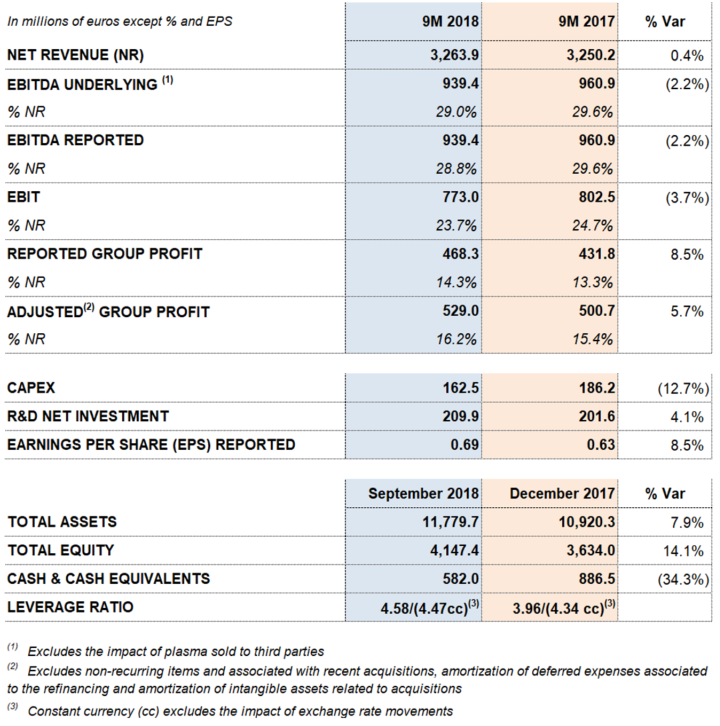

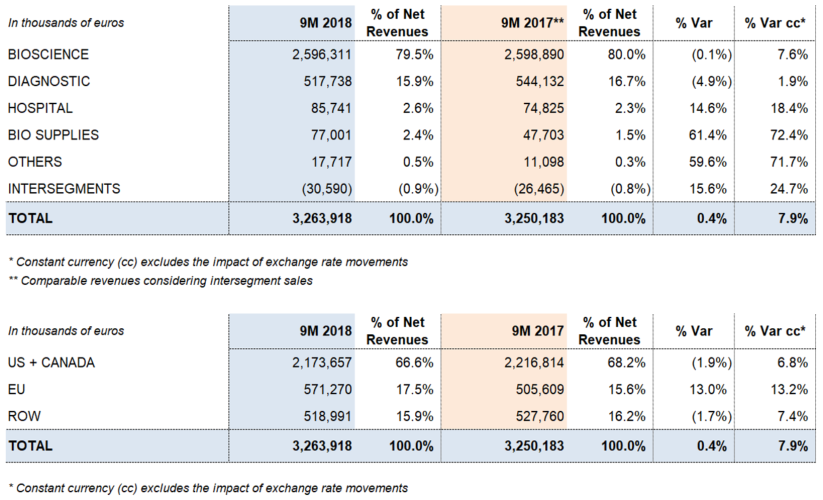

Barcelona, November 5, 2018.- Grifols' (MCE:GRF, MCE:GRF.P, NASDAQ:GRFS) revenues grew to Euros 3,263.9 million over the first nine months of 2018, with operational growth increasing by 7.9% cc or 0.4% when taking into account exchange rate variations. The company reported stronger revenues in the third quarter, which grew by 9.6% cc and 8.1%, taking into account exchange rate variations. Stronger demand of main plasma-derived products in the Bioscience Division were the driving force behind this upswing.

