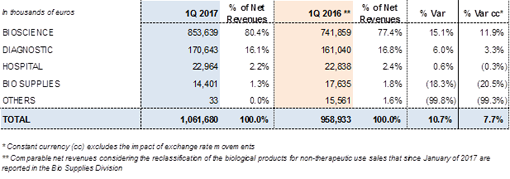

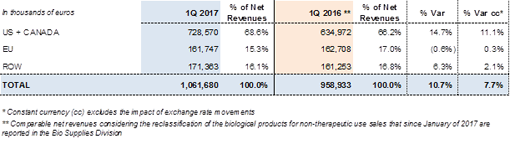

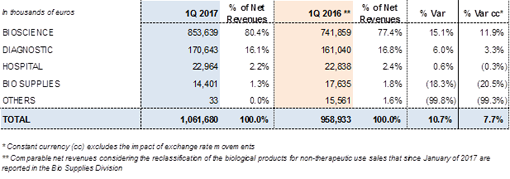

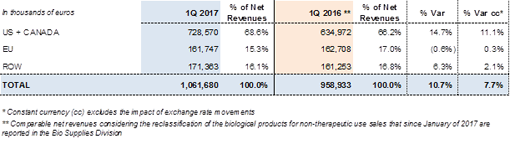

Barcelona, May 3, 2017.- Grifols' (MCE: GRF, MCE: GRF.P and NASDAQ: GRFS) turnover increased significantly in the first quarter of 2017, growing by 10.7% (7.7% cc) to reach Euros 1,061.7 million. Revenues from the company's three main divisions all rose.

The driver of growth was the Bioscience Division, whose sales increased by 15.1% (11.9% cc) to Euros 853.6 million compared to Euros 741.94 million in the same period last year. Global demand for plasma proteins continued its upward trend as anticipated in previous periods with a positive price impact. The company's forecasts of greater market demand led to a noteworthy increase in sales volumes of its main plasma-derived products, including specialty proteins.

The Diagnostic Division reported revenues of Euros 170.6 million, which represents a 6.0% (3.3% cc) increase. The key catalyst for the rise in income was the division's NAT donor screening line (Procleix® NAT Solutions) in core markets, including the United States, China and Japan. Sales of the Hospital Division have remained stable at Euros 23.0 million, growing by 0.6% (-0.3% cc).

Since January 2017, the company also has a new Bio Supplies Division that mainly comprises biological products for non-therapeutic use. The division reached sales of Euros 14.4 million in the first quarter of 2017.

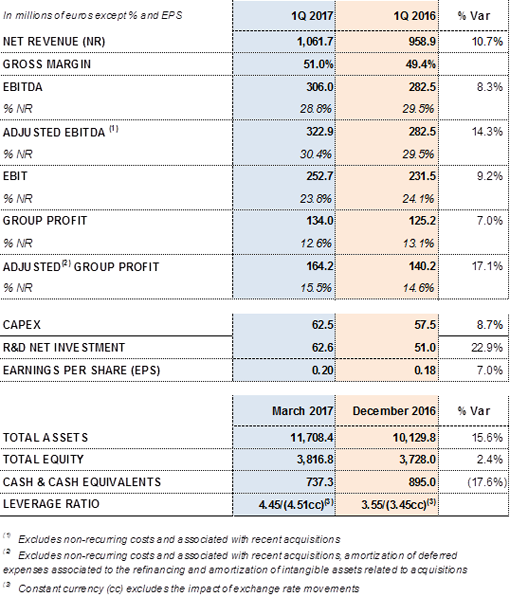

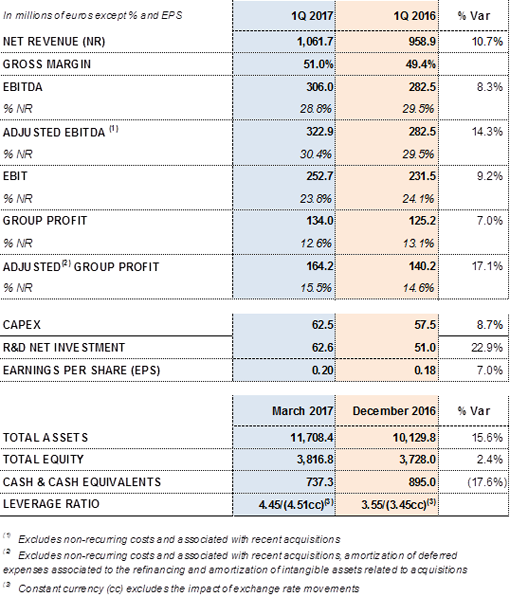

Grifols' adjusted EBITDA1 grew by 14.3% to Euros 322.9 million in the first quarter of the year, representing a margin over sales of 30.4%.

