February 26, 2021

Grifols increases its revenues to 5,340 M€ and continues to demonstrate its resilience and commitment to sustainable growth

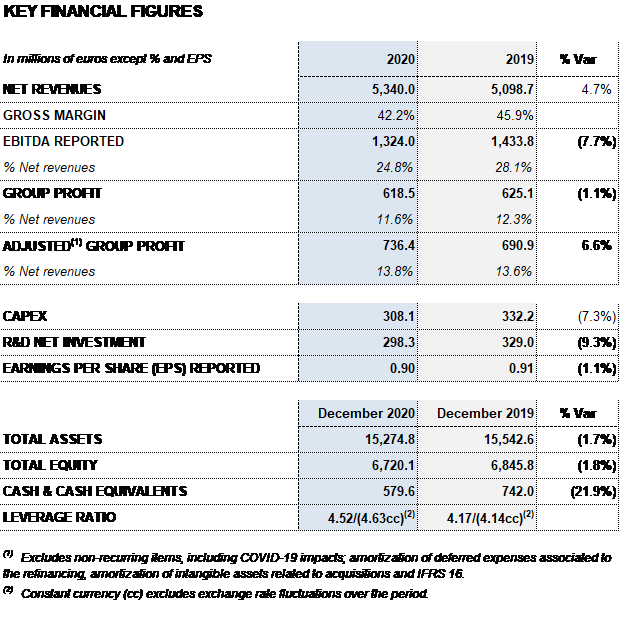

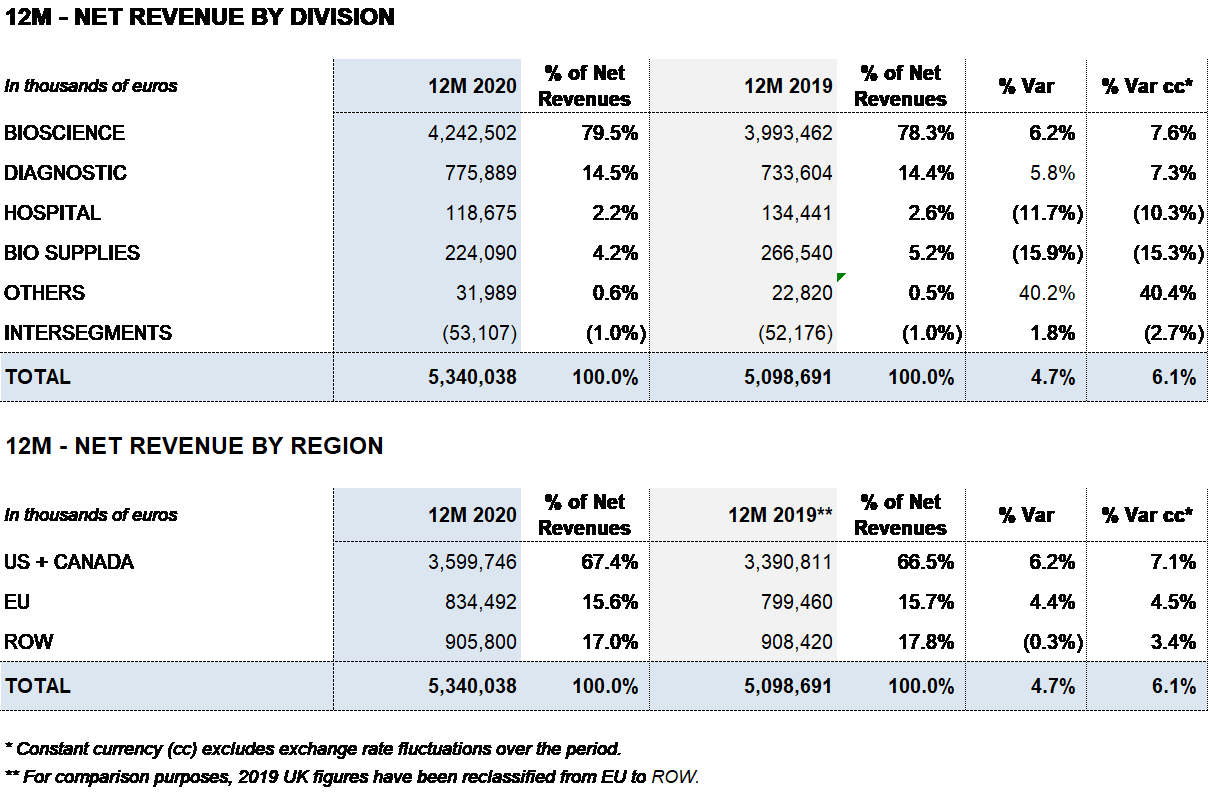

- Grifols increases revenues by 4.7% (6.1% cc1) driven by Bioscience and Diagnostic divisions; an increase of 6.5% (7.9% cc) excluding plasma sales to third parties. Contributions from new products represent more than 50% of its revenue growth

- Robust demand for plasma proteins and the launch of new products bolster Bioscience Division revenues by 6.2% (7.6% cc) to EUR 4,243 million

- The Diagnostic Division expands by 5.8% (7.3% cc) to EUR 776 million fueled by sales of molecular test to detect SARS-CoV-2

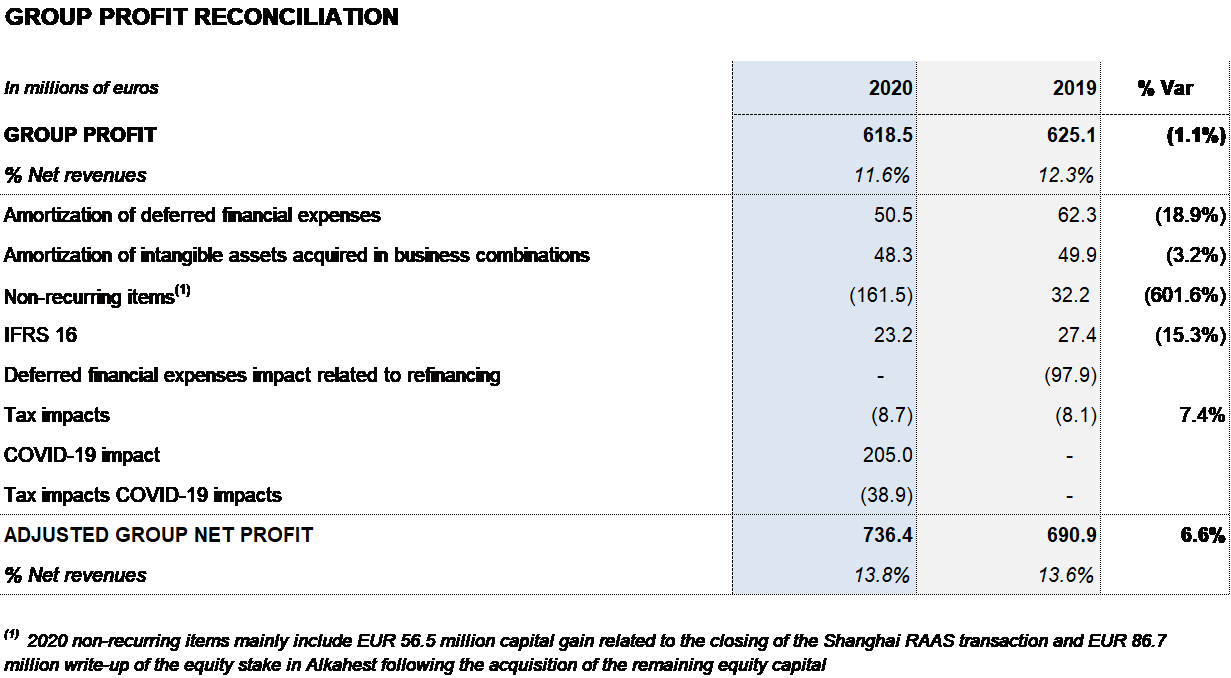

- Reported net profit total EUR 619 million, in line with the previous year. Adjusted net profit2 reaches EUR 736 million, a 6.6% increase over 2019

