Mai 3, 2018

Grifols increases its net profit by 7% to Euros 143 million and delivers significant growth in organic sales

First Quarter 2018 Results

-

Grifols' revenues grow by 7.4% cc1 to Euros 1,023 million, driven by strong organic growth in all divisions and regions amid an unfavorable exchange rate environment

-

Bioscience Division sales grow by 5.8%2 cc to Euros 808 million, evidence of the solid demand for main plasma proteins

-

Grifols continues its strategy of allocating resources to in-house initiatives and acquisitions as a means of ensuring access to its main raw material. The group leads the industry in plasma collection centers, with 190 centers in the U.S. and 35 in Europe3, a 50% increase from the start of the expansion plan in 2015

-

Diagnostic Division revenues grow by 4.0%2 cc to Euros 165 million. The Hospital Division grows by 18.1%2 cc driven by stronger performance in the U.S. market

-

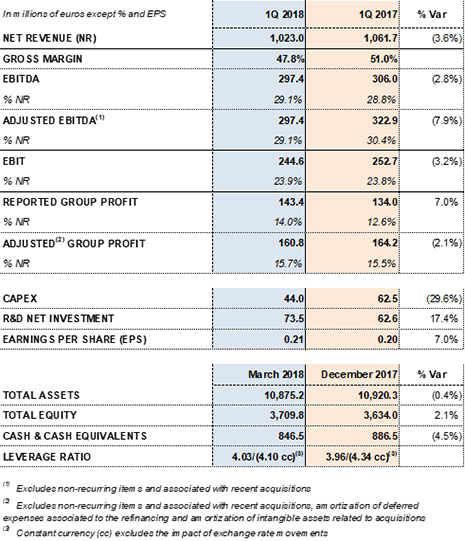

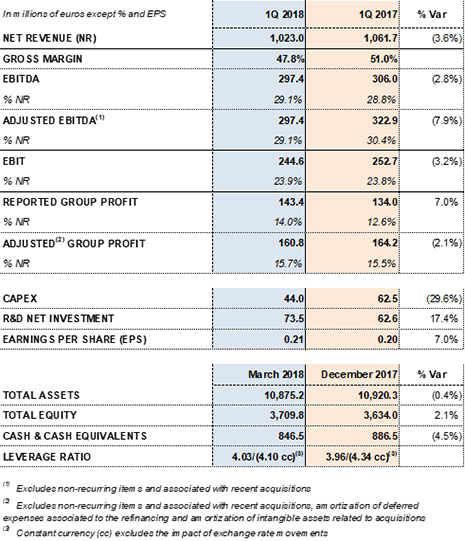

EBITDA reaches Euros 297 million, reflecting a 29.1% margin

-

Grifols' sound operational and financial management contribute to a 7.0% increase in net profit to Euros 143 million

-

Net investments in R+D+i reach Euros 74 million, including resources assigned to both internal and external projects

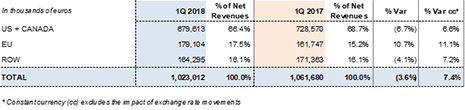

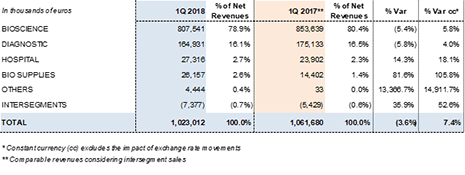

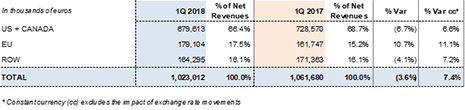

Barcelona, May 3, 2018.- Grifols (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS) reported Euros 1,023.0 million in revenues during the first quarter of 2018, representing a 7.4% increase at constant currency (cc) and a 3.6% decline taking into account foreign currency variations, especially the euro-dollar. Solid organic growth was recorded in all of the group's divisions and regions.

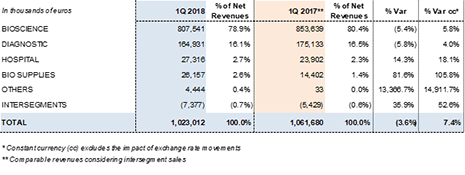

The Bioscience Division generated Euros 807.5 million in revenues, representing a 5.8%2 cc increase and a 5.4%2 decline including exchange rate variations. By way of comparison, the division reported an outstanding growth of 11.9% cc in the same period in 2017.

The global demand for main plasma proteins is strong and continues its upward trend. The division's performance was primarily fueled by increased sales volumes of the main proteins, which offset the decline in sales of Factor VIII, amid a tight plasma market.

Diagnostic Division revenues totaled Euros 164.9 million, representing a 4.0%2 increase in organic growth and a 5.8%2 decline taking into account foreign currency variations. The consolidation of the NAT technology business, coupled with solid sales for blood typing lines and antigens for immunoassays, were the main levers of growth.

The Hospital Division delivered revenues of Euros 27.3 million, with organic growth of 18.1%2 and 14.3%2 including the exchange rate impact. This growth was driven mainly by the Pharmatech line, bolstered by the acquisition of MedKeeper, and IV solutions in the U.S., including the physiological saline solutions manufactured in Grifols' Murcia (Spain) plant.