Taking into account the non-recurring costs associated with the acquisition of Hologic's share of the NAT donor-screening unit, Grifols' EBITDA from January to March 2017 was Euros 306.0 million, which represents a 28.8% margin over sales.

In line with company forecasts, the acquisition of Hologic's share of the NAT donor-screening unit at the beginning of 2017 has had a positive impact on the group's margins. The EBITDA margin continues impacted by the cost of plasma related with the opening of new donation centers.

At present, Grifols is the world leader in plasma donation centers, with a network of nearly 180 centers in the United States. The company considers guaranteeing access to its main raw material (plasma) as a strategic priority to meet the growing demand for plasma proteins. In alignment with this strategy, Grifols has continued its investment plans to open new centers during the first months of the year.

Total R&D net investments also received a significant boost, increasing 22.9% in relation to the same period last year to Euros 62.6 million. The figure includes both internal and external R&D investments that are managed through Grifols Innovation and New Technology.

Grifols' financial result was Euros 66.2 million, compared to Euros 68.6 million reported in the same period last year. Thanks to the refinancing process, the group has been able to optimize the financial expenses resultant from the increased levels of debt following its acquisition of Hologic's NAT donor screening unit.

The effective tax rate increased to 27.0% due to higher profits in the United States through its Bioscience and Diagnostic Divisions.

Grifols' net profits increased by 7.0% to reach Euros 134.0 million, which represents 12.6% of the company's net revenue. The adjusted net profit2 was Euros 164.2 million, representing a 17.1% increase compared to Euros 140.2 million reported in 2016.

At the close of the first quarter of 2017, the company's net financial debt totaled Euros 5,754.6 million, including USD 1,700 million of financing for the acquisition of Hologic's NAT donor screening unit. Net financial debt to EBITDA ratio was 4.45x.

Grifols' solid operating cash flow generation provides the necessary solvency to pursue its future expansion projects, as well as meet its objective of reducing its financial leverage, which remains a priority.

As of March 31, 2017, Grifols' cash positions exceeded Euros 737 million. Moreover, the company maintained a strong operating cash flow generation that rose to Euros 145.4 million, compared to Euros 58.3 million during the same quarter in 2016. At the close of the quarter, Grifols had undrawn lines of credit totaling Euros 440 million, taking the company's liquidity position over Euros 1,150 million.

Main financial data from the first quarter 2017:

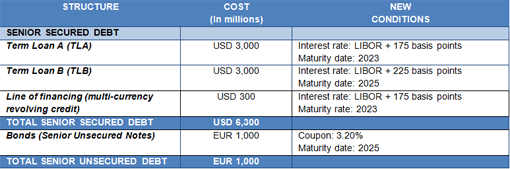

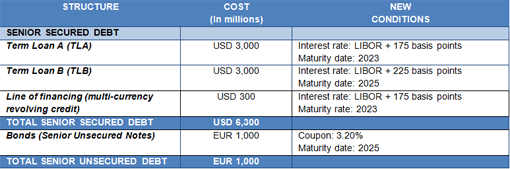

DEBT REFINANCING

Grifols concluded the refinancing process of all of its debt after the first quarter, improving financing conditions and extending maturities. The total refinanced debt amounts to USD 7,300 million (Euros 7,000 million), including USD 1,000 million in bonds. The average cost of debt dropped by 120 basis points and falls below 3%, whereas the average maturity exceeds 7 years.

Following the refinancing process, Grifols' debt structure now comprises long-term syndicated financing with financial institutions and institutional investors for a total of USD 6,300 million, which is divided into two tranches (Term Loan A and Term Loan B); a multi-currency revolving credit facility; and an unsecured bond issue of Euros 1,000 million.

The refinancing of Grifols' debt was carried out in two phases. In February, the placement of Term Loan A and Term Loan B was completed, resulting in a significant over-subscription that enabled the company to reduce the differential by 200 basis points.

Moreover, the unsecured bond issue completed after the close of the first quarter also offered the company very advantageous conditions. The new bonds accrue an annual coupon of 3.20% compared to the 5.25% of the bonds issued in March 2014.

Grifols' financial structure and new conditions following the refinancing process are as follows:

REVENUE PERFORMANCE OF GRIFOLS' MAIN DIVISION

- Bioscience Division: 80.4% of total revenues

The demand for plasma proteins continued to move upward as anticipated in previous periods. The company's planning to meet greater market demand led to a marked 15.1% (11.9% cc) upturn in revenues in the first quarter, to reach Euros 853.6 million. A notable increase in sales of the company's main plasma proteins, coupled with a positive price impact in key markets, were the main drivers of growth.