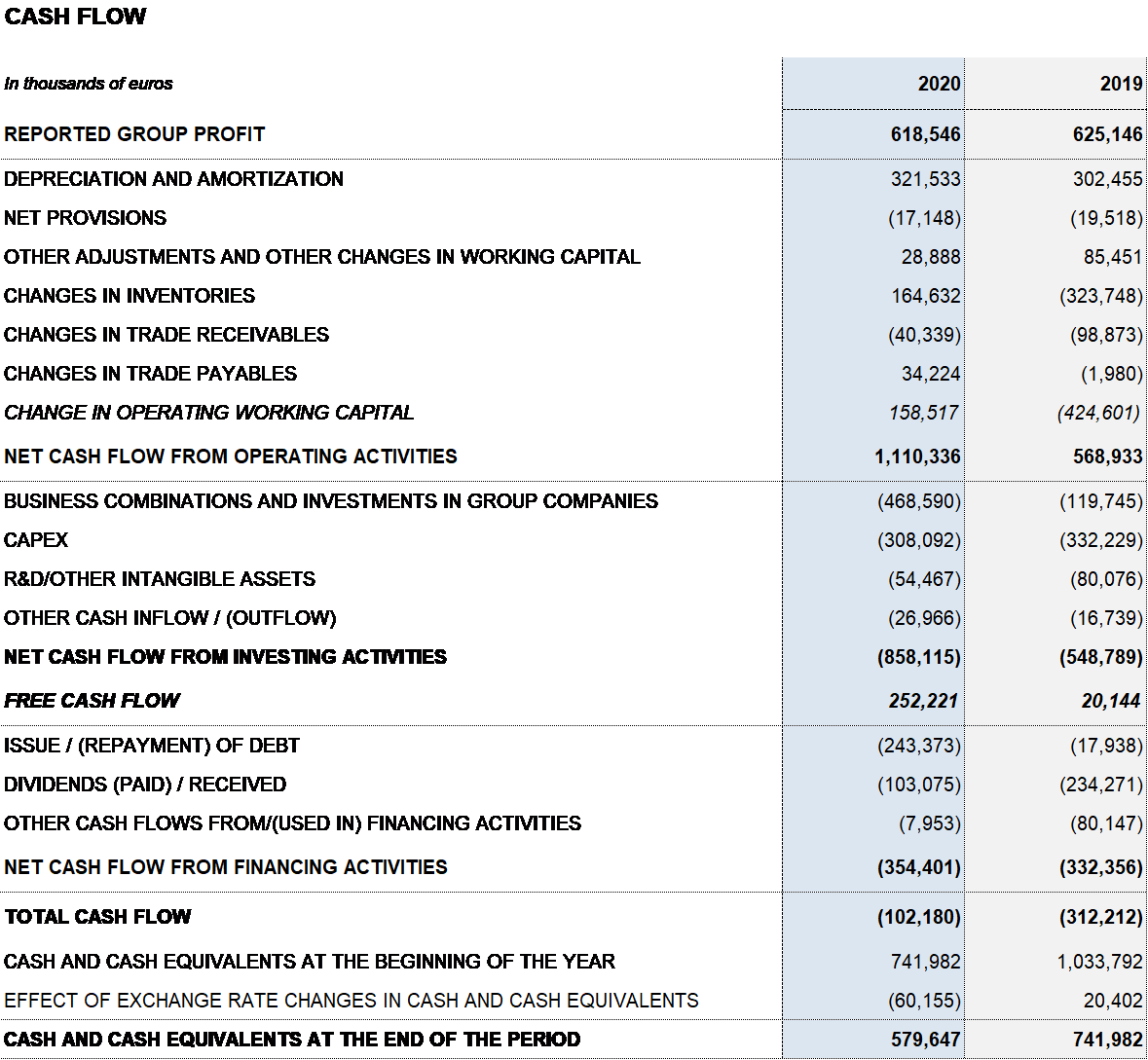

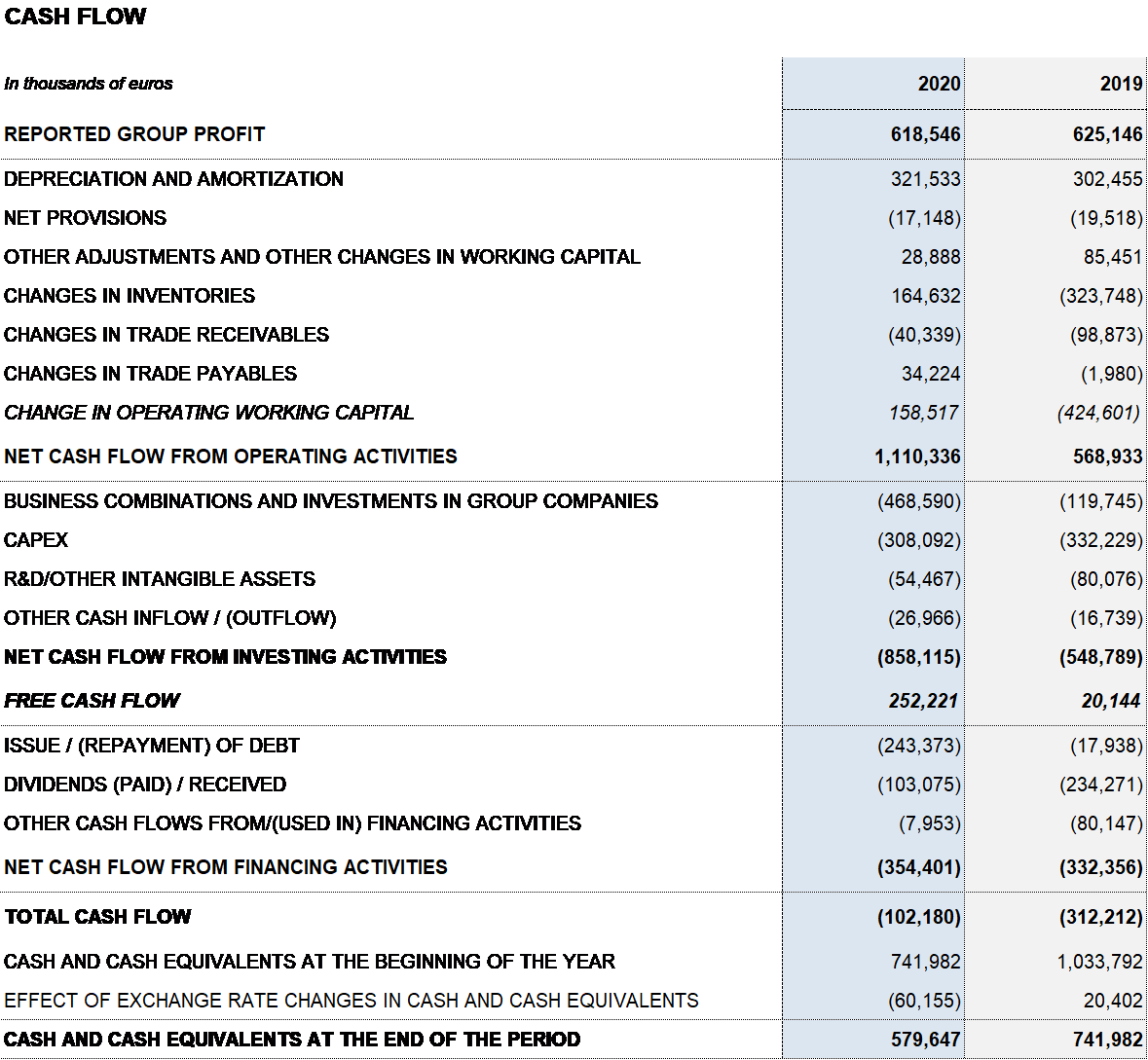

- Net operating cash flow generation reaches EUR 1,110 million. The net leverage ratio to EBITDA is 4.5x (4.2x in 2019) and 4.0x excluding COVID-19 impacts

- Grifols limited the COVID-19 impact on its net plasma supply to 15% in 2020. In 2021, the company is ready for a rebound in its plasma-collection levels in the wake of vaccination deployments and the easing of pandemic constraints, as well as its current expansion plan, including additional “ready-to-obtain” available plasma

- Grifols continues accelerating its R+D+i efforts and appoints new leadership for scientific innovation to continue executing its plan for sustained margin expansion

- Noteworthy is the integration of Alkahest’s pipeline, which hold significant commercial potential, through its multiple projects. The company moves forward on its pledge to make AMBAR a viable treatment for Alzheimer’s patients, with plans underway to open Reference Centers worldwide

- A team of nearly 24,000 people enable Grifols to continue providing its essential products and services to patients throughout these unprecedented times

- Grifols is recognized as one of the world’s most sustainable companies and listed on the Dow Jones Sustainability Index, Euronext Vigeo, FTSE4Good and Bloomberg Gender Equality Index

Barcelona, February 26, 2021.- Grifols (MCE:GRF, MCE:GRF.P, NASDAQ:GRFS) continued to demonstrate its resilience and commitment to sustainable growth in 2020. The company’s business strategy aims to drive solid financial performance by focusing on four main objectives: plasma supply, industrial excellence, global expansion and innovation.

