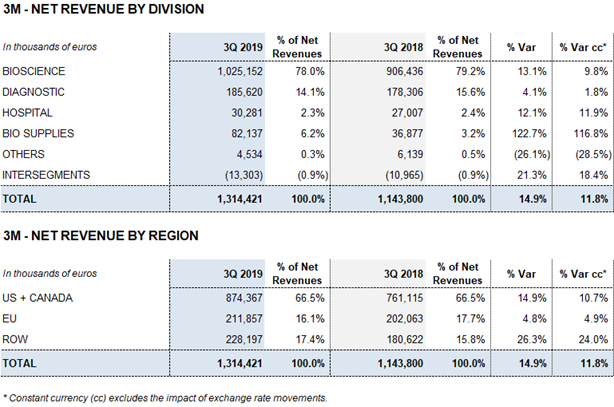

Revenues rose sharply in the third quarter, increasing by 14.9% (11.8% cc). The main growth drivers were robust demand for the Bioscience Division’s main plasma proteins, which noted 13.1% (9.8% cc) growth, and the positive performance of the Diagnostic Division (4.1% and 1.8% cc), Hospital Division (12.1% and 11.9% cc) and Bio Supplies Division (122.7% and 116.8% cc).

The Bioscience Division continues to serve as the company’s primary growth engine. The division’s revenues grew by 13.4% (8.4% cc) over the first three quarters to EUR 2,945.2 million. Immunoglobulins sales attained double-digit growth and were particularly strong in the United States. Also of note were the recovery of albumin sales in China, projected following license renewals, and the upswing in sales of alpha-1 antitrypsin.

Revenues from the Diagnostic Division reached EUR 534.3 million for the first nine months of 2019, increasing by 3.2% (-0.3% cc). The transfusion medicine business line, led by the growth of the blood typing business in the U.S and China, contributed to the division’s revenue growth.

Hospital Division revenues grew by 9.3% (8.8% cc) to EUR 93.7 million, driven by strong sales in all of its business lines. The Bio Supplies Division expanded by 142.0% (133.1% cc) to EUR 186.4 million over the first nine months of 2019.

Grifols sustained the upward trend in its operating margins in the third quarter of 2019. As of September 30, its gross margin was 46.4% (47.8% underlying), driven by strong demand for the main plasma proteins, optimized manufacturing efficiencies and a positive cost evolution of plasma. Reported EBITDA for the first nine months of 2019 increased by 13.5% to EUR 1,066.1 million, with a 28.5% margin. Underlying EBITDA2 was 29.0%.

Grifols continued to focus on innovation in the first three quarters to promote its long-term sustainable growth. Net R+D+i investments reached EUR 244.6 million, increasing by 16.5% compared to the same period last year. This figure includes in-house, external and investee-led projects.

Grifols also moved ahead with its planned CAPEX investments, allocating EUR 188.5 million (an increase of 16.0%) in the first three quarters to bolster its manufacturing capacity. These investments align with the company’s overriding objective to anticipate and meet the market’s evolving needs, which is among its strategic growth pillars.

Grifols’ financial results totaled EUR 265.4 million. The cost of debt remained stable in the third quarter compared to previous quarters at EUR 88.5 million, although exchange rate variations wielded a negative impact of EUR 9.3 million.

