February 27, 2020

Grifols reaches revenue of EUR 5,100 million, a 13.6% increase, and raises its profits to EUR 625 million

-

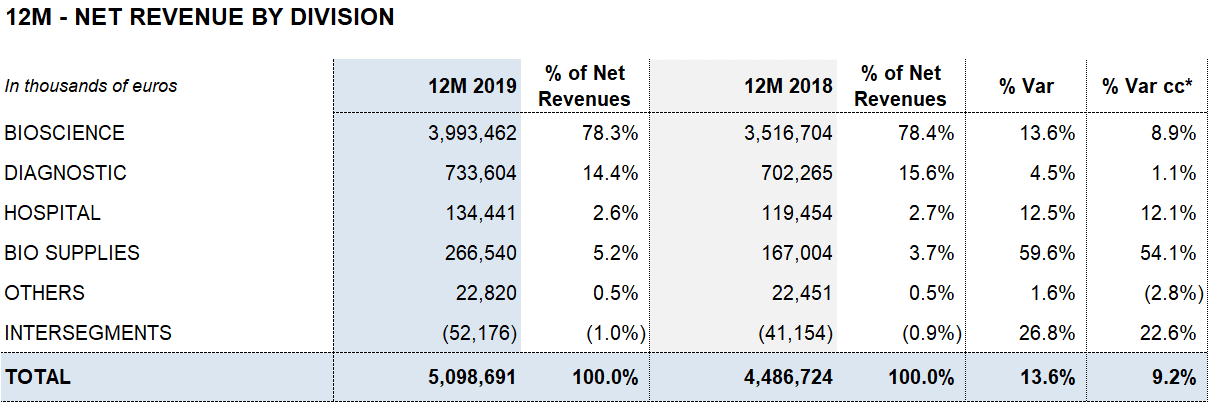

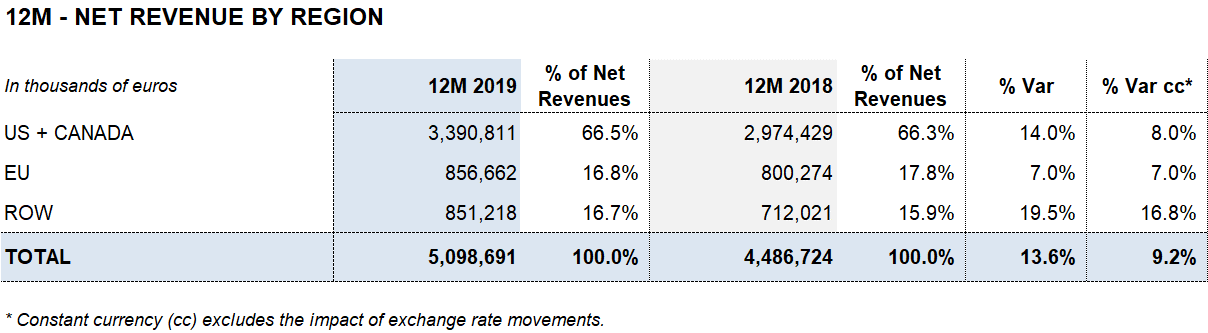

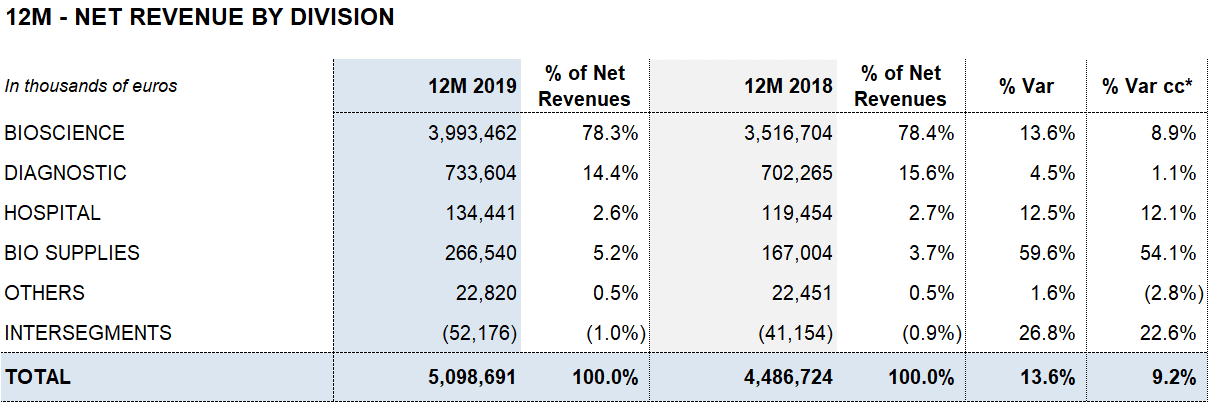

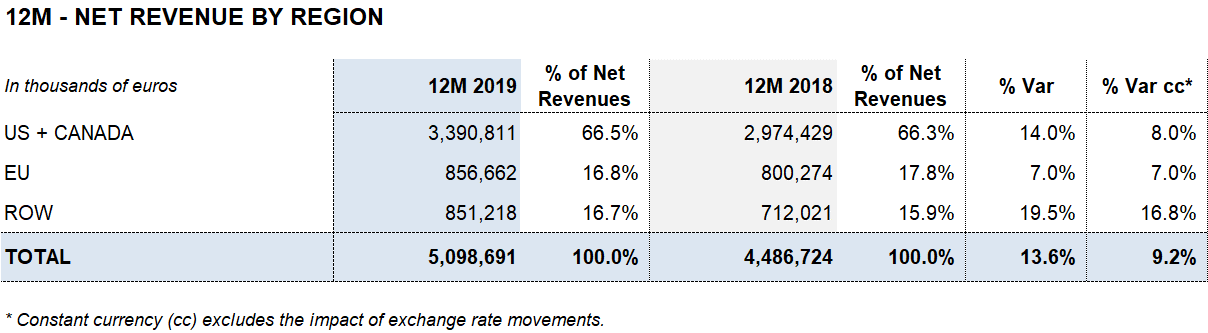

Revenue increases 13.6% (9.2% cc) as a result of the sustainable growth strategy, with advances in all divisions and regions

-

Bioscience leads the growth with EUR 3,994 million of revenue (13.6%; 8.9% cc). Diagnostic and Hospital continue to make progress with sales of EUR 734 million (4.5%; 1.1% cc) and EUR 134 million (12.5%; 12.1% cc), respectively. Bio Supplies achieves EUR 267 million in revenues, growing by 59.6% (54.1% cc)

-

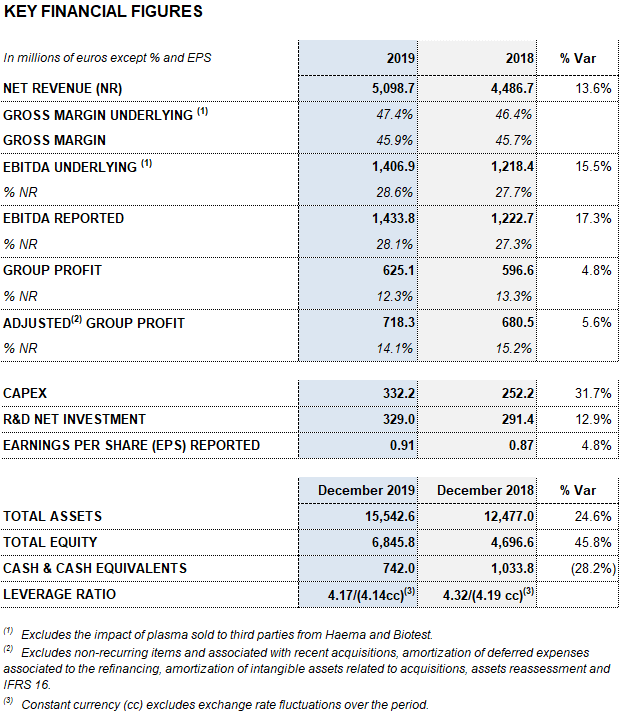

Profitability improves: the underlying gross margin stands at 47.4% and the underlying EBITDA margin at 28.6% on revenue

