July 31, 2019

Grifols increases its revenues by 14.3% to EUR 2,423 million, driven by its strategic growth plan

-

Grifols achieves robust revenue growth, higher profitability and debt reduction in the second quarter

-

The Bioscience Division continue fuels the group’s revenue growth with a 13.6% (7.6% cc1) increase in the first half. In the second quarter, the company reports growth in all divisions and regions where it operates

-

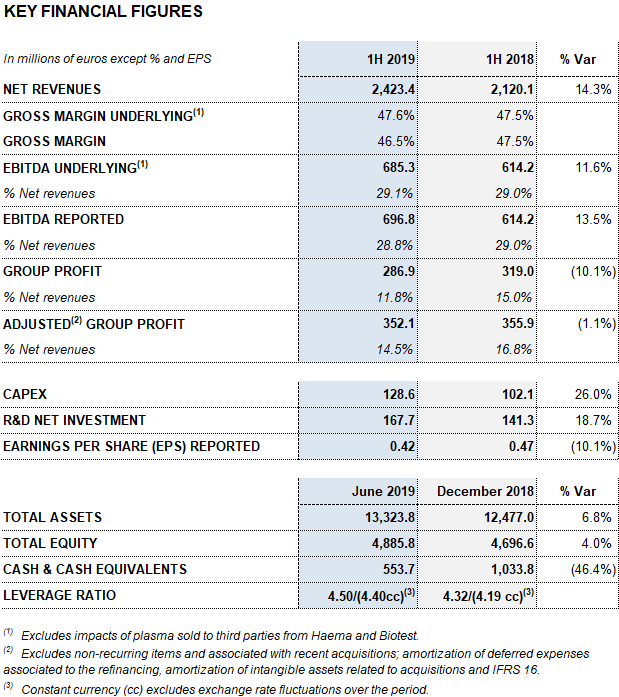

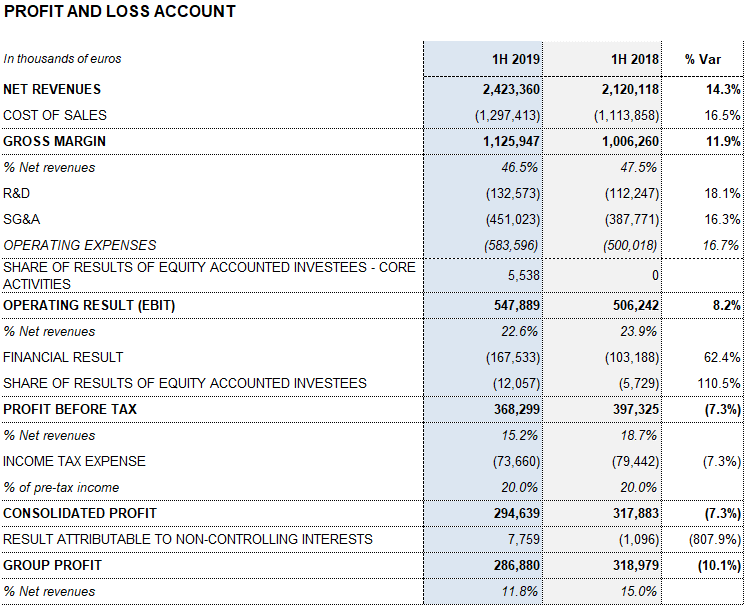

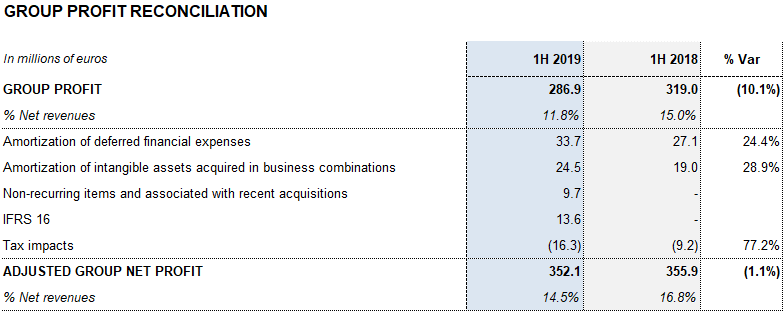

Grifols increases its profitability, with a gross margin of 46.5% and EBITDA margin of 28.8%. In the first half of 2019, EBITDA totals EUR 697 million and net profit reaches EUR 287 million