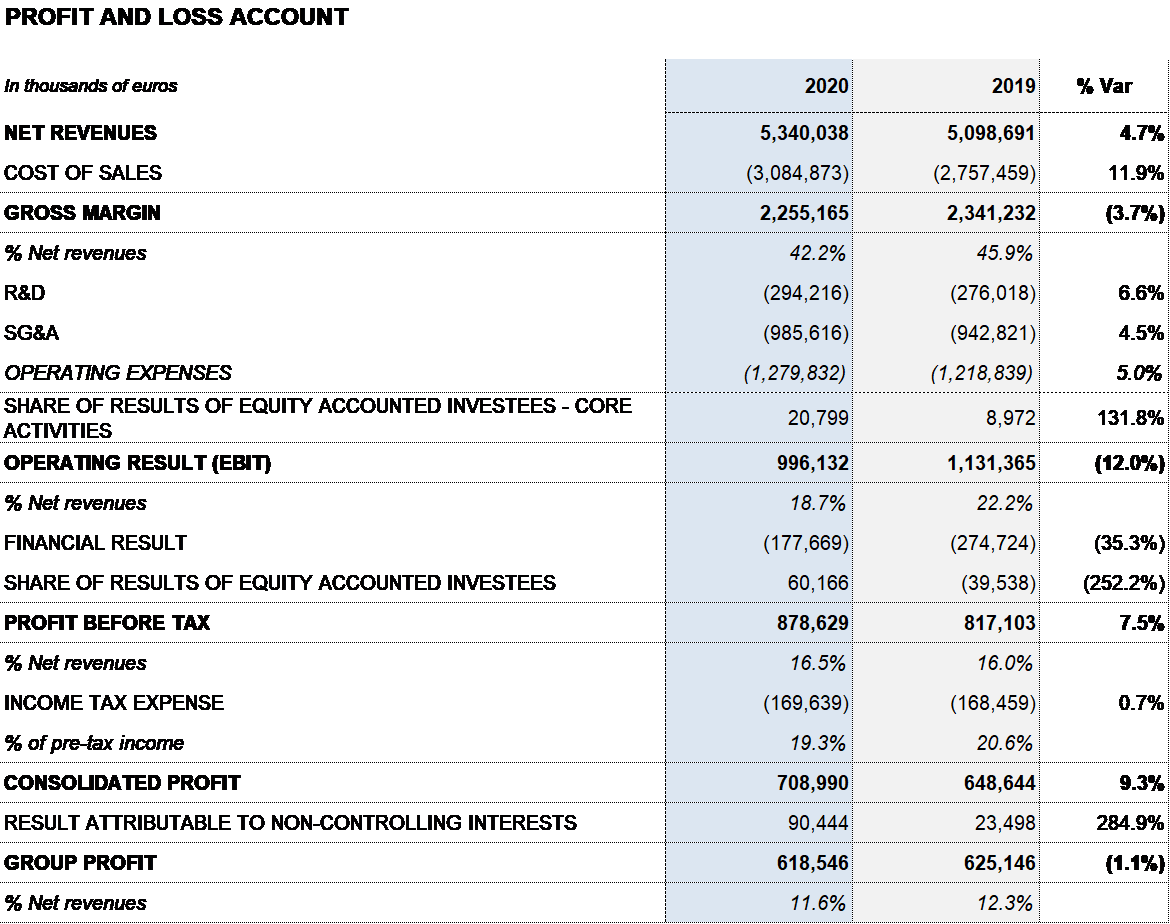

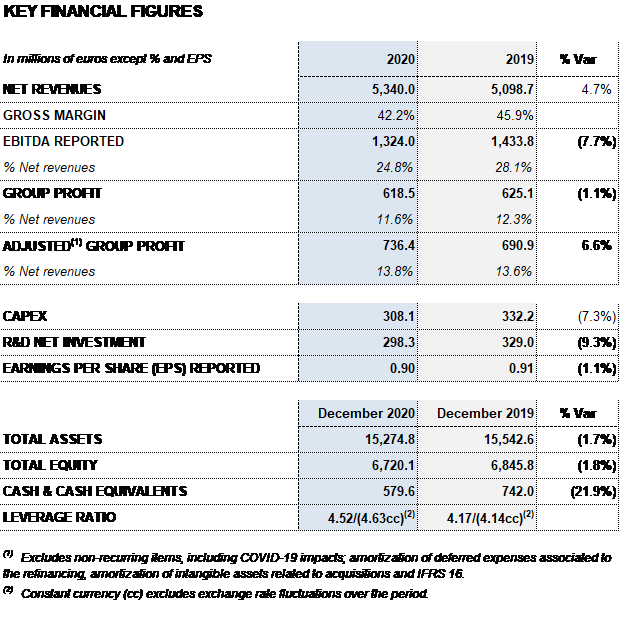

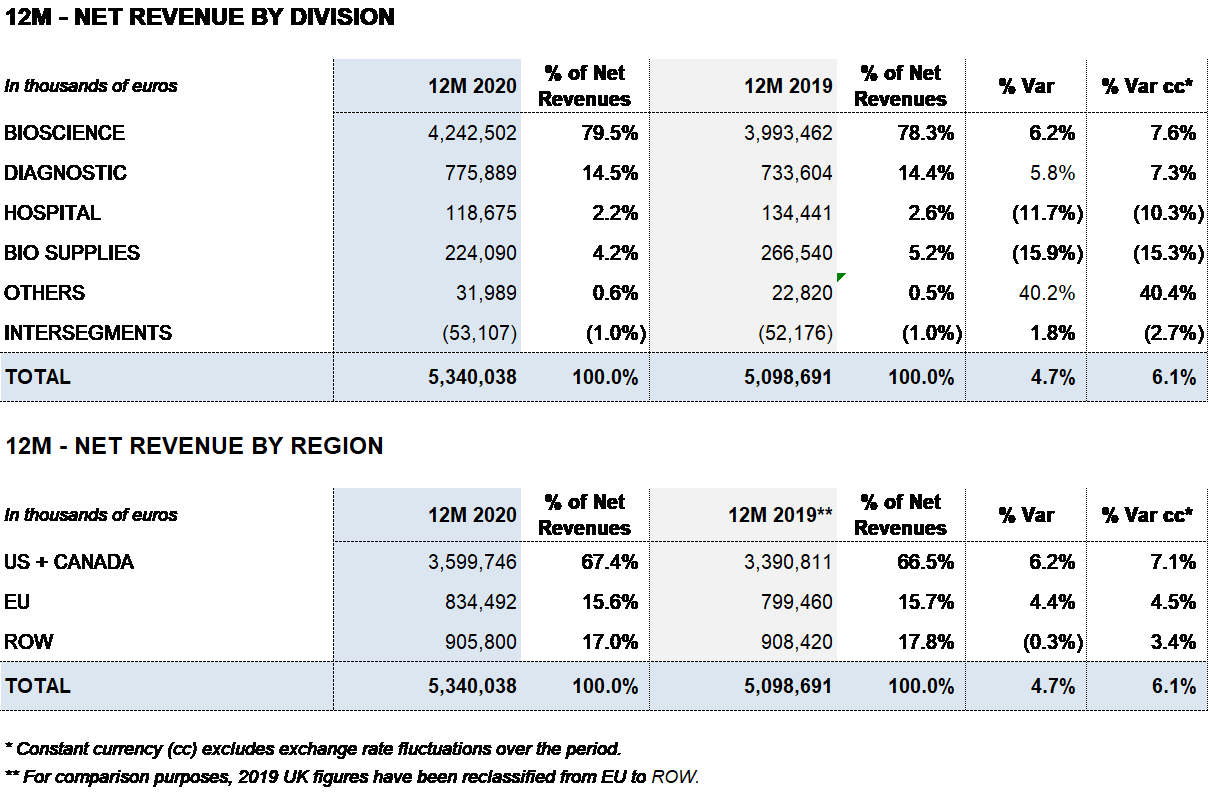

Grifols closed 2020 with EUR 5,340 million in revenues, a 4.7% (6.1% cc) increase fueled by growth in the Bioscience and Diagnostic divisions. Excluding plasma sales to third parties, revenues increased by 6.5% (7.9% cc). The contribution of new products accounted for more than 50% of revenue growth.

The Bioscience Division, the company’s main growth driver, achieved an important milestone in 2020 by marking 10 years of quarterly sales growth. Its revenues grew by 6.2% (7.6% cc) to EUR 4,243 million driven by an upturn in immunoglobulins sales in countries including the United States and Canada; an increase in albumin sales, particularly in the United States and China; and the strong contribution of new products like Xembify®, VISTASEALTM and TAVLESSE®.

In the second half of 2020, the Diagnostic Division significantly increased its revenues, reporting strong sales, particularly in Spain, of its TMA (Transcription-Mediated Amplification) molecular test to detect the SARS-CoV-2 virus. The division reported EUR 776 million in sales, a 5.8% (7.3% cc) increase over the previous year.

Hospital Division revenues were impacted by COVID-19, which prompted a slowdown in certain hospital investments and treatments. Revenues totaled EUR 119 million, a 11.7% decrease (10.3% cc) compared to 2019.

The Bio Supplies Commercial line, which includes sales of biological products for non-therapeutic use, grew by 65.6% cc in 2020, demonstrating Grifols’ commitment to this market segment. The Bio Supplies Division achieved EUR 224 million in revenues, falling 15.9% (15.3%) from 2019, due primarily to the roll-off of specific third-party plasma sales contracts.