-

EBITDA increases to EUR 1,434 million (17.3%)

-

Greater investment effort: more than EUR 660 million allocated to R&D and productive investments (22%)

-

Grifols confirms its commitment to reduce the net debt ratio, which decreases to 4.17x

-

Successfully close the debt refinancing process amounting to EUR 5,800 million

-

Grifols’ workforce increases 13% to more than 24,000 people (60% women)

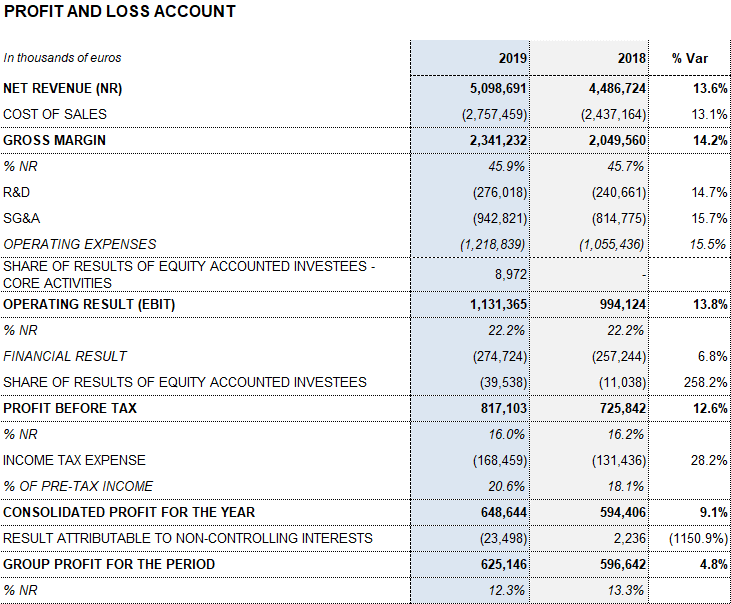

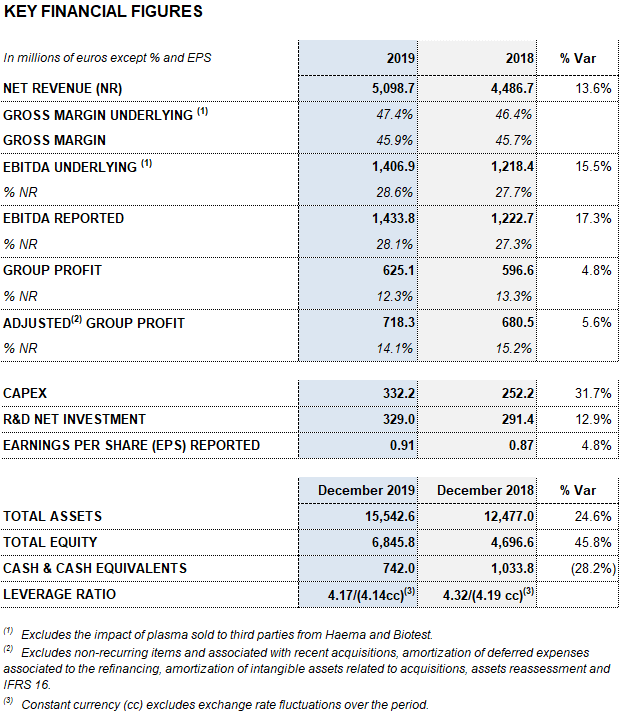

Barcelona, February 27, 2020.- Grifols (MCE:GRF, MCE:GRF.P, NASDAQ:GRFS) closed the 2019 financial year with record high revenues of EUR 5,099 million, representing a growth of 13.6% and 9.2% cc1. The company’s long-term sustainable strategy led to growth in all of its divisions and geographic regions where it operates.

Over the last years, the company’s strategic investments to increase its access to plasma, as well as greater efforts to boost its sales activities and operations, all contributed to the group’s solid performance.

The Bioscience Division continues to serve as Grifols’ main growth engine. The division increased revenues by 13.6% (8.9% cc) to EUR 3,994 million. Sales of immunoglobulins (including specialty immunoglobulins), were especially strong, growing by double digits, particularly in the United States. Also noteworthy was the recovery of albumin sales in China following the renewal of certain licenses and the upward trend in alpha-1 antitrypsin sales.

The Diagnostic Division’s sales grew by 4.5% (1.1% cc) to EUR 734 million. Revenues generated from transfusion medicine solutions continue to drive the division´s performance with a positive upward trend in NAT donor-screening solutions, used to detect viruses in blood and plasma donations, blood typing and recombinant proteins.

The Hospital Division’s revenues expanded by 12.5% (12.1% cc) to EUR 134 million, with growth in all business lines. While the Bio Supplies Division achieved EUR 267 million in revenues, growing by 59.6% (54.1% cc).

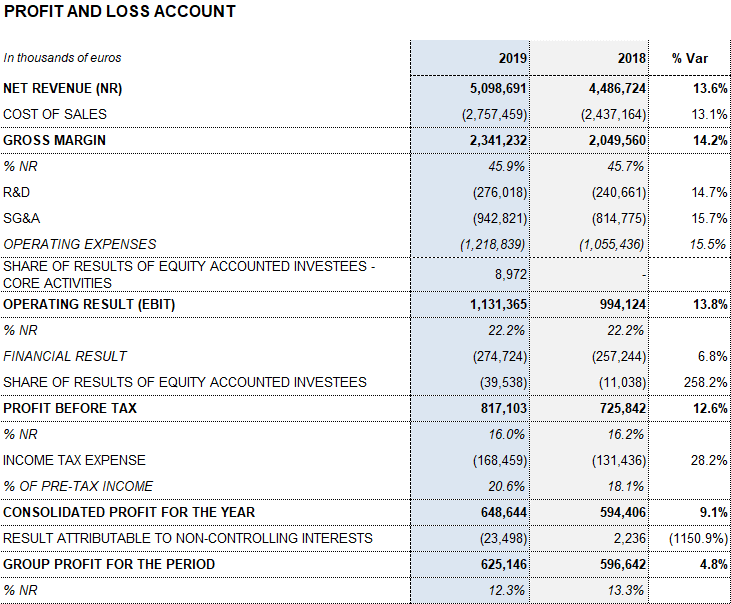

The company attained higher operating margins throughout the fiscal year. The gross margin was 45.9% (45.7% in 2018), driven by solid demand of the main plasma proteins, enhanced production efficiencies and a stable the cost of plasma. The underlying gross margin2 was 47.4% (46.4% in 2018).

Grifols established itself as the leading plasma centers company with 295 managed centers, including 35 centers (26 plasma, 9 blood donation centers and an analytical laboratory), after exercising the call option on the remaining 51% of the capital of Interstate Blood Bank Inc (IBBI).