Immunoglobulin (IVIG) sales remained strong in every region where Grifols operates, particularly in the United States and Canada. Of note is the continued use of IVIG to treat diseases such as chronic inflammatory demyelinating polyneuropathy (CIDP), a market segment that Grifols leads.

Alpha-1 antitrypsin sales continue to be one of the drivers of the division's growth, and significant increases continue in the United States, Germany and Canada. Grifols remains steadfast in its efforts to improve the diagnosis of alpha-1 antitrypsin deficiency (DAAT), and in coordination with its Diagnostic Division, works toward developing new diagnostic solutions to advance the treatment management of the disease.

In this regard, Grifols developed a cutting-edge genetic test that simultaneously analyzes the world's most prevalent mutations associated with DAAT, an effort led by Progenika Biopharma. The test has already obtained European Conformity (CE mark) for its commercialization in various European countries.

Sales of Factor VIII continue to grow, especially in the United States where Alphanate® is the most frequently prescribed plasma-derived Factor VIII. The company also strengthened its position in the treatment of previously untreated patients with severe hemophilia A, a boost motivated primarily by the results of the SIPPET5 study (Survey of Inhibitors in Plasma Products Exposed Toddlers). Meanwhile, China and the United States remain key markets for albumin sales.

The first quarter also saw significant growth for other specialty proteins that enhance Grifols' unique portfolio of products and optimize raw material costs and production capacities. These proteins include hyperimmune immunoglobulins used to treat infections such as rabies and tetanus.

Grifols closed an agreement with the Spanish Ministry of Health to provide one million units of tetanus-diphtheria (Td) vaccine starting April 2017. In 2016, Grifols obtained exclusive rights to market and distribute the Td vaccine produced by Mass Biologics' in the U.S. The relationship has allowed Grifols to reach this new agreement, helping to solve the current shortage of this vaccine in Spain.

- Diagnostic Division: 16.1% of total revenues

The Diagnostic Division attained revenues of Euros 170.6 million, a 6.0% increase (3.3% cc) in relation to the same period in 2016. Sales revenues from NAT technology systems (Procleix® NAT Solutions), used for virological screening of blood donations and plasma, were the main drivers of growth. Also noteworthy is the revenue boost from Zika virus blood screening tests in the U.S. and continued progress of this technology in the Asia Pacific, especially in China and Japan.

The company continues strengthening the presence of its blood typing business in the U.S. This is a market with a high-growth potential, with its analyzers (Wadiana® and Erytra®) and reagents (DG-Gel®).

The cost-reduction process, led by Grifols within the framework of its joint-business agreement with Ortho Clinical Diagnostics, continues to impact sales of antigens used in the production of diagnostic immunoassays. Grifols is in the final stages of construction of its new plant in Emeryville (California, U.S.).

- Hospital Division: 2.2% of total revenues

Revenues from the Hospital Division remained stable at Euros 23.0 million, compared to Euro 22.8 million reported for the same period in 2016 (0.6%/-0.3% cc). By area, the primary drivers of growth were the intravenous solutions line and the Pharmatech line, which includes intravenous therapy devices (IV tools) and Hospital Logistics.

Grifols continues to lay the groundwork to further develop this division in the United States, as well as expand its presence in various Latin American markets.

- Bio Supplies Division: 1.3% of total revenues

From January 2017 the Raw Materials activity has been included in the new Bio Supplies Division. The division will also record sales from manufacturing agreements with Kedrion, sales of biological products for non-therapeutic use and other biological products.

To enhance its future activity, in January 2017, Grifols acquired 49% of Access Biologicals' share capital for USD 51 million. Access core business is the manufacture of biological products, such as specific intravenous and plasma reagents, which are used by biotechnological and biopharmaceutical companies for in-vitro diagnosis, cell culture and research and development in the field of diagnosis. As well as the investment, Grifols signed a supply agreement to sell to Access Biologicals, products for non-therapeutic use.

1Q2017 - Net Revenues by Division:

1Q2017 - Net Revenues by Region:

INVESTMENT ACTIVITIES: R&D+INNOVATION, CAPEX AND ACQUISITIONS

- Research, Development and Innovation

Total net investment in R&D+i over January to March 2017 amounted to Euros 62.6 million, a 22.9% increase with respect to the same period last year, and representing 5.9% of revenues. The figure includes both internal and external R&D investments that are managed through Grifols Innovation and New Technology.