-

The net leverage ratio drops to 4.50x (4.40x cc)

-

The FDA approves Grifols’ 20% subcutaneous immunoglobulin (Xembify®), used to treat primary immunodeficiencies

-

New data presented at AAIC2 provide further evidence of the positive impact of the AMBAR clinical trial against Alzheimer on efficacy endpoints combining cognitive and functional ability in all treated patients

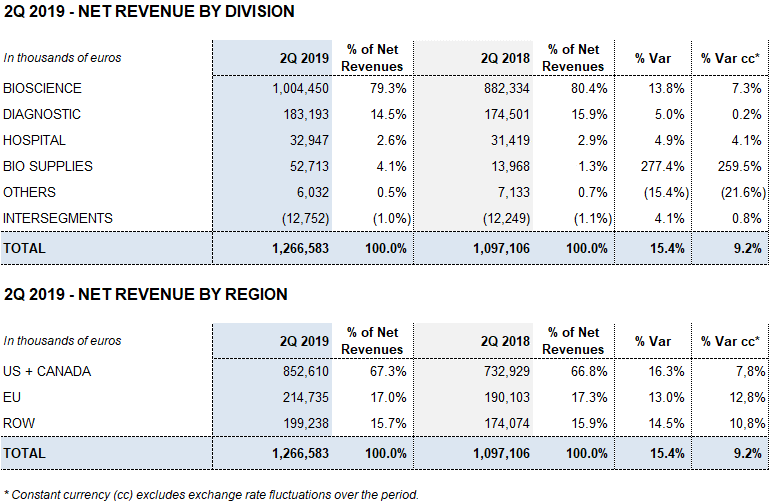

Barcelona, July 31, 2019.- Grifols (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS) reports EUR 2,423.4 million in revenues in the first half of the year, representing a 14.3% increase and 8.6% at constant currency (cc). The company grew across all divisions and key regions where it operates and made significant progress in the execution of its growth strategy.

These results clearly underline the Grifols’ commitment to patients and its historically proven ability to expand its production capacity well in advance. In recent years, greater efforts to enhance sales and operations, as well as strategic investments to boost access to plasma, played a vital role in the group’s solid performance.

Further testament to Grifols’ long-term vision and commitment to innovation and sustainable growth include the latest encouraging results from the AMBAR clinical trial in the fight against Alzheimer’s and the recent FDA approval of Xembify®, a 20% subcutaneous immunoglobulin used to treat primary immunodeficiencies.

