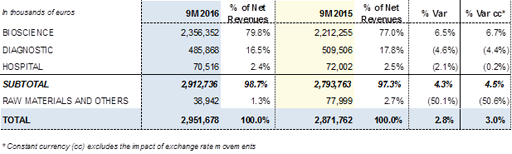

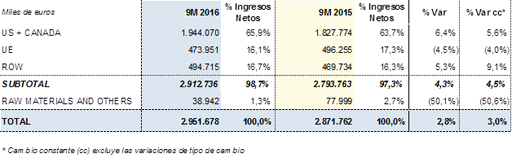

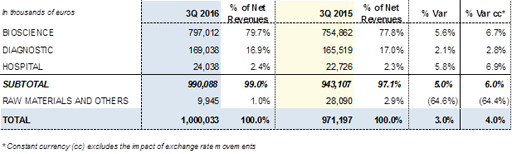

Barcelona, 8 November 2016.- Grifols (MCE: GRF, MCE: GRF.P and NASDAQ: GRFS) increased its revenues by +2.8% (+3.0% cc) to EUR 2,951.7 million for the nine months ended September 2016. Recurring revenues (excluding Raw Materials and Others) grew by +4.3% (+4.5% cc) reaching EUR 2,912.7 million, as a result of the good sales performance in the Bioscience Division and the recovery of the revenues generated by the Diagnostic and Hospital divisions in the third quarter of the year.

Revenues of the Bioscience Division increased by +6.5% (+6.7% cc) to EUR 2,356.4 million between January and September, demonstrating a solid trend, driven mainly by the sales volumes of IVIG, alpha-1antitrypsin and albumin.

Revenues of the Diagnostic Division rose by +2.1% (+2.8% cc) in the third quarter due to the expansion of NAT technology (Procleix® NAT Solutions) in China and the Middle East, as well as the progressive penetration of the blood typing line in the United States and its robust growth in the rest of the markets. These positive contributions and the absorption of the impact of the new contract signed with Abbott in July 2015 for the production of antigens resulted in revenues of EUR 485.9 million over the first nine months of the year, showing a recovery of the yearly cumulative decrease up to -4.6% (-4.4% cc).

Sales of the Hospital Division increased by +5.8% (+6.9% cc) between July and September 2016, taking the division's revenues for the first nine months of the year to EUR 70.5 million, compared with EUR 72.0 million generated in the same period of 2015. This increase was driven by the Intravenous therapy line. Growth in the United States continued to be favourable, and the division strengthened its penetration in Portugal and various countries of Latin America.

As in previous quarters, margins continued to be impacted mainly by the decline in royalties related to the transfusion diagnostics unit received during 2015, which fell significantly in 2016; by the higher plasma costs linked to the opening of new donor centres and to the greater incentives to reward donors for their time. Grifols maintains as a strategic priority the increase of supply of raw material to meet on a sustainable basis the growing market demand.

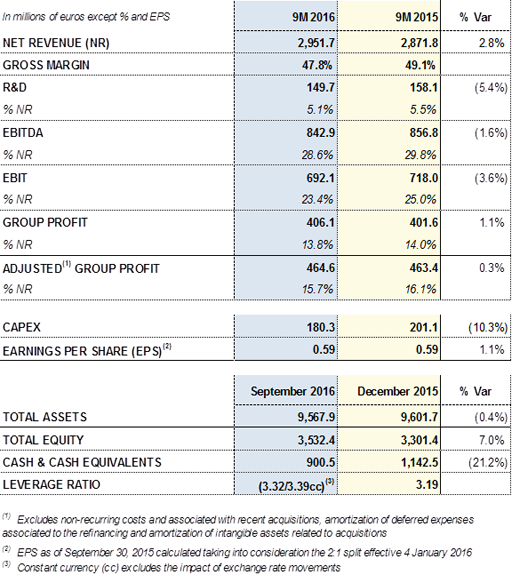

In this regard, while progressing with the plan to open new plasma centres and allocating resources required to support the increase in the commercial activity, the margin EBITDA remained stable reaching 28.6% of revenues for the first nine months of the year and amounted to EUR 842.9 million (-1.6%). EBIT stood at EUR 692.1 million (-3.6%), representing 23.4% of revenues.

The financial result continued to improve and decreased by -7.2%. The favourable impact of exchange rates and the maturity of the interest rate derivative contracts contributed to this result.