The Bio Supplies Division doubles its revenues reporting Euros 26.2 million in sales during the first quarter of 2018, an increase of 105.8%2 cc or 81.6%2 considering the exchange rate impact.

EBITDA rose to Euros 297.4 million, which represents a 29.1% EBITDA margin. In the first quarter of 2018, the company made greater efforts to increase the volume of plasma both organically and through acquisitions to continue to meet rising market demand.

As part of these efforts, Grifols added 19 new plasma donation centers to its U.S. network (13 organically) in 2017, totaling 40 new centers since the beginning of 2015, when this new plasma centers plan began.

The company reinforced its expansion strategy during the first quarter of the year by acquiring the German firm Haema. With 35 centers and three more under construction, Haema has the largest plasma collection platform in Europe. The closing of the transaction is subject to approval by German antitrust authorities, expected in the upcoming weeks.

For Grifols, ensuring access to its main raw material is a top priority in order to continue providing adequate treatment to patients and maintain long-term sustainable growth. The company is the worldwide leader in plasma donation centers, with a total of 225 centers: 190 in the United States and 353 in Europe.

Net R+D+i investments increased to Euros 73.5 million, which reflects 7.2% of revenues.

Effective operational and financial management drove net profit to increase to 7.0% to Euros 143.4 million, 14.0% of revenue.

The effective tax rate was 20.2%, resulting primarily from the U.S. tax reform approved on December 22, 2017.

At the end of the first quarter of 2018, Grifols' net financial debt stood at Euros 5,155.3 million and its net financial debt over EBITDA was 4.03x (3.96x as of December 31, 2017 and 4.45x at the close of the first quarter of 2017).

Grifols' solid operating cash flow generation ensures the necessary solvency to pursue future expansion projects and reduce financial leverage.

As of March 31, 2018, Grifols had more than Euros 845 million in cash positions and Euros 372 million in undrawn lines of credit, raising its liquidity position to more than Euro 1,200 million.

Main financial data from the first quarter 2018:

REVENUE PERFORMANCE

The rising demand for plasma-derived proteins continues its upside trend. In the first quarter of the year, revenues reached Euros 807.5 million, representing organic growth of 5.8%2.

The sales uptick of the main plasma proteins -immunoglobulin, alpha-1 antitrypsin and albumin- offset the decline in Factor VIII sales.

Revenues were negatively impacted by the euro-dollar exchange, which accounts for the 5.4%2 decline compared to the same period in 2017.

Immunoglobulin revenues remained robust, especially in the United States and main European markets. The use of immunoglobulin for its main indications is growing, including treatments for neurological conditions like chronic inflammatory demyelinating polyneuropathy (CIDP), a segment that Grifols leads.

Alpha-1 antitrypsin sales continue to spur the division's results, in addition to notable growth in the U.S. and several European countries as a result of a rising diagnosis rate.

The company continues its efforts to improve the diagnosis of alpha-1 antitrypsin deficiency through the development of diagnostic solutions and the implementation of specific patient programs. Among these initiatives, of note is the campaign in the U.S. encouraging patients with chronic obstructive pulmonary disease (COPD) to undergo testing for alpha-1 antitrypsin deficiency. Grifols developed the campaign following recommendations by the World Health Organization (WHO).

Albumin sales remain strong in China and the United States as key markets. At the same time, Grifols continues to expand its presence in diverse countries in the Middle East, Asia Pacific and Latin America.

For its part, Factor VIII sales fell significantly in the wake of its diminishing usage in treatments for patients who have developed inhibitors (immune tolerance induction or ITI).

The company continues to position plasma-derived Factor VIII as the best treatment option to eradicate inhibitors (it's estimated that up to 35% of patients with hemophilia A can develop inhibitors4), while reinforcing its position to treat previously untreated patients (PUPs) with severe hemophilia A, mainly, in the U.S.

The Diagnostic Division reported revenues of Euros 164.9 million, which reflects a 4.0%2 increase in organic growth and 5.8%2 decline taking into account foreign currency variations. Sales of the transfusional medicine line continue as the main source of revenues.

Sales of the NAT technology systems (Procleix® NAT Solutions), used to screen blood and plasma donations, remained stable, as the division continues to build this line in new markets. The first quarter of 2018 also saw the launch of Procleix® Panther -one of the portfolio's core products- in Mexico and sustained growth in the Middle East.

Sales of antigens manufactured at the Emeryville, California, plant and used to produce diagnostic immunoassays rose significantly.

Sales of the blood typing line, which includes analyzers (Wadiana® and Erytra®) and reagents (DG-Gel® cards), grew significantly across all regions. In the United States, a market with great potential for the division, the results reflects the solid sales strategy and investments in place. In Europe, growth is driven by sales of new analyzer Erytra Eflexis® that was officially launch in 2Q 2017 after obtaining CE mark at the end of 2016. The division continues to work to extend its market penetration to other regions (Middle East, Asia, and Latin America) after obtaining the required product registration for commercialization.