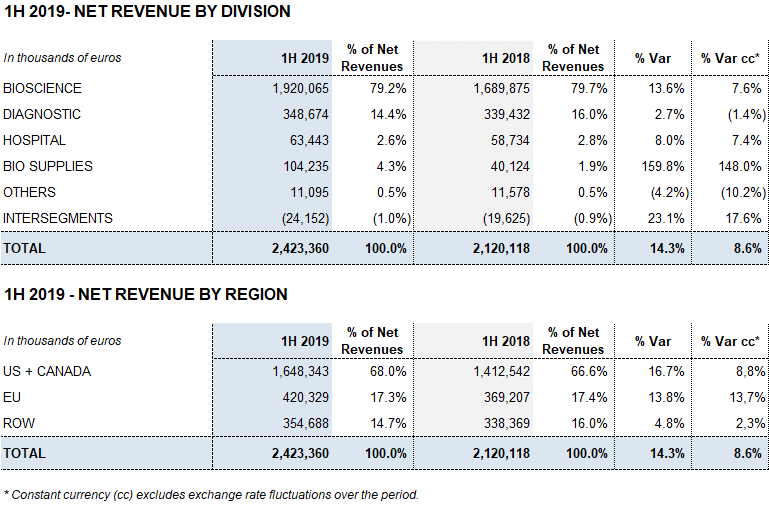

Revenues from the Bioscience Division grew by 13.6% (7.6% cc) to EUR 1,920.1 million amid an environment of solid demand for the main plasma proteins, especially immunoglobulins.

The Diagnostic Division expanded by 2.7% (-1,4% cc) to EUR 348.7 million in revenues in the first half of the year. The Hospital Division grew by 8.0% (7.4% cc) to EUR 63.4 million, while the Bio Supplies Division reported EUR 104.2 million in revenues, a 159.8% (148.0% cc) increase compared to the same period last year.

Grifols’ gross margin continued on a positive upward trend to reach 46.5% in the first half of the year (47.2% in the second quarter of 2019). A stronger demand of certain plasma proteins, the evolution of plasma costs and industrial efficiencies were the main drivers of this upswing. Underlying gross margin3 reached 47.6%.

Reported EBITDA reached EUR 696.8 million due to higher gross margin, representing a 13.5% increase over the same period in 2018 and a 28.8% margin. For the first time in several years, the Hospital Division achieves positive EBITDA. Reported EBITDA margin stood at 30.9% in the second quarter of 2019 impelled by a tailwind of some non-recurring items. Underlying EBITDA3 totaled EUR 685.3 million, reflecting a margin of 29.1%.

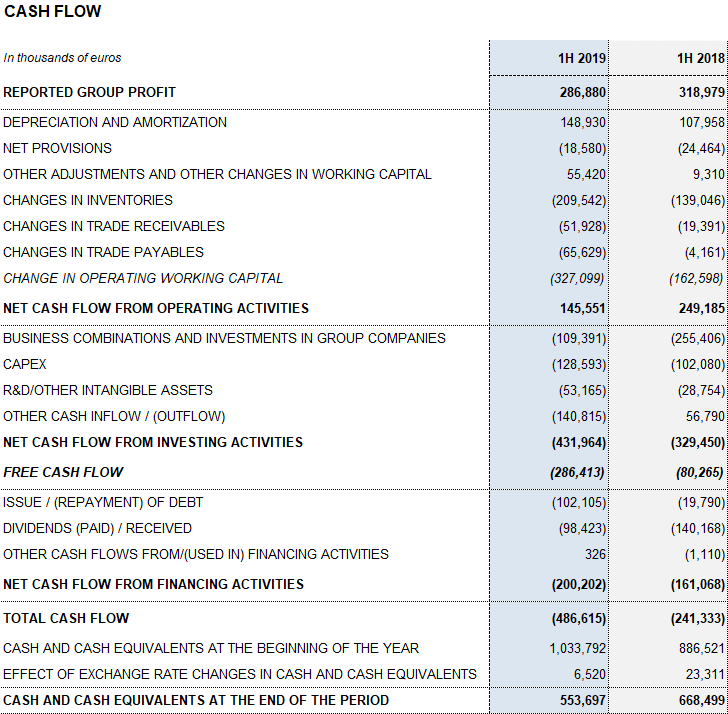

The total net R+D+i investment, which comprises in-house, external and investee investments, amounted to EUR 167.7 million, an 18.7% increase compared to the same period in 2018. Grifols also allocated EUR 128.6 million to capital investments (CAPEX).

Grifols’ financial performance in the second quarter of 2019 remained stable compared to the first quarter. In comparison with 2018, it includes the impact of the interest rate evolution and changes in accounting standards for leases (IFRS 16), which amounted to EUR 16.6 million in the first half of 2019. Of note is the positive impact in 2018 from the divestment in TiGenix for EUR 32 million.