Grifols' commitment to research, development and innovation is not limited to internal resources. Through Grifols Innovation and New Technology (GIANT), Grifols has developed an approach to innovation, whose overarching aim is to evaluate and accelerate the development and commercialization of innovative treatments, products and services through both internal and external investments such as Albajuna, Alkahest, Araclon, Aradigm, Kiro Robotics and Singulex. At end of the first quarter, Grifols Innovation and New Technology current investment reaches USD 190 million.

For the fourth consecutive year, Grifols featured on Forbes magazine's annual list of the world's 100 most innovative companies. In addition, the company once again received the highest mark of "excellent" in the 2016 Profarma Plan, an initiative of the Spanish government to increase competitiveness of the national pharmaceutical industry.

- Capital Investments (CAPEX)

Grifols invested Euros 62.5 million in the first quarter of the year to continue to enhance the production facilities of its three divisions. The ongoing investments included in the Euros 1,200 million 2016-2020 Capital Investment Plan, continue as planned.

The plan to open new plasma donation centers in the United States, as well as plans to expand, renovate and relocate existing centers is on track. The company currently has close to 180 plasma-collection donation centers with state-of-the-art capabilities to enable more efficient donation processes and aims to expand this network to 225 by 2021.

Also in the United States, the plant to produce albumin in bags in Los Angeles has entered the validation phase; the new Clayton offices were finalized and work started for the new 6 million liter fractionation facility. This new fractionation plant will double the capacity in Clayton and it is expected to be operational by 2022.

Within the Diagnostic division investments it is worth noting that the validation process of the new antigen plant in Emeryville (U.S.) continues according to plan.

In Europe, work has started for the new albumin purification plant in Dublin (Ireland) that is expected to be finalized in 2021 and the validation process for the new alpha-1 antitrypsin purification plant in Barcelona (Spain) is ongoing.

In Brazil, Grifols relocated its corporate headquarters in Curitiba (Parana) to a new location that includes a distribution warehouse to serve the domestic market. The new headquarters represent the first phase of the company's expansion plans in Brazil, which will conclude in 2017 with the completion and launch of a production plant that manufactures bags for blood collection, storage, and transfusion of blood components. The plant will be located in an adjacent building and has 5,500 square meters. These investments form part of the company's strategy to increase its presence in Latin America.

Grifols completes the acquisition of Hologic's NAT donor screening unit

The acquisition of Hologic's share of their joint business was completed in record time, as Grifols was already responsible for marketing the unit's products worldwide. Specifically, Grifols acquired the area of Hologic's business focused on the research, development and production of reagents and instruments based on NAT technology, which increases the safety of transfusion diagnostics by detecting the presence of infectious agents in blood and plasma donations.

Among the acquired assets were the production plant in San Diego (California), and the development rights, patent licenses and access to the product manufacturers.

The total amount of the transaction was USD 1,850 million, which Grifols financed with a USD 1,700 million term loan and existing cash on the balance sheet.

Acquisition of a 49% stake in Access Biologicals for USD 51 million

Grifols acquired a 49% capital stake in Access Biologicals. An industry leader based in San Diego (California), Access manufactures biological products for non-therapeutic use, including specialty serums and plasma reagents used by biotech and biopharmaceutical companies for in-vitro diagnostics, cell cultures, and R&D in the diagnostics field. The agreement includes the option to purchase the remaining 51% of the share capital in five years' time.

As part of the acquisition of a minority stake in the company, Grifols also signed a supply contract with Access Biologicals to sell biological products for non-therapeutic use. Revenues from this contract will be allocated to the Bio Supplies Division.

Acquisition of Six Kedrion Plasma Centers

In February 2017, Grifols' acquisition of six plasma centers from Kedplasma, LLC for USD 47 million was completed.

1 cc: at constant currency rates.

2 Excludes the non-recurring costs related to the acquisition of Hologic's share of the NAT donor-screening unit.

3 Excludes non-recurring costs and costs related to recent acquisitions, depreciation of deferred financial expenses associated with the refinancing process and depreciation of intangibles associated with acquisitions.

4 Comparable net revenues considering the reclassification of the biological products for non-therapeutic use sales that since January of 2017 are reported in the Bio Supplies Division.

5 The SIPPET study demonstrated that treatment with recombinant factor VIII (rFVIII) is associated with an 87% greater incidence of inhibitors than when using plasma-derived factor VIII with von Willebrand factor (pdFVIII/VWF) in previously untreated patients with severe hemophilia A.