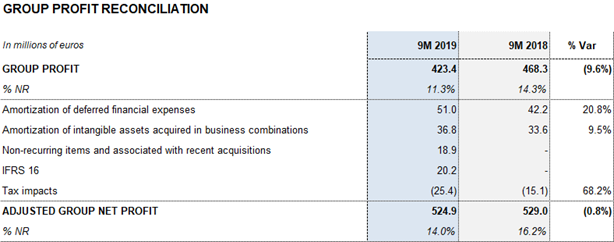

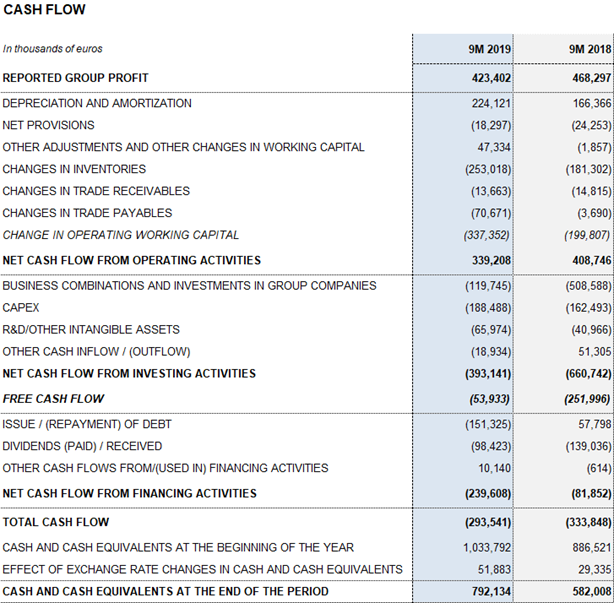

Net profit totaled EUR 423.4 million in the first nine months of the year, representing a 9.6% decrease compared to the same period last year. This decline is mainly due to the evolution of interest rates and changes in accounting standards for leases (IFRS 16), which amounted to EUR 20.2 million from January to September 2019. In 2018, Grifols’ net results included a financial positive impact of EUR 32 million generated from the divestment in TiGenix.

The effective tax rate remained at 20%.

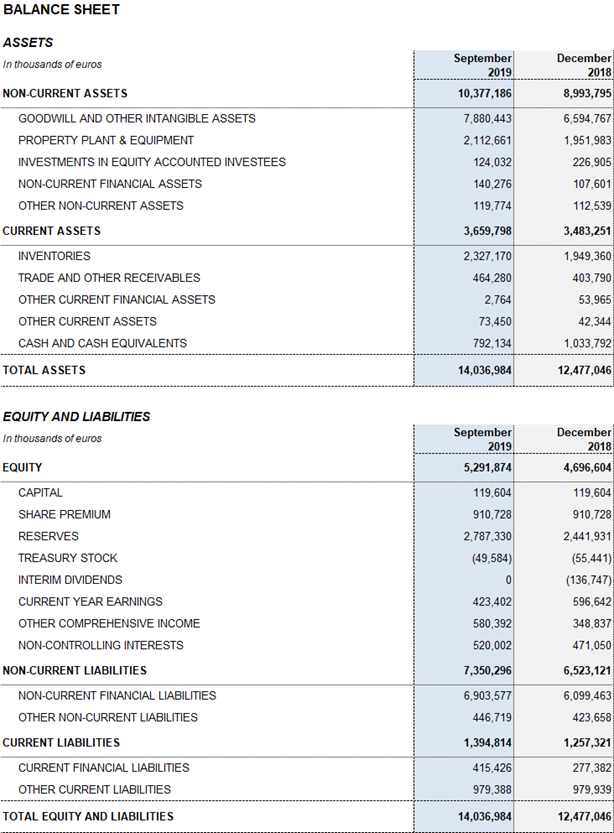

Excluding the impact of IFRS 163, Grifols’ net financial debt stood at EUR 5,803.6 million, including EUR 792.1 million in cash. The net financial debt over EBITDA fell to 4.35x (4.20x cc), a significant improvement compared to the 4.78x reported in the first quarter of 2019.

Effective financial management remains a key priority for Grifols in order to optimize and reduce its debt levels and maintain a strong cash position. Inventory levels increased as a result of the strategic decision to continue building up plasma volumes to meet the strong demand for plasma therapies.

The company maintains a solid operating cash generation to meet its planned growth initiatives. Cash generation reached EUR 339.2 million over the first nine months of the year.

As of September 30, 2019, Grifols had EUR 792.1 million in cash positions and more than EUR 420 million in undrawn lines of credit, raising its liquidity position to over EUR 1,200 million.

REVENUE PERFORMANCE

Bioscience Division

The Bioscience Division reported more than EUR 1,000 million in revenues for the second consecutive quarter. In the third quarter of 2019, the division reported EUR 1,025.2 million in sales, which grew by 13.1% (9.8% cc) compared to the same period last year.

Following this positive upward trend in the third quarter, the division’s revenues grew by 13.4% (8.4% cc) to EUR 2,945.2 million during the first nine months of the year.