The effective tax rate was 20% and net profit totaled EUR 286.9 million.

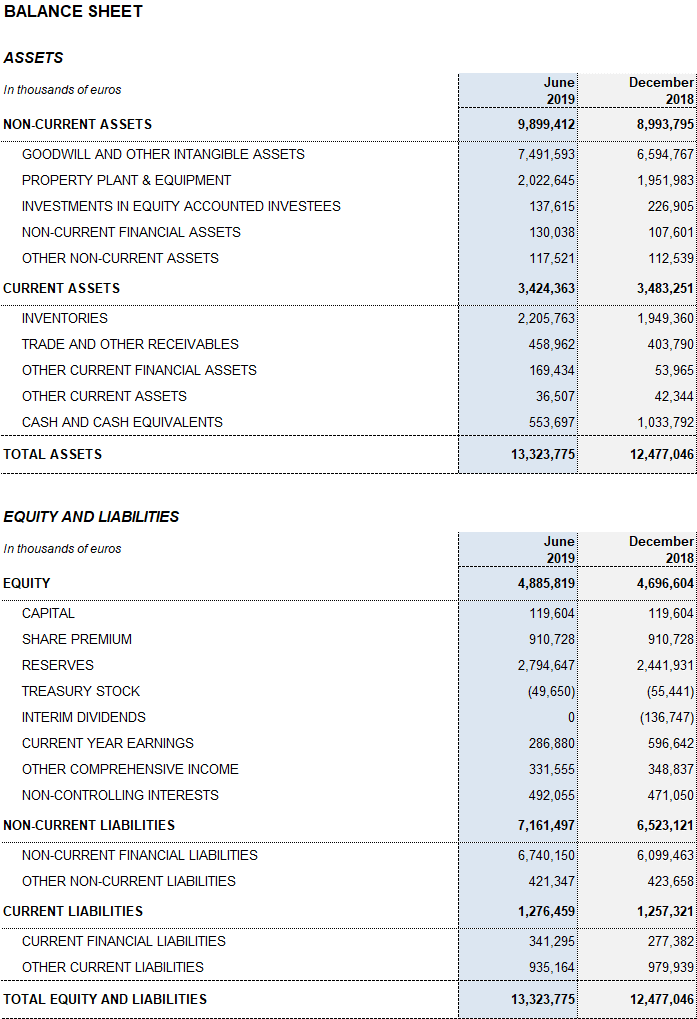

Excluding the impact from IFRS164, Grifols’ net financial debt stood at EUR 5,845 million, including EUR 554 million in cash. The net debt leverage ratio improved significantly to 4.50x (4.40x cc) from 4.78x in the first quarter of 2019. It remains a key priority once recent strategic investments are in place.

The net debt leverage ratio improved in the second quarter, due primarily to the upturn in EBITDA and optimization of working capital management. Inventory levels increased as a result of the strategic decision to continue building up plasma volumes to meet the strong demand for plasma therapies.

Additionally, in the second quarter, Grifols paid USD 100 million to exercise the call option5 on 51% of share capital of the U.S. firm Interstate Blood Bank Inc. (IBBI). The company also paid out a final dividend against 2018 earnings for a total gross amount of EUR 102 million.

As of June 30, 2019, Grifols had EUR 410 million in undrawn lines of credit and a liquidity position of more than EUR 950 million.

PERFORMANCE BY DIVISION

Bioscience Division

Revenues from the Bioscience Division served as the primary engine of growth, growing by 13.6% (7.6% cc) to EUR 1,920.1 million in the first half of the year.

The division continued to benefit from the positive upward trend seen in the second quarter, increasing sales by 13.8% (7.3% cc) to EUR 1,004.5 million in revenues. These results marked a record-high for the division, which for the first time recorded quarterly revenues in excess of EUR 1,000 million.