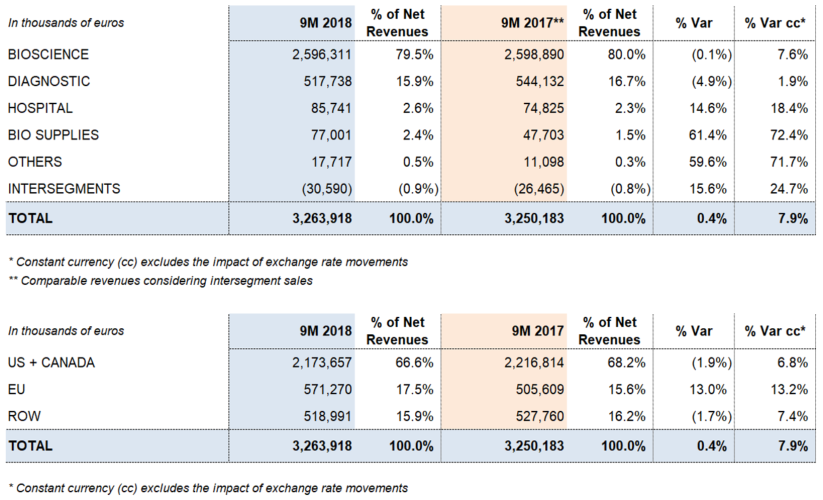

The Bioscience Division continues to serve as Grifols' primary engine of growth. Particularly noteworthy in the third quarter were higher sales volumes of immunoglobulin, albumin and alpha-1 antitrypsin, and a positive price impact of the main plasma proteins. The division boost its revenues by 7.6%2 cc from January to September to Euros 2.596.3 million (-0.1%2 taking into account exchange rate variations).

The Diagnostic Division revenues totaled Euros 517.7 million, increasing by 1.9%2 cc (-4.9%2 considering exchange rate variations). The increase in sales was led by the transfusional medicine business, which includes NAT virus-screening technology (Procleix® NAT Solutions), blood-typing systems and the manufacture of antigens for immunoassays.

The Hospital Division sales grew to Euros 85.7 million, an 18.4%2 cc increase compared to the same period last year (14.6%2 taking into account exchange rate variations). The division continued to report strong sales in all of its business lines, especially its Pharmatech and IV solutions portfolios in the U.S. market.

The Bio Supplies Division reported revenues of Euros 77.0 million, an increase of 72.4%2 cc (61.4%2 taking into account exchange rate variations). Third-quarter revenues included Euros 20.7 million stemming from Haema's third party plasma sales for the first time, in accordance with contracts in place prior to the acquisition.

Underlying EBITDA3 totaled Euros 939.0 million, representing a 29.0% margin over revenues. The company continues to absorb the impact of higher raw-material costs, in line with its strategic plan to increase its plasma supply both organically and through acquisitions.

In the third quarter of 2018, Grifols acquired 24 donation centers in the United States from Biotest as part of its plasma-center expansion strategy. The acquisition reinforces Grifols' leadership position in plasma donation centers, which now include 250 centers in total, 215 in the United States and 35 in Europe.

Net R+D+i investments grew by 4.7% compared to the same period last year to Euros 199.5 million, including in-house and external research initiatives.

Grifols' financial result improved by 12.4% to Euros 180.3 million. In the second quarter 2018, Grifols divested in TiGenix resulting in a gain of EUR 32.0 million.

The effective tax rate remained stable at 20%.

Net profit rose by 8.5% to Euros 468.3 million, representing 14.3% of revenues.

The remarkable capital investments to continue support growth accomplished during the year 2018 made that the company's net financial debt was Euros 5,781.4 million and the net debt ratio to EBITDA was 4.58x (4.47x cc) at the close of the third quarter.

Effective financial management, including the reduction of debt levels and maintaining a robust liquidity position, continues to be one of the company's strategic priorities.

Grifols' ongoing solid operating cash flow generation, which exceeded Euros 408 million for the first nine months of 2018, provides the necessary solvency to meet scheduled growth projects.

As of September 30, 2018, Grifols had Euros 582 million in cash and more than Euros 400 million in undrawn lines of credit, attaining a liquidity position of Euros 1,000 million.