Meanwhile, the reported EBITDA increased by 17.3% to EUR 1,434 million, representing a 28.1% margin (27.3% in 2018). The underlying EBITDA margin represents 28.6% of revenues (27.7% in 2018).

In 2019, as key drivers of its long-term, sustainable growth, Grifols allocated EUR 661 million to promote innovation and productive investments. Net R&D investments increased by 12.9% to EUR 329 million (EUR 291.4 million in 2018), including internal, external and investee projects. Grifols also advanced in its capital investments plan, allocating a total of EUR 332.2 million (EUR 252.2 million in 2018), up by 31.7%, to expedite the expansion of the Bioscience Division’s production capacity and the growth of the other divisions.

The financial result amounts to EUR 274.7 million. It includes the positive accounting impact recorded in the fourth quarter of 2019 for a net amount of EUR 42,2 million related mainly to the refinancing process.

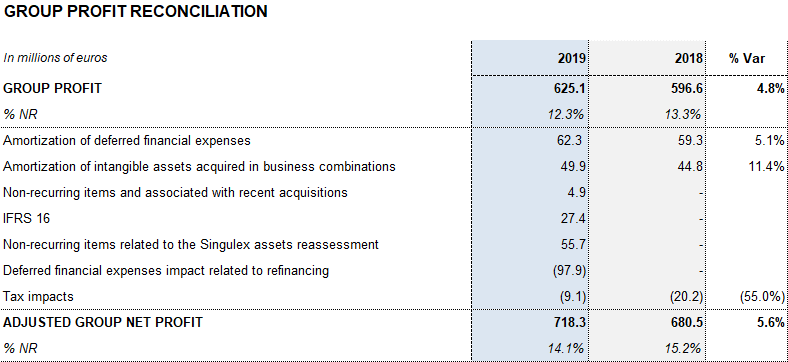

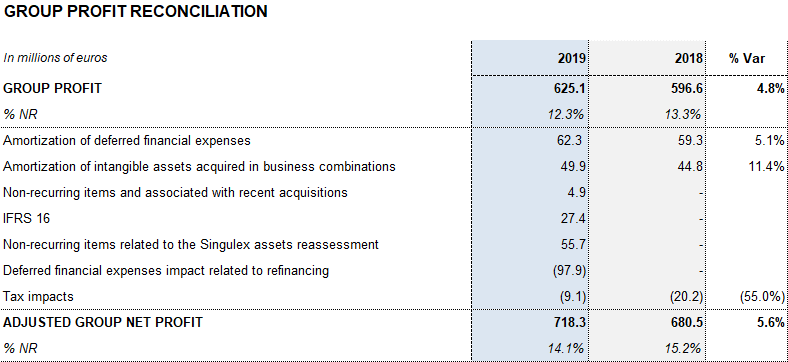

The company grew by 4.8% in 2019, achieving EUR 625 million in net profits.