The Erytra Eflexis® is a fully automated, medium-sized analyzer for performing pre-transfusion compatibility tests using DG-Gel® technology, and complements Grifols' scalable blood typing solutions.

Hospital Division revenues increased to Euros 27.3 million in the first quarter, reflecting 18.1%2 cc growth and 14.3%2 taking into account foreign currency fluctuations.

International expansion and optimal sales positioning in North America are the division's principal growth engines. In this regard, of note are the agreement with Henry Schein for the U.S. distribution of Grifols' physiological saline solution (IV solutions line) produced in its Murcia (Spain) plant and the acquisition of MedKeeper (Pharmatech line).

Regulatory changes in the U.S. that impact hospital pharmacy operations and compounding-process controls represent a market opportunity for Grifols. The company is recognized for its integrated solutions to enhance the efficiency and control of hospital pharmacy services.

This division mainly comprises sales of biological products for non-therapeutic uses, and manufacturing agreements with Kedrion. This agreement increased the division's sales to Euros 26.2 million in the first quarter of 2018, compared to Euros 14.4 million reported in the same period in 2017.

Revenues by division:

Revenues by region:

INVESTMENT ACTIVITIES: ACQUISITIONS, R+D+i AND CAPEX

The Hospital Division strengthened with the acquisition of a 51% stake in MedKeeper

Grifols acquired a 51% of capital share in Goetech LLC, whose trade name is MedKeeper, through a subscription of a capital increase, without issuing debt.

MedKeeper is a U.S. technology firm that develops mobile and web-based technology solutions to improve the efficiency and safety of hospital pharmacy operations. The transaction supports the Hospital Division's growth strategy, which aspires to expand into global markets and broaden its portfolio of integrated hospital pharmacy solutions.

The agreement includes a call option to acquire the remaining 49% interest within a three-year timeframe. The total amount of the transaction was USD 98 million.

Industry leaders in plasma donation centers: acquisition agreement with Haema

Haema operates the largest independent network of donation centers in Germany, as well as the largest private transfusion service. Grifols negotiated an agreement to acquire 100% of its share capital for Euros 220 million, without issuing debt.

The acquisition agreement includes operations currently held by Haema; 35 donation centers in nine states, and three more under construction; a 24,000-square-meter building in Leipzig (Germany), home to the company's headquarters; and a central laboratory in Berlin (Germany). Haema collected roughly 800 thousand liters of plasma from 1 million donations in 2017.

The Haema transaction reinforces Grifols' strategic plan and enables it to reinforce its global leadership in plasma collection by expanding and diversifying its plasma donation network. The Haema donation centers will represent Grifols' first outside the United States.

The closing of the transaction is subject to authorization by Germany's antitrust authorities, expected in the upcoming weeks.

-

Research, Development and Innovation (R+D+i)

From January to March 2018, Grifols' net R+D+i investment rose to Euros 73.5 million, in comparison to Euros 62.6 million reported in the same period in 2017. The figure reflects 7.2% of revenues and a 17.4% increase, and includes resources allocated to support both internal and external research initiatives.

Grifols obtained two important regulatory approvals from the U.S. Food and Drug Administration (FDA): a new intramuscular immunoglobulin formulation (GamaSTAN®) to treat patients exposed to the hepatitis A virus and measles; and a new rabies immunoglobulin (HyperRAB®) to treat people suspected rabies exposure. These new formulations broaden the Grifols' portfolio of specialty immunoglobulins.

Also of note is the completion of the phase IIb/III of the AMBAR (Alzheimer Management By Albumin Replacement) clinical trial for Alzheimer's, and the start of the collection and analysis of data gathered from the 496 patients who participated in the trial. The study's randomized and double-blind design make the evaluation process especially complex. As a result, the company expects to publish AMBAR's final conclusions in the fourth quarter of 2018.

Grifols is dedicated to promoting innovation and external R+D+i activities through collaborations and equity stakes in frontline research companies. In line with this commitment, the company will contribute Euros 1.5 million to the IrsiCaixa AIDS Research Institute over the next five years. These resources will finance leading-edge research lines to advance the search for new therapies to treat HIV/AIDS and associated diseases. The agreement grants Grifols preference to exploit the results and patents stemming from the research projects that it finances.

-

Capital investments (CAPEX)

During the first three months of the year, Grifols invested Euros 44.0 million to expand and improve its three division's production plants. The company maintains its planned investments outlined in the 2016-2020 Capital Investment Plan, which includes increasing the production capacities of main plasma proteins.

The most noteworthy projects in the 2016-2020 investment plan are the expansion of the purification capacity of alpha-1 in the Barcelona (Spain) plant, currently in the final validation phases, and the start of construction on a new immunoglobulin purification and filling plant in the Clayton, North Carolina (U.S.) facilities. Grifols will invest USD 120 million to build the new plant, which will be the first in the world to manufacture immunoglobulins in flexible containers.

1Constant currency (cc) excludes exchange rates variations.

2 Comparable net revenues considering intersegment sales.

3 Acquisition of European centers subject to approval by the German Competition Authority.

4Source: Oldengurg J, et al. Haematologica 2015; 100(2):149-156.