Key financial metrics at September 30, 2018:

PERFORMANCE OF GRIFOLS DIVISIONS

Bioscience Division: Solid growth of the main plasma proteins

Revenues increased by 7.6%2 cc (-0.1%2 taking into account exchange rate variations) to Euros 2,596.3 million. This uptick in sales was driven by strong demand for the main plasma proteins (immunoglobulin, albumin and alpha-1 antitrypsin) and a positive price impact, especially for immunoglobulin.

Immunoglobulin demand remains very strong in all regions, especially in the United States and main European countries. Immunoglobulins are widely used in these markets to treat primary and, especially in secondary immunodeficiencies and neurological diseases like chronic inflammatory demyelinating polyneuropathy (CIPD).

The company remains committed to developing new formulations and indications. To this end, Grifols earned FDA approval for a new formulation of its intramuscular immunoglobulin GamaSTAN®, the only one approved in the U.S. for immediate protection against hepatitis A virus and measles. This approval marks an important milestone in the longstanding R+D of the company, a leader in the field of post-exposure prophylaxis.

Albumin sales continue their strong upward trend, supported by China, several EU countries and the United States, where demand remains strong.

Alpha-1 antitrypsin revenues continue to grow. A solid strategic sales plan and increasing rates of diagnosis have led to greater market penetration in EU countries and the U.S., its main market.

Grifols remains committed to improving the diagnosis rate of alpha-1 antitrypsin deficiency and advancing its respiratory franchise through a broader portfolio of formulations and products. FDA approval of the only U.S.-manufactured liquid formulation of alpha-1 antitrypsin is testament to Grifols' steadfast commitment to improving the treatment of patients worldwide. The company has already launched the new liquid formulation of alpha-1 Prolastin®-C Liquid.

Sales of factor VIII followed a trend seen in previous quarters of 2018, significantly declining as a result of lower use in patients with inhibitors. Grifols continues to position factor VIII as the best treatment to treat patients without inhibitors. Its efforts in this regard are focused primarily on the U.S. market.

Diagnostic Division: A broader NAT technology portfolio

Diagnostic Division revenues reached Euros 517.7 million, increasing by 1.9%2 cc (-4.9%2 taking exchange rate variations into account). Sales growth is primarily driven by Grifols transfusion medicine portfolio, that shows growth in all product lines: NAT technology sales (Procleix® NAT Solutions), used to screen blood and plasma donations for viruses; blood typing solutions and blood collection systems.

Growth of NAT technology predominantly derives from sales of the Procleix® Zika Virus assay in the U.S. The Procleix® Zika Virus assay for the detection of Zika virus RNA, already bearing the CE mark, has been used by U.S. blood banks since June 2016 under an IND (Investigational New Drug) protocol and has received FDA approval during third quarter 2018.

The assay adds to other recent FDA approvals which include the Procleix® Ultrio Elite and Procleix® WNV assays that enable blood centers to screen for HIV, hepatitis B and C, and the West Nile virus. All three assays are run on the proven, fully automated Procleix® Panther System. The Procleix® Babesia assay is also available on the Procleix® Panther System in the U.S. under an IND protocol.

Grifols blood typing solution product line is experiencing higher sales in U.S., Europe and Latin American countries. The product line includes analyzers (Wadiana®, Erytra® and Erytra-Eflexis®), gel cards (DG-Gel® cards) and reagents (red blood cells and antisera). Over 140 units of the Erytra-Eflexis® instrument have been sold since its launch a year ago.

Grifols ID CORE XT molecular in-vitro diagnostic test for blood group genotyping has received approval from the FDA. The test has been CE-IVD marked in Europe since 2014. The ID CORE XT kit will benefit patients who require ongoing transfusions including individuals with hemoglobinopathies such as sickle-cell disease (SCD) and thalassemia, as well as cancer patients.

Grifols continues to consolidate its sales of antigens to manufacture diagnostic immunoassays and to clear milestones related to relocating existing immunodiagnostic manufacturing operations to its new facility in Emeryville, California. Grifols has recently received FDA approval for the facility as well as for the production of an hepatitis C antigen in it. This new facility is dedicated to the production of recombinant proteins and designed for Grifols with room to grow with the needs of its current and future customers.