Solid demand for the main plasma proteins – especially immunoglobulins, albumin and alpha-1 antitrypsin – served as the division’s primary growth drivers.

The demand for immunoglobulins remains exceptionally strong in all regions where Grifols operates, particularly in the U.S. and the main European markets, which saw double-digit growth in sales.

Grifols is committed to developing new formulations and indications in order to meet the evolving needs of patients. To this end, Grifols received FDA approval in July 2019 for XembifyTM, a 20% subcutaneous immunoglobulin that enhances its portfolio of products to treat primary immunodeficiencies. The company is planning the U.S. launch of XembifyTM in last quarter of 2019 and is currently working with global health authorities to obtain approval in Canada, Europe and other global markets.

Revenues of alpha-1 antitrypsin continue to rise. Grifols’ sale efforts and higher diagnosis rates have led to increased market penetration in European Union (EU) countries and a stronger position in the U.S., its main market. Grifols continues its efforts to improve the diagnosis rates of alpha-1 antitrypsin deficiency by developing in-house innovations, such as the AlphaKitTM (blood test) and AlphaIDTM (oral test).

Albumin sales grew significantly, particularly in the U.S., several EU countries and China, where growth was projected following the renewal of certain licenses.

Sales of factor VIII followed a similar pattern as that seen in previous quarters. The company’s efforts to position factor VIII as the best treatment for patients with hemophilia A, especially in the U.S. and emerging markets, have allowed it to maintain its sales volume.

Grifols continues to promote its specialty proteins to expand its product portfolio. The company also reported strong sales of hyperimmune immunoglobulins in the third quarter, particularly the new formulation for its anti-rabies immunoglobulin (HyperRAB®).

Diagnostic Division

The Diagnostic Division grew by 4.1% (1.8% cc) in the third quarter to EUR 185.6 million, contributing to a 3.2% (-0.3% cc) increase in revenues in 2019, which totaled EUR 534.3 million for the first nine months of the year.

Revenues from the transfusion medicine line continue to drive growth. Sales of NAT technology systems (Procleix® NAT Solutions), used to detect viruses in blood and plasma donations, maintained their contribution to the division’s overall performance. The company installed the first Procleix Panther® systems in Peru as part of its global expansion efforts. After receiving the CE marking, the division will launch its innovative Procleix® Panther® system with Automated Ready Technology (ART), designed to optimize laboratory workplace flows.

Over the last 12 months the division has successfully continued its strategy of geographic expansion bringing NAT technology to Malta, Hungary, Slovakia, Bulgaria, Botswana, Panama and Ecuador.

The blood typing line, which includes analyzers (Wadiana®, Erytra® and Erytra Eflexys®), gel cards (DG-Gel®) and reagents, grew by double digits. Sales were especially dynamic in China, a market with high growth potential for the division; the United States, its core market that continues to expand thanks to the firm’s strategic investments; and specific countries in Europe (such as Italy and Switzerland) and LATAM (such as Argentina, Mexico and Brazil).

Grifols continues working to bolster sales of recombinant proteins, used to produce diagnostic immunoassays. The agreement signed with the South Korean firm PCL in the third quarter will enable Grifols to bolster this business line.

The division also reported a notable sales upturn of blood-collection bags, a segment that will grow after operations commence in the new plant in Brazil in October 2019. The plant’s production output will initially meet the demand of the Brazilian market, although Grifols aims to boost its presence in other Latin American markets over the next two years as its obtains the necessary regulatory approvals.

Stable revenues were reported in the specialized diagnostics line, a business area that will benefit as the product portfolio of clinical diagnostics gradually expands. To this end, of note are the FDA approvals of QNext®, a coagulometer developed in-house, and DG-PT (thromboplastin), one of the main reagents to promote hemostasis. With this latter approval, Grifols became the first company in more than 15 years to earn authorization in the U.S. market to sell instruments and reagents for routine hemostasis testing.

Hospital Division

The Hospital Division continued to grow in the third quarter of 2019. Sales in 3Q 2019 increased by 12.1% (11.9% cc) to EUR 30.3 million. The division grew by 9.3% (8.8% cc) to EUR 93.7 million in the first nine months of the year.