The continued division’s growth was mainly fueled by strong global demand for immunoglobulin, as well as hyperimmune immunoglobulins in the United States (USA).

Immunoglobulin sales remained robust, attaining double-digit growth. Grifols is currently one of the global leaders in the production and sale of immunoglobulin, with 30.3%6 market share (volume) in the United States.

Grifols also recently received approval from the U.S. Food and Drug Administration (FDA) for Xembify®, its new 20% subcutaneous immunoglobulin used in the treatment of primary immunodeficiencies.

This approval underscores Grifols’ commitment to patients in the U.S., where the company continues to allocate in an increasing part of its production to meet demand. Its U.S. market launch is scheduled for the fourth quarter of 2019.

Sales of antitrypsin alpha-1 remain solid in the U.S., Germany and Spain, with growing rates of diagnosis thanks to new solutions developed by Diagnostic Division. At the same time, the company spearheads a variety of programs and strategic sales actions to promote sales of this protein.

Albumin sales in China have started to recover following delays in the renewal process of specific licenses in the fourth quarter of 2018. Sales in China are expected to meet their projected growth for the year and pick up considerably in the second half of 2019.

Meanwhile, sales of factor VIII continue to feel the impact of their declining use to treat patients with inhibitors. The company’s efforts to position its factor VIII as the optimal treatment for patients with hemophilia A have resulted in an enhanced tender market presence and higher sales volumes.

Grifols continues to promote its specialty proteins to enhance its differential product portfolio. Of note in the first half of 2019 was the upward trend in hyperimmune immunoglobulins, particularly sales of the new formulation anti-rabies immunoglobulin (HyperRAB®).

At the same time, Grifols will be prepared for the launch of a new plasma-protein-based biosurgery solution. The market introduction of VISTASEAL®, designed to control surgical bleeding by combining Grifols’ biologic fibrin sealant with Ethicon technology, is scheduled for the second half of the year.

The Grifols-Ethicon agreement encompasses a second product combining Grifols’ lyophilized thrombin, a blood-clotting protein, with Ethicon’s hemostatic matrix SURGIFLO®. This product will offer surgeons more advanced options to accelerate and induce coagulation during surgery.

Diagnostic División

The Diagnostic Division grew by 2.7% (-1,4% cc) to EUR 348.7 million in revenues in the first half of 2019.

In the second quarter, Diagnostic Division revenues increased by 5.0% (0.2% cc) to EUR 183.2 million.

Revenues generated from transfusional medicine solutions continue to drive the division’s performance. Sales of NAT technology systems (Procleix® NAT Solutions), used to detect viruses in blood and plasma donations, maintain their contribution to the division’s results. Grifols continues its efforts to develop new reagents to expand its differential product portfolio and boost its reach in diverse markets.

Sales of the blood-typing line expanded by double digits. This product portfolio includes analyzers (Wadiana®, Erytra® and Erytra Eflexys®), gel cards (DG-Gel®) and reagents. Sales were especially robust in China, a market with high growth potential for the division; the United States, its primary market whose success directly reflects the division’s strategic investments and solid sales plan; Latin America, particularly Mexico; and several countries in Asia and Europe.

Other highlights include the upcoming installation of the first Erytra Eflexis® in the largest hospital in Tunisia. Grifols’ alliance with one of the region’s most notable medical facilities will pave the way for further expansion in other African markets.

Hospital División

Hospital Division revenues increased by 8.0% (7.4% cc) to EUR 63.4 million. The division reported strong sales in the United States, one of its core markets, and an upsurge in sales in all business lines.

Pharmatech sales were notably strong in the first half of the year, achieving double-digit growth. This line includes the inclusiv® IV compounding portfolio of devices, software and services to maximize the safety, quality and efficiency of hospital-pharmacy operations, including the MedKeeper® and Kiro Grifols® technological solutions.