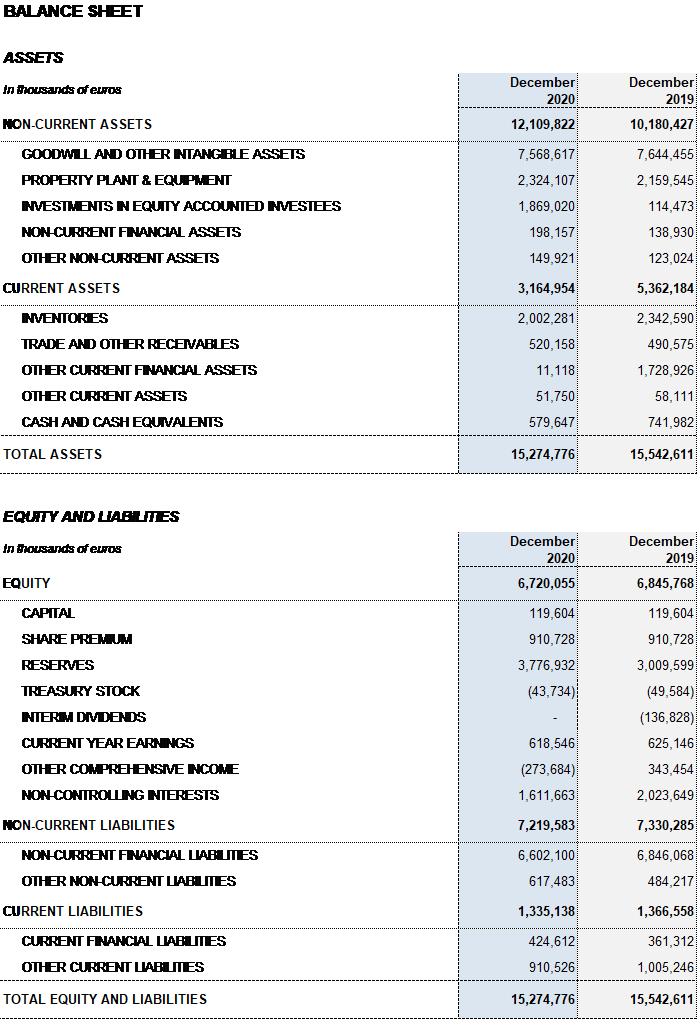

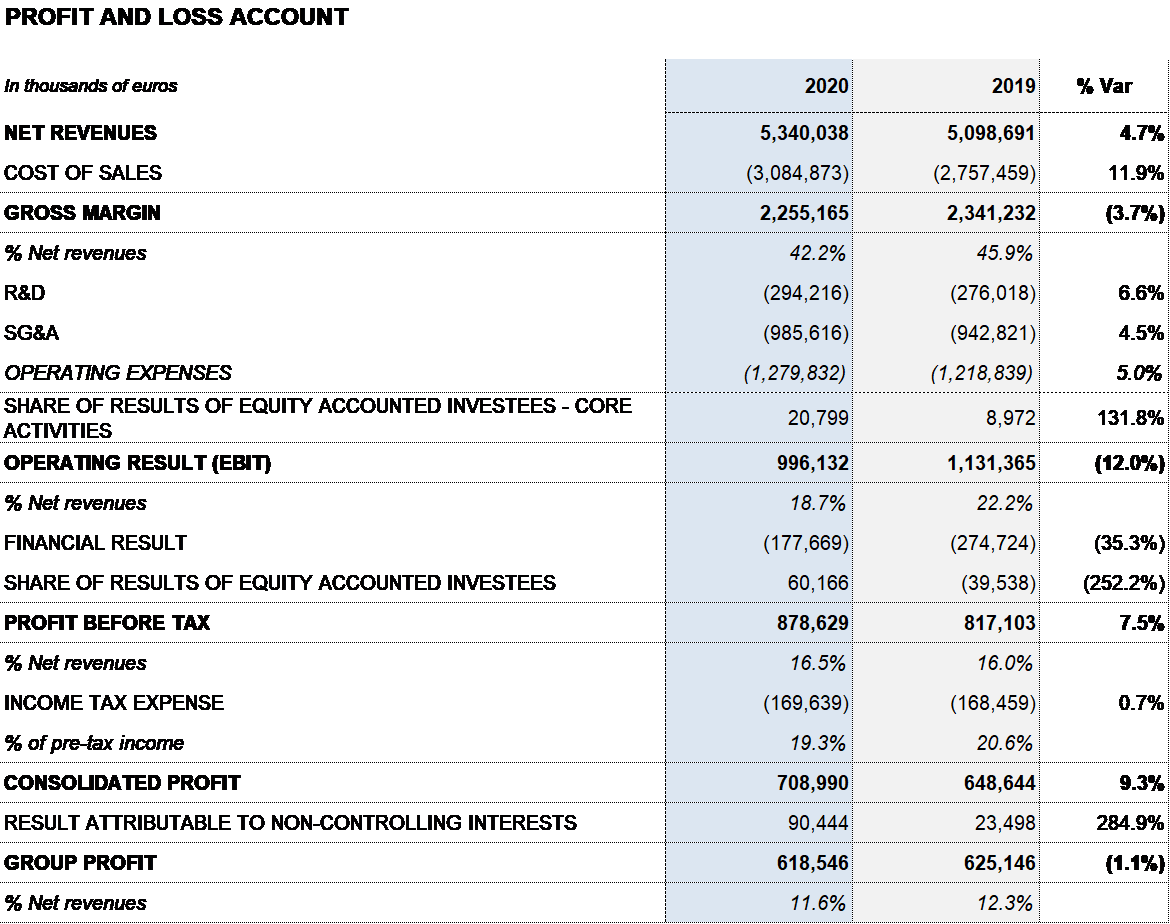

As of December 31, 2020, the gross margin was 42.2% (45.9% in 2019), including the EUR 205 million impact to adjust Grifols’ inventory value (non-cash) mainly as a result of COVID-19 effects.

In reflection of its commitment to prudence and profitability, Grifols implemented an operating expense containment plan with an estimated positive impact of EUR 112 million in the 2020 profit and loss account. The company is working to make a significant part of it permanent. The plan has no impact on the company’s labor force or innovation investments.

Grifols estimates a net impact of EUR 155 million on EBITDA as a result of COVID-19. This figure includes the negative impact on inventory value and lower fourth-quarter sales of the Bioscience Division, as well as the positive impact of the operating expense containment plan and contribution of the SARS-CoV-2 detection test.

All in all, reported EBITDA totaled EUR 1,324 million, representing a 24.8% margin over revenues (28.1% in 2019). Excluding the EUR 155 million COVID-19-related impact, EBITDA stands at EUR 1,479 million, a 27.4% margin on revenues.

Grifols’ financial results continued to improve during the year, reaching EUR 178 million. It includes EUR 97 million reduction in net financial expenses, stemming mainly from the completion of the debt-refinancing process in November 2019; a positive EUR 18 million impact from exchange rate differences; and EUR 57 million in capital gains following the closing of the Shanghai RAAS transaction in the first quarter of 2020.