Grifols' EUR 406.1 million net profit increased by +1.1% to 13.8% of the group's net revenues. The effective tax rate for the nine months to September 2016 was 22.3%.

At the end of September, net financial debt was EUR 3,809.2 million, including EUR 900.5 million in cash. The company maintained its liquidity position above EUR 1,300 million, taking into account undrawn credit lines in excess of EUR 400 million.

Grifols' net debt to EBITDA ratio was 3.32x, in line with the figure reported at the beginning of the year. Excluding the exchange rate impact, it stood at 3.39x.

The reduction of indebtedness remains a priority, and to this end the company continues to focus on cash generation. At 30 September 2016, Grifols' operating cash flow amounted to EUR 372.9 million, a positive milestone considering the higher inventory levels associated with the opening of new plasma centres and higher volume of sales.

Following the end of the quarter, on October 28, 2016, the Board of Directors approved the payment of an interim dividend on account of 2016 profit of EUR 0.18 per each share by which the Company´s share capital is represented. The payment of the interim dividend will be made on December 7, 2016.

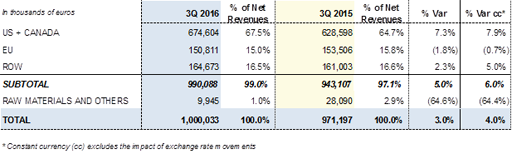

Key figures for the nine months ended September 2016:

- Bioscience Division: 79.8% of revenues

The Bioscience Division represents Grifols' main line of organic growth. Significant increases in the sales' volumes of the main plasma proteins continue. The geographic mix has favoured revenues, and, prices as a whole remained stable. Revenues in the first nine months of the year rose by +6.5% (+6.7% cc) to EUR 2,356.4 million.

Sales of IVIG remained solid through September. Demand for this plasma product continued to be very strong, buoyed by growth in the United States and Europe. There was notable growth in certain countries of the Asia-Pacific region. Grifols is leader in the field of immunodeficiencies, and promotes better diagnosis and treatment of these diseases. In the field of neurology, where the use of immunoglobulins is on the rise, the company is promoting advanced training for its sales teams in order to provide a better response to the needs of patients and healthcare professionals.

In this regard, representatives of Grifols' neurology and immunology business areas have taken part in the advanced training organised by the American Association of Neuromuscular & Electrodiagnostic Medicine2 (AANEM) on chronic inflammatory demyelinating polyneuropathy (CIDP). Initiatives of this kind are part of the association's education programme to help improve the diagnosis and treatment of the disease.

Sales of albumin continue to grow, supported by China and the United States, where demand remains very strong. The positive trend in various Latin American countries also continues.

Grifols is leader in the production and sale of alpha-1 antitrypsin, and actively promotes the diagnosis of the deficiency of this protein (AATD) in the United States, Europe and - in a more incipient manner - Latin America. Sales are steadily growing significantly in the United States, Canada and several European countries.

The company continues to advance the development of its respiratory franchise. In addition to the above-mentioned growth in sales of alpha-1 antitrypsin, progress is being made on the development of Linhaliq® (Pulmaquin®), an innovative inhaled ciprofloxacin compound for the treatment of severe respiratory diseases. Grifols holds the worldwide sales rights for this compound under the global agreement reached following the acquisition of 35.13% of Aradigm Corporation.

In the third quarter of 2016, Aradigm announced the final dosing of the last patient in its Phase III clinical trial for the indication of the compound for the treatment of non-cystic fibrosis bronchiectasis (BE)3. The completion of the study and the approval of the product would enable Grifols to complement its product portfolio.

Sales of factor VIII continue to grow in the United States, largely driven by the treatment of patients who have developed inhibitors. This segment shows a very positive sustainable trend.

In parallel, the results of the SIPPET study (Survey of Inhibitors in Plasma Products Exposed Toddlers) - which shows that treatment with recombinant factor VIII (rFVIII) is associated with an incidence of inhibitors 87% higher than treatment with plasma factor VIII with von Willebrand factor (pdFVIII/VWF) in previously untreated patients with severe hemophilia A - continues to influence the choice of treatment for these patients.