As a leader in systems for sterile IV compounding for hospital pharmacies, Grifols is poised to benefit from the recent rollout of new regulations affecting hospital pharmacy and compounding operations in the United States.

Sales of the division’s IV solutions also grew, driven by the U.S. distribution of the physiological saline solution produced in Grifols’ Murcia (Spain) plant and their usage in its proprietary network of plasma donation centers. Sales of medical devices, clinical nutrition products and contract manufacturing also remained strong.

Bio Supplies División

Revenues from the Bio Supplies Division totaled EUR 104.2 million during the first half of the year, attaining 159.8% growth (148.0% cc) in relation to the same period in 2018.

The division primarily oversees sales of biological products for non-therapeutic use and third-party plasma sales by Haema and Biotest (EUR 72.3 million in the first half of the year).

INVESTMENT OPERATIONS: ACQUISITIONS, CAPEX AND R+D+i

Grifols exercises call option on the 51% of IBBI share capital

Grifols paid USD 100 million to exercise its call option on the remaining 51% of share capital of Interstate Blood Bank Inc. (IBBI) and its subsidiaries.

In the second quarter of 2016, Grifols signed an agreement with IBBI to acquire 49% of its share capital, which included a call option for the remaining 51%.

Following this transaction, Grifols added 36 FDA-licensed centers (26 plasma centers and 10 whole blood-donation centers), as well as an analytical laboratory.

This operation forms part of Grifols’ strategic plan to expand and diversify its access to plasma, which is critical to meeting the growing demand for plasma-derived therapies and enhancing the health and well-being of patients worldwide.

Grifols is currently the worldwide leader in plasma centers, with a network of 293 centers in the United States and Europe.

Grifols allocates EUR 1,400 million to CAPEX from 2018 to 2022

Grifols invested EUR 128.6 million in the first six months of the year to continue improving and expanding the production facilities of its four divisions.

The company furthermore announced its intention to allocate EUR 1,400 million to capital investments over the 2018-2022 period.

Particularly noteworthy is the construction underway of the world’s first purification and sterile filling plant of immunoglobulins in flexible bags. Located on Grifols’ Clayton (North Carolina, USA) complex, the plant will require a EUR 140 million investment and commence operations in 2022.

Grifols obtains FDA approval for Xembify® thanks to its steadfast commitment to R+D+i

Following the close of the second quarter, Grifols received FDA approval for its new 20% subcutaneous immunoglobulin (Xembify®) to treat patients with primary immunodeficiencies.

Grifols is currently working with diverse healthcare authorities to obtain approval in Canada, Europe and other markets.

The latest AMBAR results demonstrate improvement in all treated patients

Grifols recently presented additional results of its AMBAR (Alzheimer Management by Albumin Replacement) clinical trial for the treatment of Alzheimer's disease (AD) at the Alzheimer’s Association International Conference (AAIC) 2019 in Los Angeles (USA).

These results complement and confirm those presented in October 2018, which showed improvement in AD patients in both mild and moderate stages of the disease, and point in the same direction at those unveiled at the 14th International Congress on Alzheimer's and Parkinson's (AD/PD) in Lisbon (Portugal) in March 2019.

These latest results center on two scales that reflect the patient’s cognitive status and daily functioning: CDR-Sb (Clinical Dementia Rating-Sum of Boxes) and ADCS-CGIC (Alzheimer’s Disease Cooperative Study-Clinical Global Impression of Change).

Both scales demonstrate statistical improvement in all treated patients, regardless of the disease stage (mild or moderate.)

In particular, the CDR-Sb scale – which assesses memory, orientation, reasoning, planning and problem resolution, social interaction, domestic activities and hobbies, and personal care – shows a statistically significant 71% decline compared to patients in the placebo group. This significance remains when analyzing the three study treatment arms separately, with less decline at 14 months ranging from 65% to 71%.