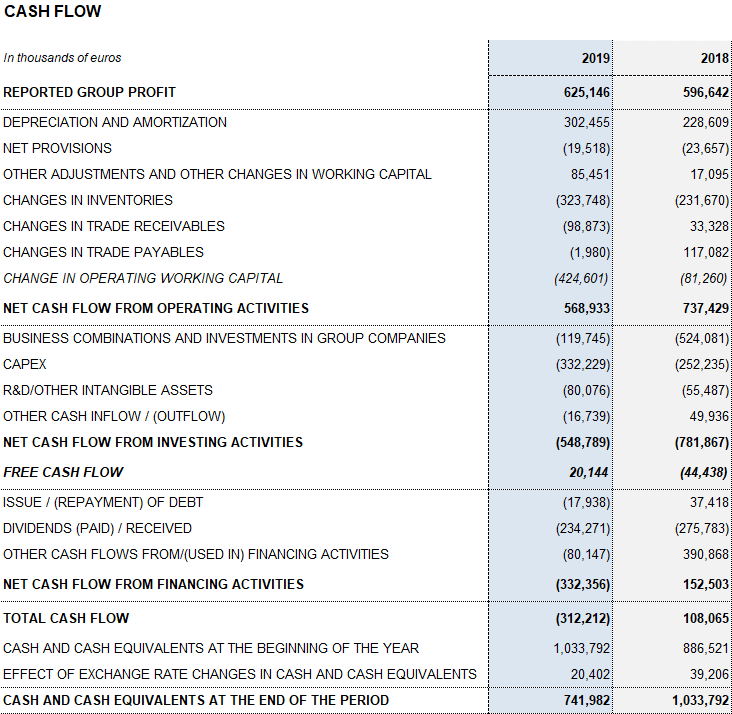

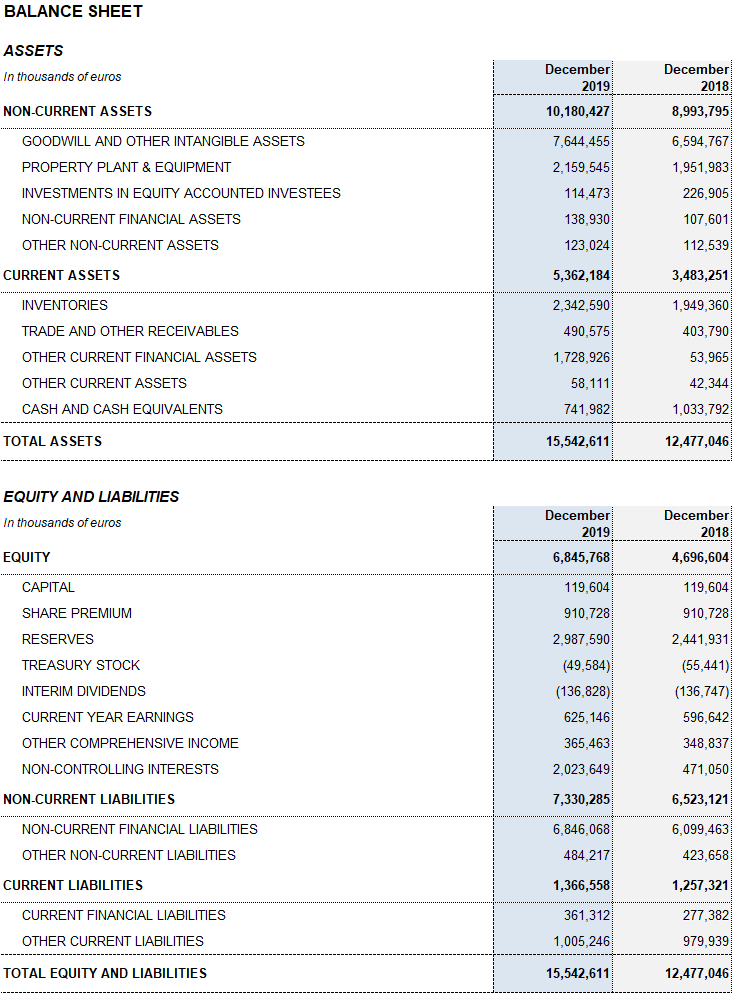

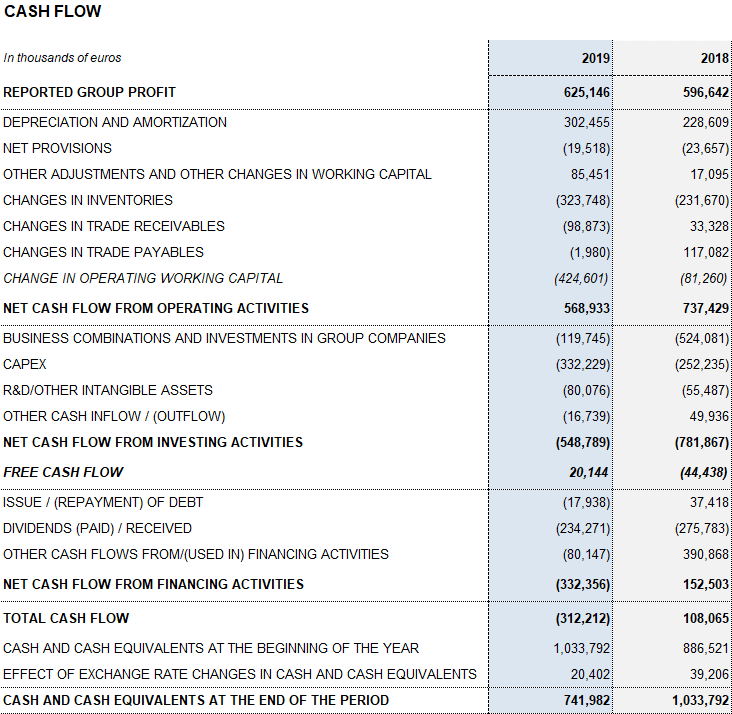

Excluding the impact of IFRS 163, as of December 31, 2019 Grifols’ net financial debt totaled EUR 5,725 million, including EUR 742 million in cash. The company has EUR 532 million in undrawn lines of credit, increasing its liquidity position to EUR 1,274 million.

The company progressively improved its debt-to equity ratios in 2019, attaining a net debt leverage ratio of 4.17 times in December 2019 from the maximum of 4.78 times in 1Q 2019.

Following its strategic investments of recent years, effective financial management remains a key priority for Grifols in order to optimize and reduce its debt levels. Thus, the company maintains sustainable operational levels and a solid operating cash generation. Cash generation reached EUR 568.9 million in 2019, allowing Grifols to carry out its planned investments and meet anticipated increases in demand.

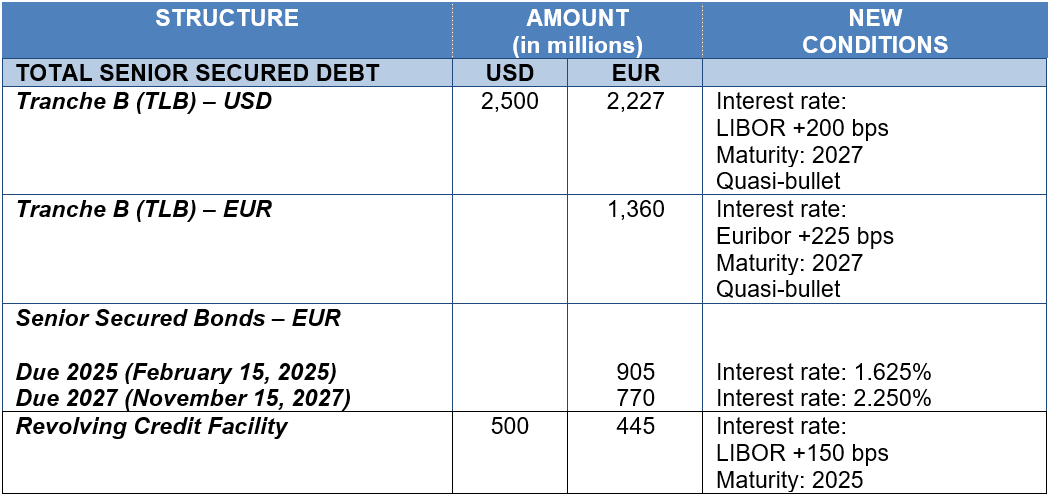

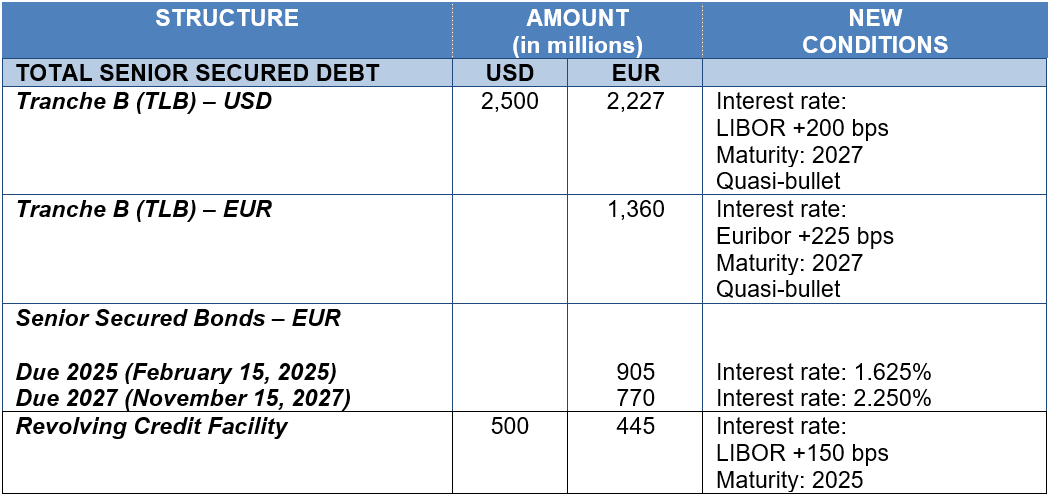

Initiated on October 28, Grifols’ debt-refinancing process was concluded in record time on November 15 for EUR 5,800 million. Well-accepted by markets, the new financing includes Term Loan B (TLB) for USD 2,500 million and EUR 1,360 million, both aimed at institutional investors; the issue of two bonds for EUR 1,675 million (Senior Secured Notes); and extension of a multi-currency revolving credit facility (RCF) of up to USD 500 million.

The debt-refinancing optimizes Grifols’ financial structure and significantly improves all financing

conditions, including average cost of debt is 2.8% (reduction of 80bps) and average maturity increases to more than 7 years. It also provides with greater flexibility on the terms of the covenants (cov-lite).

Following the debt-refinancing, Grifols’ financial structure and conditions are as follows:

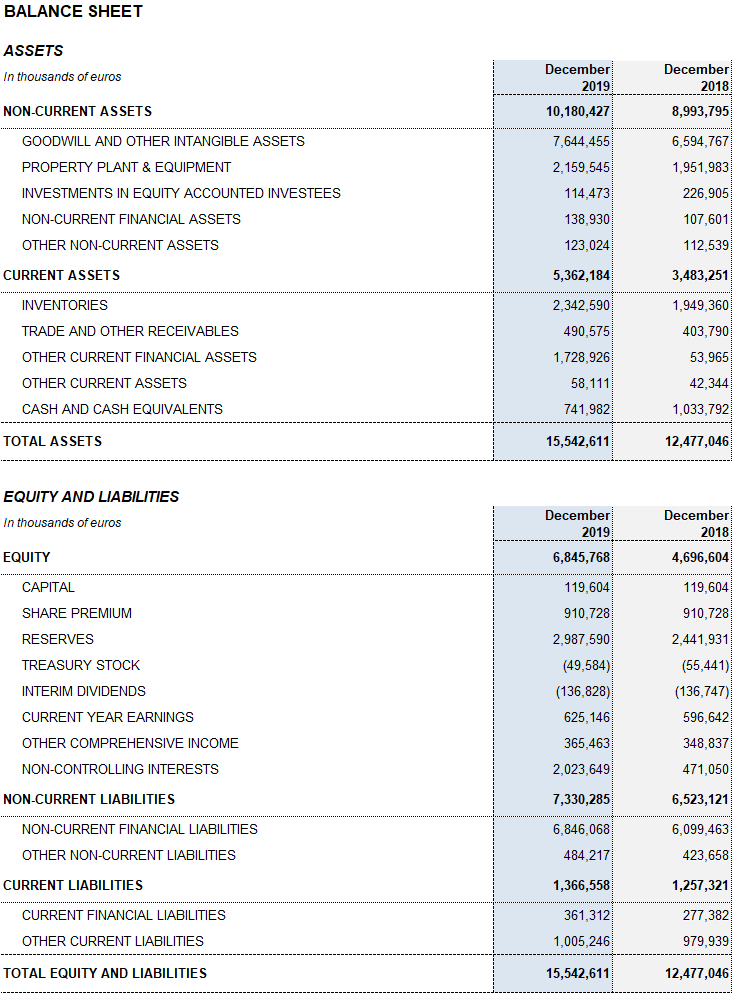

Grifols’ solid performance and positive cash flow trend helped reinforce the balance sheet. Consolidated assets as of December 2019 totaled EUR 15,542.6 million (EUR 12,477.0 million in 2018). This variation is due primarily to the growth of the Bioscience Division including the strategic build-up of inventories, which expanded both organically and via corporate transactions, as well as capital expenditures and R+D investments.

The optimization of working capital remains a priority to strengthen the company’s financial position. Inventory levels increased to EUR 2,342.6 million, with a turnover of 310 days compared to 292 days in December 2018 following the implementation of several strategic initiatives to better anticipate and meet the solid demand for plasma-derived products.

The company’s equity was EUR 6,845.8 million as of December 31, 2019. The share capital includes 426,129,798 common shares (Class A), with a nominal value of EUR 0.25 per share, and 261,425,110 nonvoting shares (Class B), with a nominal value of EUR 0.05 per share.

In 2019, two dividend payments totaling EUR 238.7 million were distributed. In the second quarter of 2019, a second payment was made as a final dividend related to 2018 earnings. In December 2019, an interim dividend was paid based on 2019 earnings for EUR 136.8 million. Grifols remains committed to compensating its shareholders with dividend (pay-out of 40%).

EVOLUTION BY DIVISIONS: SUSTAINABLE GROWTH OF ALL BUSINESS UNITS

Bioscience division leads the growth: +13.6% and EUR 3,994 million

The Bioscience Division achieved record sales of EUR 3,993.5 million in 2019. Revenue growth stemmed from strategic investments and efforts in recent years to increase the company’s access to plasma and successfully meet the rising demand of the main plasma proteins.

Demand for immunoglobulin remains strong in all regions, especially in the U.S. and main European Union (EU) markets. These markets, in addition to using immunoglobulins to treat primary immunodeficiencies, also utilize them to treat secondary immunodeficiencies and neurological diseases like chronic inflammatory demyelinating polyneuropathy (CIPD). Sales of this plasma protein recorded double-digit growth in 2019.

The company remains committed to continuously developing new formulations and indications of its therapies to meet the growing needs of patients worldwide. In July 2019, Grifols received FDA approval for Xembify®, a 20% subcutaneous immunoglobulin that broadens its portfolio of products to treat primary immunodeficiencies. The company launched Xembify® in the U.S. in the last quarter of 2019 and is currently working with global health authorities to obtain approval in Canada, Europe and other global markets.

Albumin sales recovered throughout the year, particularly in the second half of 2019. Its double-digit growth was the result of strong demand in China, the U.S. and various EU countries. The Chinese market currently leads sales for the plasma protein and continues to hold great growth potential.

Alpha-1 antitrypsin revenues continue to grow. Market breakthrough of this plasma protein grew in the U.S. and the main EU markets thanks to effective sales strategies and an upsurge in the number of diagnosed patients. Grifols continues its efforts to boost the rate of diagnosis of alpha-1 antitrypsin deficiency by developing innovative solutions like AlphaKitTM (blood test) and AlphaIDTM (buccal swab).

The sales trend of factor VIII moderated its decline in the last quarter of 2019. In the new market scenario FVIII/VWF concentrates still play a key role to prevent and treat bleeds, and for the prevention and eradication of inhibitors. The company’s commitment to ensure product availability for all patients and the efforts to position Grifols factor VIII products in the new competitive landscape led to a stabilization in our sales volume.

Grifols continues to promote its specialty proteins to enhance its differential product portfolio. Strong sales of specialty hyperimmunoglobulin, most notably the new formulation of its anti-rabies immunoglobulin (HyperRAB®), contributed to the division’s revenue growth.

VISTASEALTM is a fibrin sealant developed by Grifols to control surgical bleeding and distributed by Ethicon as part of a strategic global alliance. VISTASEALTM reflects Grifols’ ongoing strategic efforts to expand its product portfolio of plasma proteins.

VISTASEALTM combines fibrinogen and thrombin and is administered with Ethicon’s airless spray device technology. The biological components of VISTASEALTM are manufactured in Grifols’ industrial complex in Barcelona (Spain) in a designated plant with a production capacity of 30,000 kits, as well as the capacity to expand to 3 million equivalent liters of plasma.

Diagnostics division progresses in its growth: +4.5% up to EUR 734 million

Grifols is the worldwide leader in transfusion diagnostics, the division’s main engine for growth in 2019. This business area includes NAT donor screening diagnostics (Procleix® NAT Solutions), blood typing solutions and the manufacture of recombinant antigens for immunoassays.

Sales of NAT donor screening solutions remained stable due to an increase in plasma donations and greater market breakthrough in EMEA and Japan. Over the last 12 months, the division continued to consolidate its global-expansion strategy, opening up new markets for its NAT-technology solutions in Malta, Hungary, Slovakia, Bulgaria, Peru, Panama and Ecuador.

The company also broadened its product portfolio by incorporating new FDA-approved reagents to detect babesiosis. After obtaining the CE mark, the division will launch its innovative Procleix® Panther® with ART (Automated Ready Technology), designed to improve workflow efficiencies in laboratories.

Sales of the blood-typing line grew by double digits. The product portfolio includes analyzers (Wadiana®, Erytra® and Erytra Eflexys®), gel cards (DG-Gel®) and reagents. Sales were especially strong in China, a market with significant growth potential; the U.S., its main market thanks to a solid sales strategy and successful strategic investments; Latin America, and specific markets in Asia and Europe.

Grifols also reinforced its presence in Africa with the installation of the first Erytra Eflexis® in the largest hospital in Tunisia.

Grifols continues its efforts to consolidate its line of recombinant proteins for immunoassays. The agreement with PCL will further consolidate this business line.

Sales of blood-extraction bags grew significantly, a segment that will expand following the start-up of operations in the new Brazil plant. The new plant in Campo Largo (Brazil) dedicated to the manufacturing of blood-collection bags has an annual production capacity of 2 million units, scalable to 4 million units. The plant’s production output will initially serve the Brazilian market, although Grifols plans on reinforcing its presence in other Latin American markets over the next two years as it obtains the necessary regulatory approvals.