At the patient world congress organised by the World Federation of Hemophilia (WFH), the results of the SIPPET study were one of the main topics. In addition, since the publication of the study in The New England Journal of Medicine, the main hemophilia associations, for doctors and patients alike, have recognised the impact of the results and issued recommendations for physicians to assess and present both treatment options (plasma derived and recombinant) to patients and their families. The objective is to foster informed decision-making when choosing the best option for their treatment, even in countries where the recombinant approach was previously the only option recommended in the treatment guides.

These include associations in the United States (NFH/MASAC), the United Kingdom (UKHCDO), France (AFH), Canada (CHS/AHCDC) and Europe (EAHAD and EHC), as well as WFH. Moreover, the European Medicines Agency (EMA) is currently conducting a review of different factor VIII concentrates in order to assess the risk of developing inhibitors in patients who start treatment for hemophilia A, and will be issuing its recommendations soon.

- Diagnostic Division: 16.5% of revenues

Revenues of the Diagnostic Division amounted to EUR 485.9 million, moderating their decline, compare with the first half of the year, to -4.6% (-4.4% cc) due to the positive contribution of sales in the third quarter of 2016, which increased by +2.1% (+2.8% cc).

Significant features included the expansion of NAT technology (Procleix® NAT Solutions) in countries of the Asia-Pacific region (including China) and the Middle East, as well as the sales performance in such an important and consolidated market as the United States; the absorption of the impact of the new contract signed with Abbott in July 2015 for the production of antigens; and the positive trend in sales of analysers (Wadiana® and Erytra®) and reagents (DG-Gel® cards) in the blood typing business line in the United States, as well as their introduction in new markets.

As a result of the marketing efforts, Grifols is laying the foundations to grow the division through new products, expansion into new markets and the strengthening of its commercial presence in geographical areas where it already operates.

In the Middle East, Grifols has become the main supplier of NAT technology in Saudi Arabia after being awarded the contract to supply transfusion services to the Saudi Ministry of Health (MoH) and for the majority of the member countries of the Cooperation Council for the Arab States of the Gulf (CCASG). This tender adds to the 2015 contract for the National Guard Hospitals (NGH) project, and reinforces Grifols' goal of establishing itself as a leading provider of NAT technology in the region.

Another highlight of the period was the opening of a diagnostic training centre in Dubai, which will offer specialised training courses on Grifols Transfusion Medicine and Clinical Diagnostic products.

In the Asia-Pacific region, Grifols won its first tender in South Korea as a supplier of blood typing solutions to the Korean Red Cross. It has also won tenders in Tunisia and the Maghreb, confirming its commitment to new emerging markets.

The Group also continued to promote its presence in Latin America with its Diagnostic Division. Highlights included the launch of its NAT technology line in the region, with the installation of the first Procleix Panther® in Peru, as well as the official approval by the Brazilian health authorities (ANVISA) to market the ID CORE XT® and ID HPA XT® genomic DNA blood genotyping systems. These systems are developed and manufactured by Progenika Biopharma, and opportunities in leading Brazilian blood banks have already been identified.

In Europe, highlights included the agreements reached in Poland with two of the country's main healthcare companies for the exclusive use of Grifols inmunohematology and reagent products in their laboratories. CE mark approval was also obtained from the European Union for the VITROS® HIV Combo test, developed by Grifols and Ortho Clinical Diagnostics for the early detection of acute HIV infection. This is an important milestone in the joint business between the two companies, in which Grifols is responsible for manufacturing the antigens for the test.

In the United States, the FDA amended the response protocol relating to the Zika virus extending the screening requirement of all donations to the blood banks of the country. The Grifols test developed with Hologic is approved under the research protocol (IND) for use in areas with a risk of transmission and to meet this new requirement.

- Hospital Division: 2.4% of revenues

Revenues of the Hospital Division amounted to EUR 70.5 million. Sales in the third quarter were positive (+5.8% / +6.9% cc) and contributed to reduce the cumulative decline to -2.1% (-0.2% cc) when compared to the EUR 72.0 million reported in the same period of 2015.

The Intravenous Therapy has driven the growth. As anticipated by Grifols, various public tenders relating to the Pharmatech lines (include hospital logistics and i.v. Tools) were launched in a number of Latin American countries. Growth in the United States continued to be favourable.