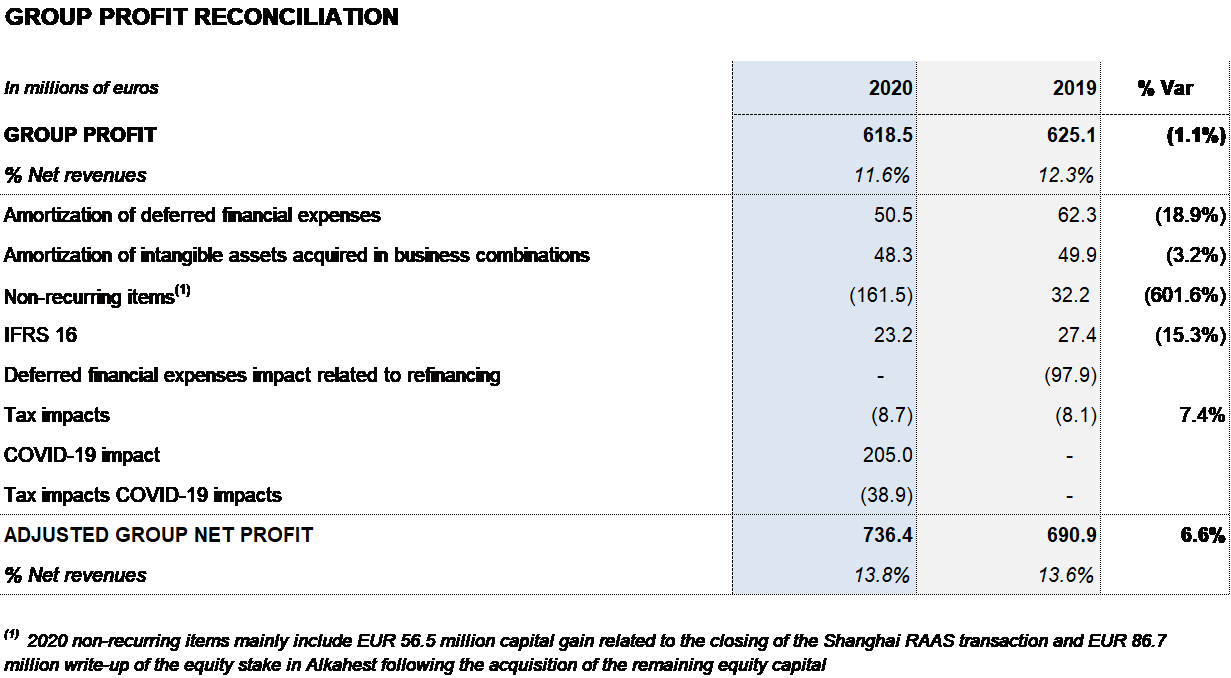

The reported net profit totaled EUR 619 million in 2020, a 1.1% decrease compared to the EUR 625 million reported in 2019. Adjusted net profit1 amounted to EUR 736 million (EUR 691 million in 2019).

In 2020, Grifols continued to promote innovation and CAPEX investments to promote its sustainable and long-term growth. Net R+D+i investments, including internal, external and investee projects, totaled EUR 298 million (EUR 329 million in 2019).

Grifols also moved forward with its capital investments plan, allocating EUR 308 million (EUR 332 million in 2019) to accelerate the expansion of the Bioscience Division’s production capacity and spur growth of its other divisions.

Grifols’ strategic investments in recent years to increase its plasma supply, combined with efforts to boost operational efficiencies, were the driving forces behind the company’s growth and robust inventory levels. The company maintained its upward growth trend in 2020 thanks to these investments and effective inventory management.

In 2020, Grifols was able to limit its net plasma supply impact by roughly 15% despite COVID-19-related constraints, including social distancing, mobility restrictions and lockdowns. In 2021, the company is ready for a rebound in its plasma-collection levels in the wake of wider vaccination and the easing of COVID-19 constraints. Grifols is also advancing on its efforts to increase its plasma supply through its expansion plan, comprising organic and inorganic growth.

As part of this strategy, it acquired centers in the United States and Europe and three production plants in Canada. Also underway is the construction of 20 plasma centers and production facilities in Egypt, following the alliance signed with the Egyptian government, a partnership that will expand the company’s presence in the Middle East and Africa. In terms of organic growth, the company plans on opening 15 to 20 new plasma centers in 2021

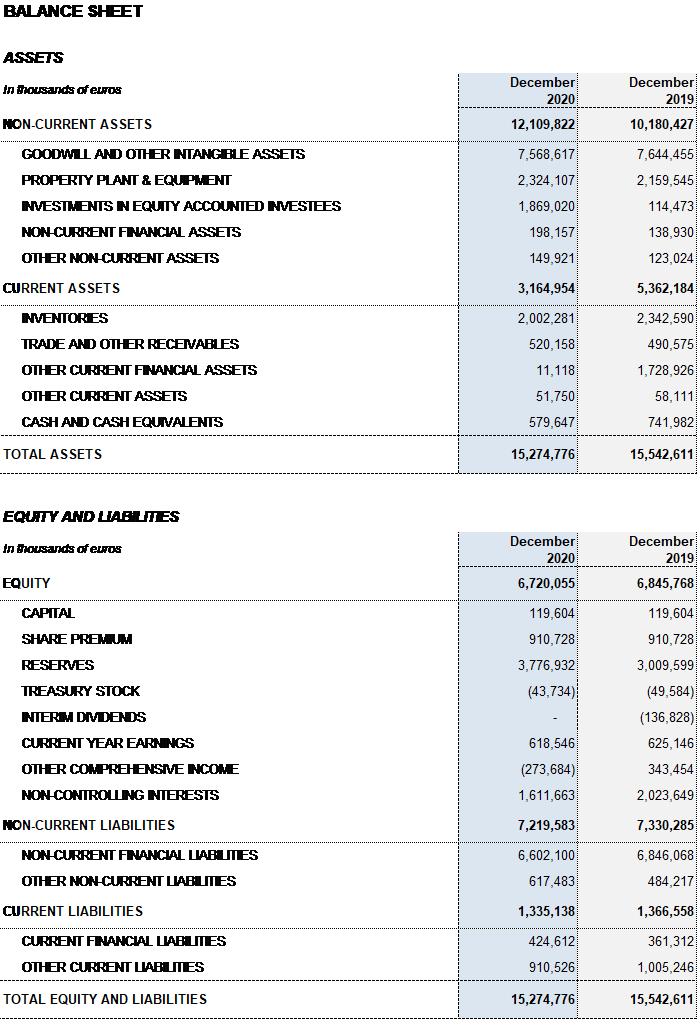

As of December 31, 2020, Grifols’ liquidity position stands at close to EUR 1,500 million, including EUR 580 million in cash position and nearly EUR 900 million of undrawn lines of credit.

Grifols took additional measures to strengthen its liquidity position in the second quarter, including the upsizing of its multicurrency revolving credit facility from USD 500 million to USD 1,000 million, with maturity in November 2025. This credit facility has similar terms and conditions as those signed in November 2019 and its expansion did not increase the company’s indebtedness.

In a context of growth, corporate transactions and sustained levels of CAPEX and R+D investments, Grifols boasts high and sustainable levels of activity and net operating cash flow generation. The optimization of working capital management continued to strengthen Grifols’ financial performance. In 2020, the company generated EUR 1,110 million in operating cash flow (EUR 569 million in 2019), providing the necessary solvency to meet its planned investments amid a context of higher demand.

Excluding the impact of IFRS 163, as of December 31, 2020 Grifols’ net financial debt totaled EUR 5,714 million. The net financial debt over EBITDA ratio is 4.5x (4.2x in December 2019) and 4.0x excluding COVID-19 impacts.

Following the completion of the debt-refinancing process in November 2019, Grifols does not face significant maturity repayments or down payments until 2025. Optimizing and reducing its debt levels remains a priority for Grifols’ financial management.

Grifols is prepared to respond to the demands of the current context and remains committed to its long-term growth strategy. It will continue to monitor any potential impacts on operations and will take all necessary measures to mitigate possible effects on its supply chain.

PERFORMANCE BY DIVISION

Bioscience leads growth

The Bioscience Division reported EUR 4,243 million in revenues, a 6.2% (7.6% cc) increase, fueled by strong demand for the main proteins, especially immunoglobulins and albumin, and the positive performance of new product launches like Xembify®, VISTASEALTM and TAVLESSE®.

Immunoglobulins sales remain strong, achieving double-digit growth thanks to solid demand in markets with high per capita consumption, namely, the U.S. and Canada, and several countries in the European Union (EU) and Latin America. Grifols has a range of immunoglobulins for both intravenous and subcutaneous administration (Xembify®) to adapt to patients’ diverse needs.

Albumin sales also remain strong amid positive growth in the U.S., Canada and China .