The results of the ADCS-CGIC scale follow the same lines: a statistically significant stabilization is observed in all treated patients. This effect remains in all three arms when analyzed separately. The ADCS-CGIC scale evaluates several domains of cognition, daily functioning and behavior, from both patient and caregiver perspectives.

At AAIC, it was also revealed that the plasma amyloid-beta saw-tooth mobilization pattern, observed in earlier clinical trials, is similar for both conventional and low-volume plasmapheresis performed in the AMBAR trial. This, reinforces the investigational use of lower volumes of plasma protein replacement therapies.

Grifols plans on presenting complete results of the AMBAR clinical trial, including biomarkers and neuroimaging results, in December 2019 at the Clinical Trials on Alzheimer’s Disease Conference in San Diego (USA).

NON-FINANCIAL INFORMATION

Talent: important advances in job creation, training and development

In the first half of 2019, the Grifols team grew to 22,282 employees, expanding by 5.0% compared to December 31, 2018. Job creation was especially significant in Spain, where Grifols’ talent pool increased by 4.6% to 4,035 people. In North America, the employee base expanded by 3.9% to 15,924 people and by 13.8% in the rest of the world (ROW), to 2,323 people.

The average seniority of Grifols’ employees is 5.8 years, with a median age of 37.7 years. The company continues its efforts to promote equal opportunity between men and women. As of June 30, 2019, women comprised 59% of staff and men, 41%.

Talent development remains a priority for the company. In-house training plays a critical role in Grifols’ talent development. In the first half of 2019, the company reported an average of 55 training hours per employee. Moreover, Grifols continues to foster the leadership development of its senior executive team through the “Challenging the Future” program, jointly designed and delivered by ESADE and Georgetown University.

With regard to organizational performance and development, of note is the high percentage (90.5%) of Grifols’ employees who take part in the annual Grifols Performance System (GPS). This figure confirms the full integration of the GPS process, which allows the company to continue to nurture a culture of open dialogue and ongoing development among its global talent pool.

One of Grifols’ core commitments is ensuring the health and safety of its staff, as reflected in its new “Occupational Health and Safety Policy” released in the first half of the year. To this end, the company advocates a robust occupational-health system grounded on solidly defined objectives, follow-up of risk-prevention measures in both technical and organizational processes, rigorous controls, and in-house and external audits.

In this regard, at the onset of 2019, Grifols established organization-wide safety targets and site-specific objectives focused on continuously improving occupational and safety in Grifols’ installations. Of note among these global objectives: the development of a new occupational health and safety management platform in the U.S., and the implementation of new corporate standards, including the one specifically aimed at contractors.

Environmental management

Environmental management is one of the cornerstones of Grifols’ corporate social responsibility platform.

In the first half of 2019, the company broadened the scope of its 2017-2019 Environmental Program, which aims to reduce its annual consumption of electricity, natural gas and water, and improve waste management and recovery.

Among these new objectives are targets to reduce electrical consumption by more than 829,000 kWh per year, generated mainly by the Parets del Vallès (Barcelona, Spain) facility; decrease natural-gas consumption by 4.1 million kWh per year in the Parets del Vallès and Clayton (North Carolina, USA) installations; reduce water consumption by 6,500 m3 per year in the Clayton complex; and reduce CO2 emissions and plastic consumption in the group’s Spanish facilities. The annual 150,000 kWh generated via photovoltaic power in the Las Torres de Cotillas (Murcia, Spain) complex will also help diminish the volume of CO2 emissions.

Grifols also had energy audits in its production plants in Dublin (Ireland) and sales subsidiaries in Italy and Germany. And it is planned to install new cooling systems with refrigerant gases that do not affect the ozone layer or climate change.

Grifols recently earned from UL a new environmental recognition, the “Zero Waste to Landfill” validation in the “Gold” category for its North Carolina production complex. In this way, Grifols became the first U.S. pharmaceutical company to achieve this distinction, awarded to companies that allocate 95% to 99% of their waste to recovery systems other than landfills. The waste sent to energy recovery was 5%.