- Raw Materials and Others Division: 1.3% of revenues

Grifols' non-recurring revenues in the Raw Materials and Others Division amounted to EUR 38.9 million, representing 1.3% of total revenues. These include, among others, third-party engineering projects performed by Grifols Engineering, income deriving from manufacturing agreements with Kedrion, and revenues from royalties.

As anticipated, the lower revenues for this division are directly related to the reduction in royalties related to the transfusion diagnostics unit.

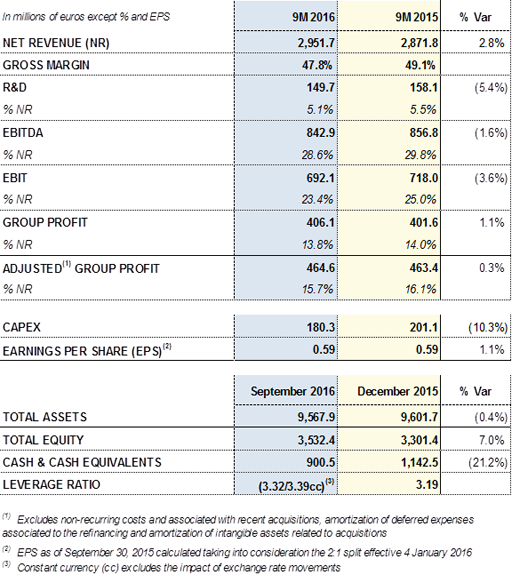

Revenues by division for the first nine months of 2016:

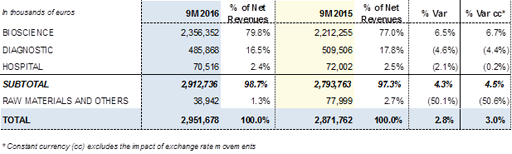

Revenues by region for the first nine months of 2016:

INVESTMENT ACTIVITIES: RD AND CAPEX

- Over EUR 163 million invested in Research & Development in nine months

Net investment in R&D amounted to EUR 163.2 million for the nine months ended September 2016, representing 5.5% of revenues. This figure mainly comprises EUR 149.7 million of R&D expenses, as well as investments made through investee companies.

One of the group's main strategic lines of R&D is focused on Alzheimer's. In addition to the AMBAR study (Alzheimer Management By Albumin Replacement), a trial that combines the extraction of plasma and its replacement with albumin (plasma exchange), Grifols is also working with Araclon Biotech on a vaccine against Alzheimer's.

The results obtained in the phase I clinical trial of this active immunotherapy against Alzheimer's disease (ABvac40) were presented during the third quarter of the year. The study did not evaluate the effectiveness of the treatment. However, ABvac40 produced an immune response in more than 87% of the patients who received the active principle during the trial.

The conclusions of the study, which support its continuation, were presented at the Alzheimer's Association International Conference held in Toronto. The compound ABvac40, which focuses on combating Alzheimer's in its early stages, shows a good safety and tolerability profile.

- Capital Expenditure (CAPEX): execution continues as planned

In the first nine months of the year, Grifols invested EUR 180.3 million to continue improving and expanding its manufacturing facilities. The investment plan currently under way progresses, including investments to expand industrial capacity and in the group's investee companies. One of the main efforts focuses on increasing stocks of plasma in order to be able to satisfy the growing demand for plasma-derived products on a sustainable basis, by streamlining the plan to open plasma donor centres in the United States.

After the quarter end, Grifols relocated its headquarters in Germany to a new office building with sufficient capacity to consolidate its presence in that country at a single location.

The new building located in Frankfurt – also home to its previous German headquarters – covers approximately 5,400 m2 and houses the company's Sales and Marketing department for Germany. The logistic function, currently managed from Langen, will also be transferred to the new building in December, with more than 1,500 m2 of storage space available for handling the distribution of Grifols products in the country.

Grifols has had a commercial subsidiary in Germany since 1997. Following the acquisition of Talecris in 2011, the country also hosts the commercial headquarters of the Bioscience Division in Europe.

1Constant currency (cc) excludes the impact of exchange rate movements

2AANEM (American Association of Neuromuscular & Electrodiagnostic Medicine) is the leading organisation in the United States in the provision of quality support and training to doctors and other healthcare professionals for the treatment of neuromuscular diseases and the practice of electrodiagnostic medicine.

3Full information available at http://investor.aradigm.com/releasedetail.cfm?ReleaseID=990452