Despite the pandemic, alpha-1 antitrypsin revenues continue to grow in the U.S. and Canada, its core markets. The company continued to enhance its portfolio in 2020, integrating new products and presentations, including the FDA-approved Prolastin®-C Liquid in 0.5-gram and 4-gram vials. Grifols currently has three presentations to offer patients more treatment alternatives.

In terms of new product launches, of note are the robust sales of the biological sealant, developed and manufactured by Grifols using a combination of two plasma proteins (fibrinogen and thrombin) to control surgical bleeding. Launched in the last quarter of 2019, the product is sold and distributed by Ethicon under the trade name VISTASEALTM. Also worth highlighting is the market launch of TAVLESSE® (fostamatinib) in specific European countries. Sold under an agreement with Rigel Pharmaceuticals, this product is used to treat chronic immune thrombocytopenia (ITP) in adult patients who are refractory to other treatments.

Diagnostic accelerates its growth

The Diagnostic Division achieved notable results in the second half of the year, reporting a 5.8% (7.3% cc) year-on-year increase in sales to EUR 776 million.

Especially noteworthy was the contribution of Grifols’ Transcription Mediated Amplification (TMA) test, used to detect SARS-CoV-2. This diagnostic test was the main driver of NAT systems (Procleix® NAT Solutions) sales, especially in Spain. TMA is a commonly used technique known for its high sensitivity and capacity to automate large sample volumes.

Sales of Procleix® NAT Solutions, used to analyze blood donations, were also strong in Japan, Australia, the Philippines and Bulgaria, among other countries. These systems are able to screen for a diversity of pathogens, including the human immunodeficiency virus (HIV), hepatitis viruses (A, B, C and E), West Nile virus, Zika, dengue and the causative agents of babesiosis.

The blood-typing line maintains its upward trend in the U.S. and Latin America, where sales continued to grow in countries such as Argentina. Sales include both analyzers (Erytra®, Erytra Eflexis® and Wadiana®) and reagents (DG-Gel® cards, red blood cells and anti-serums).

Hospital prepares its recovery

The Hospital Division recorded EUR 119 million in revenues, an 11.7% (10.3% cc) decrease from the previous year. The division’s main business lines were impacted by COVID-19, which caused a slowdown in certain hospital investments and treatments.

Grifols is a leading supplier of technology and services for hospitals, clinics and specialized centers. Its leading-edge automated compounding device (KIRO Fill®) and next-generation suite of web- and mobile-based applications (PharmacyKeeper) optimize hospital-pharmacy operations and enhance patient safety by affording greater accuracy and safety in the preparation of intravenous (IV) medications. These advancements improve patient safety and reduce reliance on manual processes.

Grifols’ Pharmatech business line offers comprehensive solutions to enhance hospital pharmacy operations, including the inclusiv® product portfolio, comprised by equipment, software and solutions to improve the safety and quality of sterile compound preparations. The division also consolidated sales of its MedKeeper® and Kiro Grifols® technological solutions.

Bio Supplies grows significantly in biological material supply

The Bio Supplies Division primarily oversees the sales of biological products for non-therapeutic use and Haema and Biotest’s third-party plasma sales.

In 2020, this division reported EUR 224 million in revenues, decreasing by 15.9% (15.3% cc) compared to the previous year. This variation is mainly due to a drop in third-party plasma sales, stemming mainly from the roll-off of supply contracts. As planned, this will enable Grifols to increase its plasma volume to fuel growth of plasma-derived therapies.

The Bio Supplies Division grew by 65.5% cc in 2020, demonstrating Grifols’ commitment to this market niche.