Revenues of specialty diagnostics remain stable, with sales expected to grow with the gradual expansion of the clinical diagnostics portfolio. As such, it is important to highlight the FDA approvals of QNext®, a coagulometer developed in-house, and DG-PT (thromboplastin), one of the main reagents to promote hemostasis. With this latter approval, Grifols became the first company in more than 15 years to earn authorization in the U.S. market to sell instruments and reagents for routine hemostasis testing.

Hospital division notes its geographical expansion: +12.5% and revenues of EUR 134 million with very significant growth in the U.S.

Sales increased in 2019 across all of the division’s business lines, especially the Pharmatech line in the U.S. This business line offers comprehensive solutions for operational pharmacy, including the inclusiv® product portfolio, which includes equipment, software and services to improve safety and quality in compounded sterile preparations. With a double-digit upturn in sales, this line represents an important growth lever for the division fueled by the MedKeeper® and Kiro Grifols® technology solutions.

Grifols is a leading supplier of technology and services for hospitals, clinics and specialized centers for the manufacture of medicines. The launch of its leading-edge system for automated compounding of intravenous treatments (KIRO Fill®) and software enhancements to the workflow platform for intravenous preparations (PharmacyKeeper) optimize hospital-pharmacy operations by affording greater accuracy and safety in the preparation of (IV) medications. This advancement improves patient safety and reduces reliance on manual processes.

Sales of IV solutions grew as a result of U.S. demand for Grifols’ physiological saline solution (manufactured in the Murcia, Spain plant) and its use in the company’s network of plasma centers. Sales of the Nutrition and Medical Devices lines also increased, accompanied by an upturn in third-party manufacturing services.

Bio Supplies Division: EUR 267 million for the significant increase in sales of biological products for non-therapeutic use and plasma sold to third parties

The division mainly consists of the sales of biological products for non-therapeutic use and plasma sales to Haema and Biotest third parties, which amount to EUR 180 million.

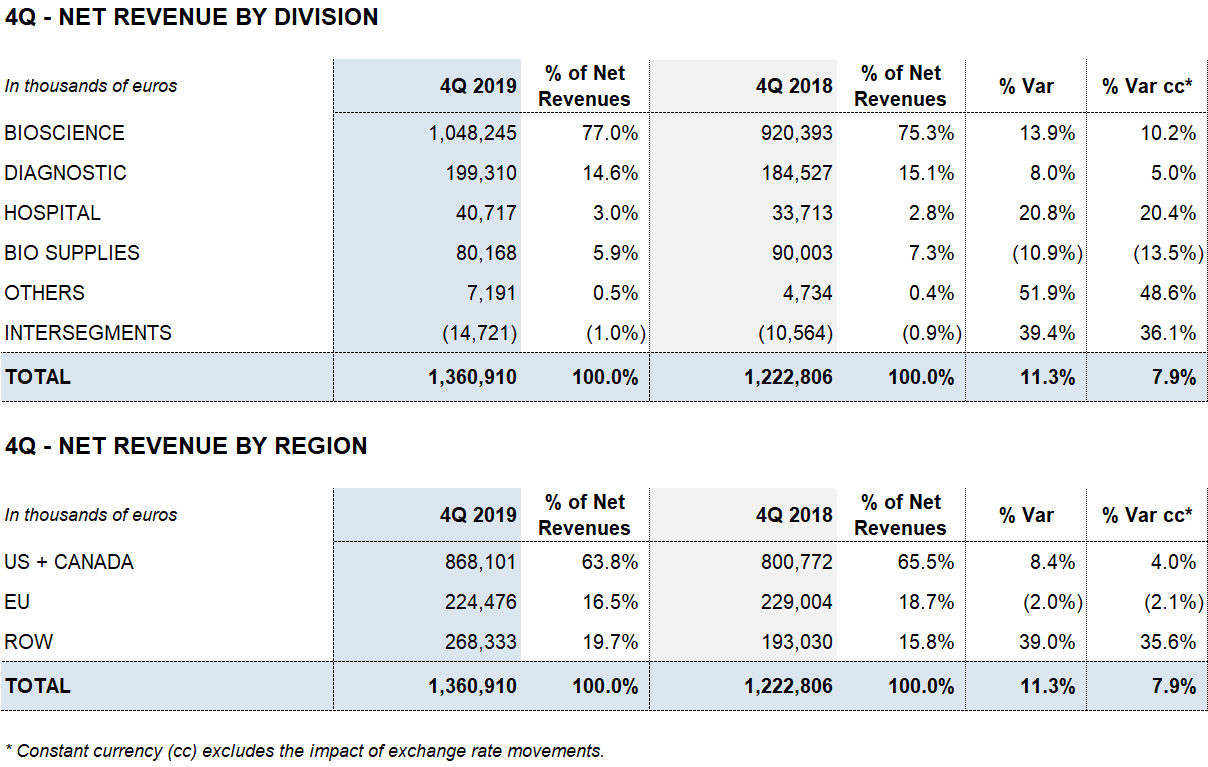

FOURTH QUARTER 2019

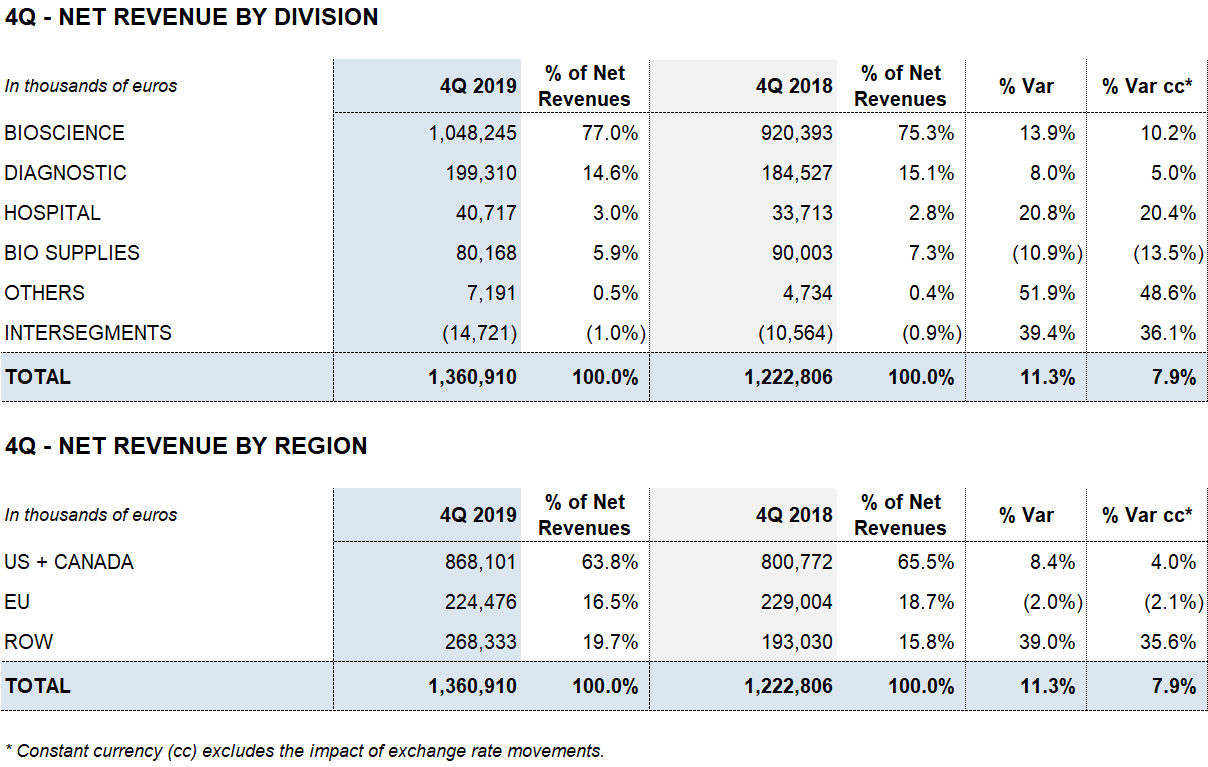

Grifols grew 11.3% in Q4 driven by Bioscience division

Revenue has reached EUR 1,360.9 million, which represents an increase of +11.3% (+7.9% cc).