Hospital Division: Solid growth in the U.S.

Hospital Division revenues totaled Euros 85.7 million for the first nine months of 2018, compared to Euros 74.8 million reported in the same period last year. This increase represents 18.4%2 cc growth (14.6%2 including the impact of exchange rate variations).

In line with its strategic plan, Grifols continues to reinforce the division's international expansion. The U.S. market grew, mainly thanks to higher sales of physiological saline solution, produced in the Murcia (Spain) plant, and its usage in Grifols' network of plasma donation centers. The Pharmatech business also experienced an upturn in the United States and key Latin American countries. This business line offers integrated hospital-pharmacy solutions, including the products and services of the recently acquired firm, MedKeeper.

Bio Supplies Division: Stronger growth as a result of Kedrion manufacturing agreements and Haema plasma sales

This division oversees the sale of biological products for non-therapeutic use, revenues related to the manufacturing agreements with Kedrion, and Haema's third-party plasma sales. The Kedrion agreement and Haema's plasma sales collectively increased the division's revenues to Euros 77.0 million for the first nine months of 2018, compared to Euros 47.7 million reported for the same period last year.

Revenues by division and region:

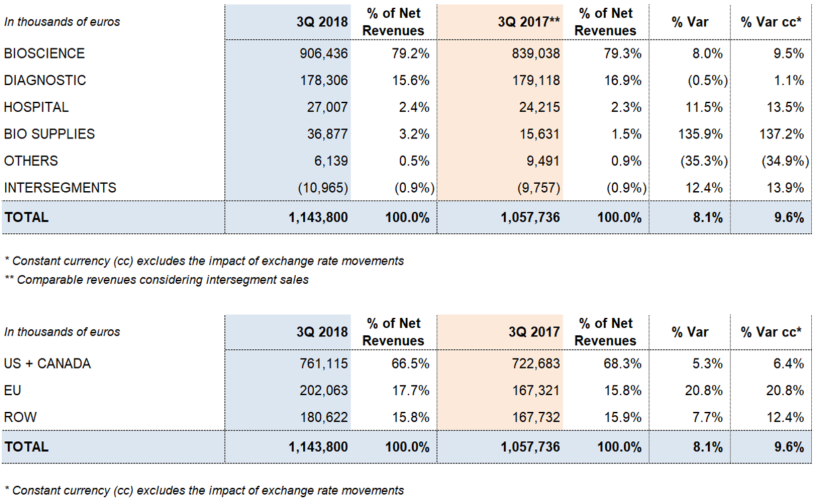

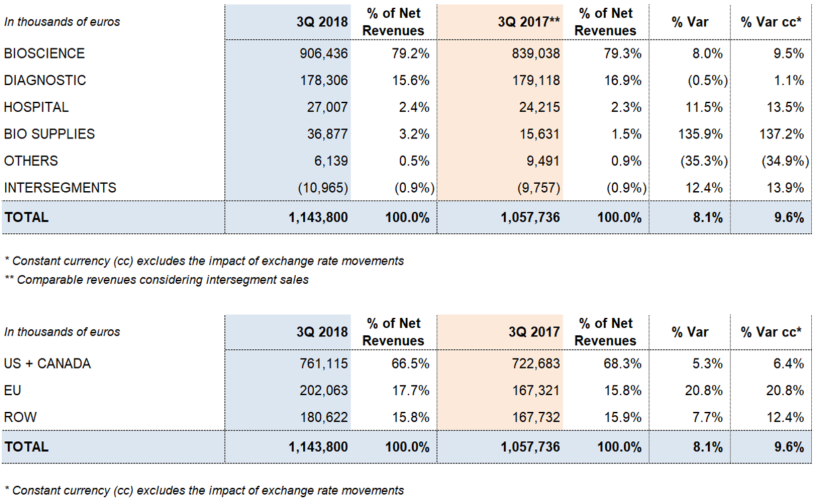

THIRD QUARTER 2018

Operational revenues grow by 9.6%, led by the Bioscience Division

Grifols' total revenues amounted to Euros 1,143.8 million, representing 9.6% cc operational growth (8.1% taking into account exchange rate variations). Sales have grown in all divisions and regions where the company operates.