FOURTH QUARTER 2020

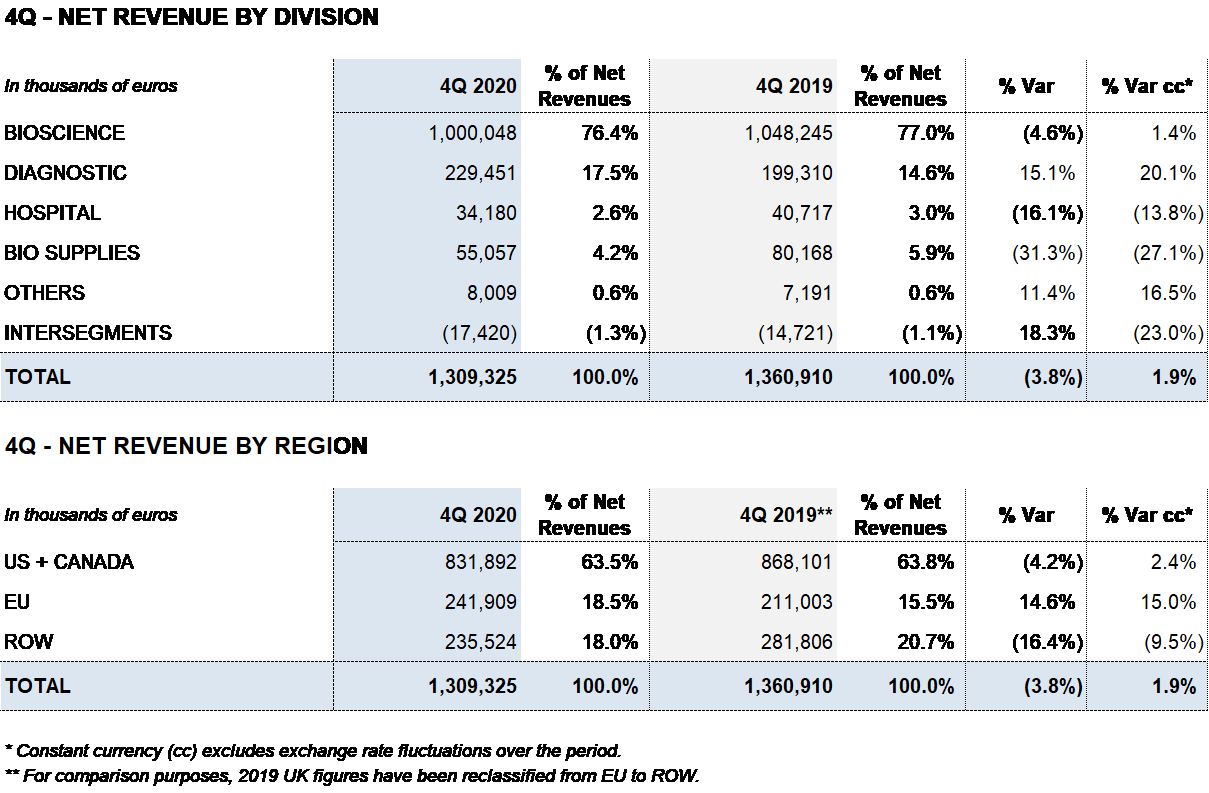

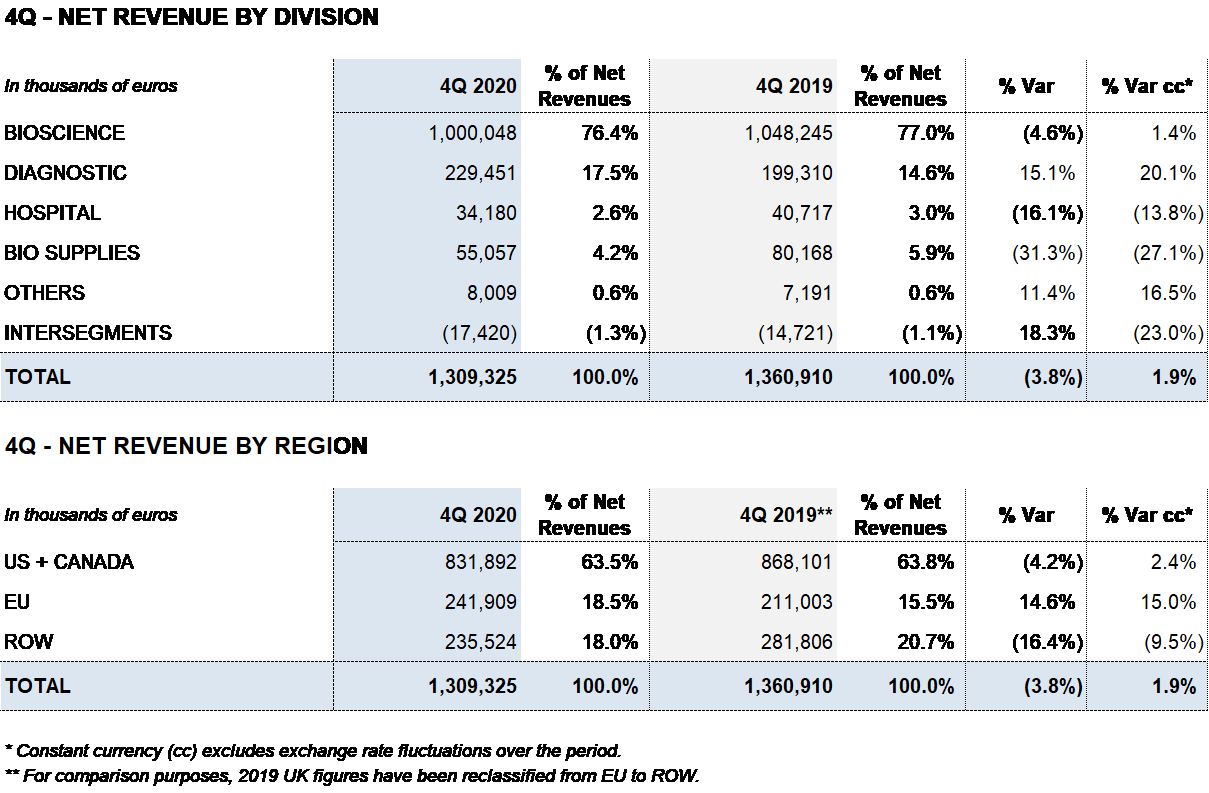

Revenues reached EUR 1,309 million, denoting a decline of 3.8% (an increase of 1.9% cc) in relation to the EUR 1,361 million reported for the same period in 2019.

The Bioscience Division recorded EUR 1,000 million in sales, a decline of 4.6% (an increase of 1.4% cc) compared to 2019 stemming from the downturn in plasma collections in Q2 and Q3 2020 as a result of COVID-19 mobility restrictions.

Demand for the main plasma proteins remains robust. Grifols is working to increase plasma donations, both organically and inorganically. The company’s ongoing efforts are expected to lead to a continued and progressive recovery in plasma donations which, together with plans to expand the number of plasma centers, will lead to higher sales volumes as the supply of plasma for fractionation increases.

The Diagnostic Division reported solid revenue growth in the fourth quarter to EUR 229 million (15.1%; 20.1% cc).

Grifols’ operating margins in the fourth quarter reflect its efforts to increase its plasma supply, as well as operating expenses associated with corporate transactions, including Green Cross and Alkahest.

INVESTMENT ACTIVITIES: R+D+i, CAPEX, ACQUISITIONS AND CORPORATE TRANSACTIONS

R+D+i: STRATEGIC APPROACH

Grifols’ R+D+i strategy is based on a comprehensive approach encompassing both in-house and investee-led initiatives complementary to its core operations.

In 2020, Grifols continued to bolster its R+D+i efforts. Taking into account net investments and excluding equity stakes, the company allocated EUR 298 million to R+D+i, representing 5.6% of revenues. More than EUR 11.5 million were allotted for COVID-19-related research projects. More than 1,100 employees are dedicated to R+D+i.

Global response to combat COVID-19

As part of its solid commitment to society, Grifols organized a global response to combat COVID-19, leading and participating in more than 25 international research projects.

In this regard, the company is collaborating with researchers and health authorities in the United States, Spain and Germany on clinical trials using plasma-derived products such as hyperimmune immunoglobulin, intravenous immunoglobulin, alpha-1 antitrypsin and antithrombin III, as well as convalescent plasma inactivated with methylene blue.