The Bioscience Division has been the main engine of growth and its turnover has increased +13.9% (+10.2% cc) to EUR 1,048.2 million. The division maintains its favorable trend of income growth supported by the sales of the main proteins: immunoglobulins, albumin and alpha-1 antripsin.

Albumin sales have increased significantly in China in the last quarter of the year contributing to the recovery of the estimated growth after the renewal of certain licenses. It also highlights the change in the trend of FVIII factor boosted by revenues from emerging countries.

The revenues of the Diagnostic Division stood at EUR 199.3 million with an increase of +8.0% (+5.0% cc), mainly driven by the positive evolution of the blood typing line, which continues to show double-digit growth.

The Hospital Division confirms a very positive development as a result of its solid internationalization strategy. It reports a revenue growth of +20.8% (+20.4% cc) to EUR 40.7 million. Finally, the Bio Supplies Division has generated revenues of EUR 80.2 million.

The evolution of revenues in the last quarter of the year has contributed to the consolidation of operating results. The reported EBITDA has reached EUR 368 million with an increase of +29.8%, which represents a margin of 27.0% (23.2% in 2018). The underlying EBITDA margin2 represents 27.6% of revenues (24.0% in 2018).

Net profit stands at EUR 201.8 million, which represents an increase of 57.2% over the same period in 2018. It includes the positive accounting impact before taxes for a net amount of EUR 42.4 million mainly related to the refinancing process.

INVESTMENT ACTIVITIES: R+D+i, CAPEX AND ACQUISITIONS AND CORPORATE TRANSACTIONS

R+D+i: Strategic approach and resources allocated

Grifols’s R+D+i strategy promotes a comprehensive approach that comprises both in-house initiatives and external projects in investee companies that complement the company’s operations.

In 2019, Grifols has intensified its efforts in R&D. Taking into account both internal and external net investments, the resources allocated have increased by +12.9% to EUR 329 million, which represents 6.5% of revenues. The company has more than 1,000 people dedicated to R+D+i. The main projects of 2019 include:

Presentation of global results of the AMBAR study

Throughout 2019, Grifols progressively presented additional results of phase IIb/III of its clinical trial AMBAR (Alzheimer Management By Albumin Replacement) in various congresses. The clinical trial is designed to evaluate the efficacy and safety of plasma exchange (procedure that combines periodic extraction of plasma by means of the plasmapheresis technique with the infusion of albumin and immunoglobulin).

All results show positive effects of the treatment in reducing the progression of the disease in patients with mild and moderate Alzheimer's disease. Although Grifols will continue investigating and anticipates the launch of a new study, for now it finalizes its AMBAR clinical trial with the presentation of the latest results at the Clinical Trials on Alzheimer's Disease (CTAD) 2019 conference held in December in San Diego (USA).

The results achieved reinforces Grifols' research line of therapies based on plasma protein replacement (Plasma Protein Replacement Therapies) to promote the research and development of projects related to the exchange of plasma proteins applied to different pathologies of greater prevalence.

Bioscience Division

Completion of the clinical research phase in Europe to obtain EMA authorization for the 20% subcutaneous immunoglobulin to treat patients with primary immunodeficiencies.

Development of Gamunex® as maintenance therapy for myasthenia gravis (MG). Additionally, development of the phase III PRECIOSA trial on the potential benefits of albumin to treat liver cirrhosis and phase III APACHE trial to treat acute chronic liver failure (ACLF) with albumin. Patients admitted in clinical trials to evaluate the efficacy and safety of Grifols’ fibrin sealant to promote hemostasis during liver and soft-tissue surgery. As well as, the launch of the research phase of intravenous fibrinogen for pediatric use.

Establishment of Plasma Protein Replacement Therapies (PPRT) group in 2019 for the research and development of projects related to plasma-protein replacement applied to different pathologies with larger prevalence.

Diagnostic Division

Grifols continues innovation in Diagnostic solutions using NAT (Nucleic Acid Test) technology through multi-target (multiplexed) diagnostic tests that allow various virus/pathogens to be tested in a single sample; new reagents for emerging pathogens and pathogen detection through new-generation sequencing.

In the serology space, Grifols improves blood-antibody detection thresholds in terms of both sensitivity and specificity to speed up obtention of results.

Grifols continues to innovate in the area of immunohematology, one of the division’s core diagnostic lines. Noteworthy is the in-house development of a new CD38 recombinant protein that facilitates the identification of suitable blood donors for myeloma and lymphoma patients undergoing monoclonal anti-body immunotherapy (Daratumumab), one of the newest therapies on the market.

Hospital Division

The Hospital Division’s research and development efforts focus on expanding the range of hospital logistics systems and compounding processes for hospital pharmacies, as well as providing hospitals with intravenous solutions.

At present, 10% of hospital prescriptions require IV compounding, a process that entails preparing a unique intravenous therapy by modifying the medication’s formulation. Most personalized compounds are prepared manually, a costly process that requires specific cleanroom facilities, equipment and maintenance in a sterile environment. A higher degree of automation in these processes enhances patient safety and reduces hospital costs.

CAPEX and manufacturing operations

In 2019, Grifols intensified its capital expenditures to expand and enhance its divisions’ production facilities. The company allocated EUR 332.2 million to CAPEX in 2019, a 31.7% increase over the EUR 252.2 million invested in 2018. Within the framework of its long-term sustainable growth strategy, the company announced plans to invest EUR 1,400 million over 2018-2022.

Construction of a new plasma fractionation plant on the North Carolina (USA) complex continued as planned. With a fractionation capacity of 6 million liters per year, it will include the installation of two parallel plasma fractionation and grouping lines to maximize flexibility and efficiency. Expected to be operational by 2021.

Construction also continues on the world’s first purification, dosing and sterile filling plant of immunoglobulins in flexible bags. The plant will have an annual production capacity of 6 million equivalent liters of plasma and is expected to be operational in 2022.

The construction of a new albumin purification, dosing and sterile filling plant in Dublin (Ireland) continues according to plan. The plant will have an annual production capacity of 6 million equivalent liters of plasma and incorporate state-of-the-art filling technology.

Expansion of the fibrin and topical thrombin sealant production plant is underway at the Barcelona industrial complex. Upon completion of the new purification and dosing installations, this extension will increase production capacity to 3.3 million equivalent liters of plasma and also include a packaging and finishing plant.

In addition, Grifols continues investing to increase access to plasma. As of December 2019, Grifols operated the largest plasma center network in the world, with 295 centers. Thanks to its capital investments, the company increased its capacity to 45,000 average daily donations and total volume of plasma obtained for fractionation to nearly 13,5 million liters. This volume represents a 12.5% increase compared to 2018.

The San Diego facilities (California, USA) have been remodeled to consolidate the production of the NAT product line and the Brazil plant for the production of bags for the extraction, separation, conservation and transfusion of blood components has started operating. The facility has an initial production capacity of two million units expandable to four in the future.