Growth was seen in all of the division’s business lines. These include Pharmatech, comprised by the inclusiv® product portfolio of equipment; software and IV solutions designed to optimize the safety, efficiency and handling operations of hospital pharmacies, as well as MedKeeper® and Kiro Grifols® technological solutions; intravenous solutions, led by the U.S. distribution of the physiological saline solution manufactured in Grifols’ Murcia (Spain) plant and its use in Grifols’ plasma centers; medical devices, clinical nutrition products and third-party manufacturing services.

Bio Supplies Division

The Bio Supplies Division generated EUR 186.4 million in revenues over the first nine months of the year, growing by 142.0% (133.1% cc) compared to the same period last year.

The division’s growth stems primarily from sales of biological products for non-therapeutic uses and third-party plasma through Haema and Biotest (EUR 131.6 million for the first three quarters).

CORPORATE TRANSACTIONS, R+D+i and CAPEX

Grifols presents additional encouraging results of the AMBAR trial at AAIC in Los Angeles (U.S.)

Grifols presented additional findings on its AMBAR (Alzheimer Management by Albumin Replacement) clinical trial for the treatment of Alzheimer’s disease at the Alzheimer’s Association International Conference (AAIC), held last July in Los Angeles (USA).

These results complement and confirm those presented in October 2018 for patients in both the mild and moderate stages of the disease. They also point in the same direction as those unveiled at the 14th International Congress on Alzheimer's and Parkinson's (AD/PD) in Lisbon (Portugal) in March 2019.

These latest findings center on two scales that evaluate the cognitive and daily living status of patients: CDR-Sb (Clinical Dementia Rating – Sum of Boxes) and ADCS-CGIC (Alzheimer’s Disease Cooperative Study – Clinical Global Impression of Change).

The results showed a statistically significant reduction in disease progression in all patients treated, regardless of the stage of the disease (mild or moderate).

In particular, the CDR-Sb scale – which assesses memory, orientation, reasoning, planning and problem-solving – shows a statistically significant 71% less decline with respect to placebo in patients treated as a whole. This significance remains when analyzing the three study treatment arms separately, with less decline at 14 months which ranged 65-71%.

Results of ADCS-CGIC scale follow a similar line: a highly statistically significant stabilization is observed in all treated patients with respect to placebo. This effect remains in all three treatment arms when analyzed separately. This scale evaluates several domains of cognition, daily functioning and behavior from both patient and caregiver perspectives.

Another result shared at AAIC was that the plasma amyloid-beta saw-tooth mobilization pattern, observed in earlier clinical trials, proved to be similar for both conventional and low-volume plasmapheresis performed in the AMBAR trial. This finding reinforces the investigational use of smaller volumes of plasma protein replacement therapies.

Grifols plans to release complete clinical results, including biomarkers and neuroimaging results, on December 6, 2019 at the Clinical Trials on Alzheimer’s Disease (CTAD) Conference in San Diego (USA).

First project in Africa

In the third quarter of 2019, Grifols reached an agreement with Soludia Maghreb, a Morocco-based provider of hemodialysis solutions, to build a new production line of intravenous solutions in the country.

Under the agreement, Grifols will develop, build and automate the main process equipment for the IV solutions line, while Grifols Engineering will design a leading-edge manufacturing line to produce IV solutions bags.

Scheduled to open in 2020, the plant is Grifols’ first industrial venture on the African continent.

Capital investments (CAPEX)

Grifols invested EUR 188.5 million in the first three quarters of 2019 to further enhance and expand the production capacities of its four divisions. The company continues its scheduled investments outlined in the 2018-2022 Capital Investment Plan, endowed with EUR 1,400 million to guarantee Grifols’ long-term sustainable growth.

In the third quarter, Grifols was awarded with Spain’s Industrial Excellence Award (IEA), which highlighted the company’s successful business models and supply chain management.

1Constant currency (cc) excludes exchange rate fluctuations over the period.

2Excludes third-party plasma sales carried out by Haema and Biotest.

3As of September 30, 2019, the impact from the application of IFRS 16 on the debt total was more than EUR 723 million.