The Bioscience Division was the main catalyst of Grifols' revenue growth, increasing its sales by 9.5%2 cc (8.0%2 considering exchange rate variations) to Euros 906.4 million. Demand for immunoglobulin and alpha-1 antitrypsin in the U.S. and the EU remains solid. The division also noted higher sales of albumin, particularly in China, the U.S. and Europe.

Diagnostic Division revenues totaled Euros 178.3 million (1.1%2 cc and -0.5%2), while the Hospital Division also showed strong results, confirming the success of its internationalization strategy. The Bio Supplies Division generated Euros 36.9 million in sales (137.2%2 cc and 135.9%2), with growth predominantly derived from third-party plasma sales following the Haema acquisition.

Sales remained strong in the main EU countries (20.8% cc and 20.8%), with Euros 202.1 million in revenues. Sales in the U.S. and Canada grew by 6.4% cc and 5.3%, respectively, to Euros 761.1 million. Revenues in the rest of the world (ROW) grew by 12.4% cc (7.7%), reaching Euros 180.6 million.

Revenues by division and region:

INVESTMENT ACTIVITIES: ACQUISITIONS, CAPEX AND R+D+i

Acquisition of 24 Biotest plasma centers

Grifols acquired 24 U.S. plasma collection centers, in addition to two centers under construction and other assets from Biotest as part of its efforts to expand and diversify its plasma supply. The transaction cost was USD 286 million (Euros 244 million), which the company financed with its own resources.

These newly acquired donation centers are all licensed by the FDA and European health authorities. In 2017, these centers collected approximately 850,000 liters of plasma.

Capital investments (CAPEX)

Grifols invested Euros 162.5 million over the first nine months of the year as part of its on-going efforts to enhance and expand the production facilities of its four divisions. Capital investments continue as outlined in the 2016-2020 Capital Investment Plan, endowed with Euros 1,200 million to enable the company's long-term sustainable growth.

Among the most notable developments was the FDA approval for the new production plant in Emeryville, California (USA), dedicated to the production of recombinant proteins. Grifols plans on submitting five additional FDA applications by the end of the year to relocate the manufacture of other products to this new location. Once the transition has been finalized, by mid-year 2019, Grifols will have transferred 21 products to the new installations.

R+D+i: An important step forward in the fight against Alzheimer's

Grifols allocated a total of Euros 199.5 million to R+D+i, including both in-house and external projects, over the first nine months of 2018. These investments represent a 4.7% increase compared to the same period last year.

Grifols unveiled phase IIb/III results of the AMBAR trial (Alzheimer Management By Albumin Replacement) to treat Alzheimer's disease (AD) at the 11th Clinical Trials on Alzheimer's Disease (CTAD) Congress, held in October in Barcelona.

AMBAR is an international, multicenter, randomized blinded and placebo controlled, parallel group clinical trial that enrolled mild and moderate Alzheimer patients from 41 Treatment Centers in Europe and the United States. The study was designed to evaluate the efficacy and safety of short-term plasma exchange followed by long-term plasmapheresis with infusion of Human Albumin combined with intravenous immunoglobulin in patients with mild and moderate AD.

Results analyzed two primary efficacy endpoints as measured by the Alzheimer's Disease Assessment Scale-cognitive (ADAS-Cog) and the Alzheimer's Disease Cooperative Study – Activities of Daily Living (ADCS-ADL) scales.

These results mark an important milestone in Grifols' 15 years of research on Alzheimer's disease and encourage the company to continue its research efforts on the benefits of plasma exchange with Grifols albumin as a treatment against AD.