ACQUISITIONS AND CORPORATE TRANSACTIONS

Strategic Alliance with Shanghai RAAS

In 2019, Grifols and Shanghai RAAS announced a strategic alliance agreement to manufacture, market and develop plasma products and transfusion diagnostic solutions in China in compliance with international quality and safety standards.

Grifols will be the second-largest shareholder in Shanghai RAAS, with a 26.2% stake (economic and voting rights) in exchange for a non-majority share (40% voting rights and 45% economic rights) in Grifols Diagnostics Solutions (GDS), a 100% Grifols subsidiary.

This transaction will represent the first equity swap made in China with shares of a foreign company (GDS) and a non-state-controlled Chinese listed company.

Over the past 35 years, Grifols has increasingly expanded its presence in China, which is currently the company’s third-largest sales market. Grifols has operated in the Chinese market since the 1980s and in 2019, the company had a total of 28 registered products. Grifols will continue its efforts to expand its portfolio of registered products in China over the coming years.

At present, China leads sales of albumin and is third in sales for the Diagnostic Division, as the country with the highest sales for gel cards (DG-Gel®) and second in sales for NAT technology solutions (Procleix® NAT Solutions).

For Grifols, this transaction represents a singular opportunity to continue its global expansion and bolster its position in China, one of the markets with the highest growth potential for plasma products and transfusion diagnostics.

Collaboration and License Agreement with Rigel Pharmaceuticals

In January 2019, Grifols signed an exclusive license agreement with the U.S.-based biotechnology company Rigel Pharmaceuticals to commercialize fostamatinib in Europe and Turkey, as well as in all potential future indications. This drug is used as a second line of treatment for chronic immune thrombocytopenia (ITP).

In January 2020, Rigel Pharmaceuticals received market approval from the European Commission for TAVLESSE® (fostamatinib). The market launch of this product, expected in the second quarter of 2020, reinforces Grifols’ sales strategy and reflects its commitment to enhance its product portfolio for patients and offer more therapeutic options for healthcare professionals.

Interstate Blood Bank Inc.

In the second quarter of 2019, Grifols exercised its call option on the remaining 51% capital of Interstate Blood Bank Inc (IBBI) and its subsidiaries for USD 100 million. Grifols has had a 49% stake since 2016.

This operation forms part of Grifols’ strategic plan to expand and diversify its access to plasma. Through this transaction, Grifols incorporated 35 FDA-approved centers (26 plasma centers, 9 blood donation centers as well as an analytical laboratory).

WORKFORCE: MORE PEOPLE WORKING, EMPLOYMENT QUALITY AND CONTINUOUS TRAINING

As of December 31, Grifols’ workforce was made up of 24,003 employees, growing more than 13% over the previous year. The number of women has increased by 15%, and there has been an increase in the number of women in all professional categories. In 2019, the representation of women on the Board of Directors of Grifols is 31%, 32% of the top management members and 41% of senior managers are women.

The workforce also grew across all geographic areas where the company operates. There was significant growth in U.S. personnel, which increased 14.0% to 17,450 following the expansion in the number of U.S. plasma centers. In Spain the workforce totals to 4,134 people (+7.1%) and in ROW (rest of the world) it reaches 2,419 people.

Grifols employment in 2019 is shown below:

-

60% Women - 40% Men

-

98% of workforce have permanent contracts

-

51% of workforce between 30-50 years old

-

93% of workforce are employed full-time

-

More than 80 nationalities

Training and professional development is one of the main areas of action within human resources. The retention and enhancement of talent is promoted through a policy of equal remuneration, promotion, professional development and training.

Grifols works to continuously train its team with the skills and competencies necessary to efficiently perform their work and prepare them so that they can assume more responsibilities in the future. Grifols established The Grifols Academy in 2009, which encompasses the Professional Development Academy, the Academy of Plasmapheresis and the Academy of Transfusion Medicine.

Through the Grifols Academy the company provides educational and professional development opportunities to its staff worldwide; reinforces its philosophy and corporate values; and provides resources and services to medical professionals that contribute to improving patient care. Grifols Academy partnered with College for America in 2015 to offer Grifols employees the opportunity to earn college degrees. In Los Angeles, Grifols collaborates with local universities to support the education and development of its employees, while creating employment opportunities for residents of the region.

Grifols’ workforce completed 1.99 million training hours in 2019, reflecting more than 112 hours of training per employee. Women received 63% of the training hours provided and men received 37%. This highlights the increase in the number of training hours dedicated to safety, health and the environment, amounting more than 134,000 hours in 2019 compared to 100,437 hours in 2018.

Likewise, around 87% of training hours have been carried out by production and administrative operators. Grifols favors the training of people with lower qualifications within the organization to boost talent and professional projection within the framework of its commitment to equal opportunities.

ENVIRONMENT AND CLIMATE CHANGE

Grifols works to minimize the potential impact of its operations on the environment, striving to efficiently manage resources as part of its commitment to sustainable development. In this regard, it has various policies and guidelines that define its environmental management.

Currently, 75% of Grifols’ total production was manufactured in ISO-14001-certified facilities.

Grifols’ environmental management is grounded on the concept of a circular economy, highlighting an efficient use of material resources, water and energy and waste reduction in consideration of the life cycles of the company’s various products and services.

This strategy incorporates the transition toward a low-carbon economy aimed at minimizing the impact of climate change. Grifols analyzed its management of climate related risks and opportunities following the guidelines established by the Task Force on Climate-Related Financial Disclosures (TCFD), which focus on four main areas: governance, risk management, strategy and establishment of metrics and objectives.

As part of Grifols commitment to continuous improvement in environmental performance, significant resources are allocated to environmental activities and this has allowed the company remarkable progress in the fulfillment of its 2017-2019 Environmental Program and the development of a new 2020-2022 Environmental Program.

In addition to the environmental programs, Grifols has established six main commitments to the environment for 2030 that are part of the axes that make up the lines of action. Among them: reduce greenhouse gas emissions by 40% per unit of production, increase energy efficiency by 15% per unit of production by systematically applying eco-efficiency measures in new projects and existing facilities, and consume 70% of electricity from renewable sources, among others.

In 2019, the joint consumption and emissions of the production plants that make up the four divisions in Spain, USA. and Ireland, was the following:

-

Energy consumption increases below the increase in production:

-

Electric consumption: 409 million kWh

-

Gas consumption: 438 million kWh

-

A 4% water consumption reduction up to 3.2 million m3

-

Total associated emissions: 330,521 T CO2e

The resources allocated by Grifols in 2019 to environmental initiatives amounted to EUR 21.8 million. 61% of the investments have been destined to promote the reduction of water consumption and the reduction of energy and electricity consumption, contributing to the decrease in atmospheric emissions. 71% of environmental expenses are related to waste management of the different Grifols facilities.

Including expenses and investments, 66% of the resources have been allocated to waste management; 26% are related to the water cycle; and the remaining 8% has been allocated to the reduction of atmospheric emissions, energy and others.

In relation to climate change, Grifols participates annually in the Carbon Disclosure Project (CDP), which assesses the firm’s corporate strategy and climate change performance. In 2019, Grifols earned a “B Management” rating, the same as in 2018.

1Operating or constant change (cc) excludes the exchange rate variations of the year.

2Excludes the impact related to third plasma plasma sales of Haema and Biotest

3As of December 31, 2019, the impact of the application of IFRS 16 on the amount of debt amounts to EUR 741 million.