Transparency: Grifols voluntarily discloses transfers of value to healthcare professionals and organizations

In alignment with its ongoing commitment to transparency, Grifols voluntarily adopted the European Federation of Pharmaceutical Industries and Associations (EFPIA) Disclosure Code in 2015.

For the fourth consecutive year, the company disclosed all payments and other transfers of value made to healthcare professionals and organizations within the scope of the EFPIA, including Spain.

In Europe, Grifols’ transfers of value grew by 5% in 2018 to EUR 12.3 million compared to EUR 11.7 million in 2017. This increase stemmed primarily from costs related to the firms R+D+i initiatives, which amounted to EUR 8.8 million in 2018 and accounted for 72% of the total. In Spain, R+D+i activities represented 66% of the total transfers of value carried out in Europe.

Although the EFPIA code refers specifically to medicines, Grifols voluntarily decided to expand its scope to include transfers unrelated to medications and those derived by its three main divisions. Grifols applies this transparency policy in the U.S. in accordance with the competent governmental authority (Centers for Medicaid and Medicare Services, or CMS).

Committed to patients: more than 100 million international units (IUs) of clotting factors donated to the World Hemophilia Federation through 2021

For more than a decade, Grifols has collaborated with the World Hemophilia Federation (WHF) to support its global efforts to improve access to treatment for patients who suffer from blood-clotting disorders.

The company recently donated 100 million IUs of clotting factors to help combat hemophilia in emerging markets. This contribution marked the midway point of Grifols’ eight-year pledge to donate to the WFH’s Humanitarian Aid Program through 2021.

According to the WFH, Grifols’ support will secure a projected average of 10,300 doses to treat acute bleeds in 6,000 patients per year in developing regions through 2021. Since 2017, more than 5,000 patients and over 10,000 acute bleeds have been treated thanks to Grifols’ donations.

The company also launched the “Grifols Hemophilia Awareness Global Awards” to encourage healthcare providers, medical sites, paramedical centers and hemophilia associations to support education initiatives and treatment access for the approximately 400,000 people in developed and developing regions affected by this inherited condition.

Inauguration of the newly refurbished Museu Grifols de Barcelona

The company unveiled the newly refurbished Museu Grifols last May in Barcelona. Located at the original headquarters, the new, larger museum includes interactive, immersive and user-friendly technology to engage visitors and showcase the company’s track record of innovation and transformation that has characterized it over its history.

Annual Investors’ and Analysts’ Meeting

Grifols held its annual meeting for investors and analysts in Clayton and Raleigh (North Carolina, USA) in June. Among the topics highlighted were the company’s market potential in China; efforts to develop an innovative product portfolio, including its AMBAR project; CAPEX and plasma collection plans; and financial performance.

The meeting featured members of Grifols Board of Directors, including the CEOs and several senior leaders.

Grifols included in FTSE4Good index second straight year

Grifols has been included in sustainability stock index FTSE4Good for the second consecutive year. Specifically, Grifols has been chosen to form part of the FTSE4Good Global, FTSE4Good Europe and FTSE4Good Ibex indices.

The FTSE4Good Index independently rates companies on their environmental, social and corporate governance performance.

1Constant currency (cc) excludes exchange rate fluctuations over the period.

2Alzheimer’s Association International Conference 2019 in Los Angeles (USA).

3Excludes third-party plasma sales carried out by Haema and Biotest.

4As of June 30, 2019, the impact from the application of IFRS 16 on the debt total was more than EUR 683 million.

5In the second quarter of 2016, Grifols acquired a minority stake of 49% share capital in IBBI. The agreement included a call option on the remaining 51%, which it executed in the second quarter of 2019.

6Source: Grifols Global Plasma Database, Provisional Data 2018.