Grifols is also spearheading the development of immunoglobulins with specific antibodies against the SARS-CoV-2 virus using plasma from recovered COVID-19 patients. In October 2020, in collaboration with diverse U.S. healthcare agencies and other entities, Grifols launched the Inpatient Treatment with Anti-Coronavirus Immunoglobulin (ITAC) clinical trial, a multicenter, randomized and double-blind study designed to test the efficacy and safety of anti-SARS-CoV-2 hyperimmune plasma in critically ill hospitalized patients.

In early 2021, the company initiated a new clinical trial in Spain to assess a subcutaneously administered anti-SARS-CoV-2 immunoglobulin, which would provide immediate protection against the virus. This immunoglobulin would be particularly beneficial for the elderly, healthcare professionals and immunocompromised patients, among others, for whom vaccination is not recommended.

Grifols also developed a specialty TMA (Transcription-Mediated Amplification) molecular test to rapidly and accurately detect the SARS-CoV-2 virus in plasma, blood and respiratory samples by generating multiple copies of unique genetic sequences specific to the virus. The test’s sensitivity is the same or even higher than other molecular tests like PCRs (polymerase chain reaction).

Advancing its comprehensive Alzheimer’s strategy

Throughout 2020, Grifols continued to strengthen its comprehensive Alzheimer’s strategy. At the same time, Grifols moves forward with its plans to make AMBAR a viable treatment option for Alzheimer’s patients.

The results of Grifols’ AMBAR study (Alzheimer Management by Albumin Replacement), which demonstrates a positive impact in reducing the progression of Alzheimer's symptoms in patients treated over a 14-month period compared to untreated patients, were featured in the prestigious peer-reviewed publication Alzheimer’s & Dementia: The Journal of the Alzheimer’s Association.

The company is working on opening AMBAR Reference Centers as pilot facilities in collaboration with medical institutions, following the same standard clinical practices established in the AMBAR study. In addition to benefiting AD patients, this initiative would also offer a channel to collect more data and real-world evidence, reinforcing the clinical trial findings.

Initially, Grifols will collaborate with several AMBAR centers worldwide. Among these are the Fundació ACE in Barcelona, a key player in the study’s design and development and a Grifols collaborator since 2004, when the company launched its integral Alzheimer’s research strategy.

The American Society for Apheresis (ASFA) modified its previous procedure regarding its “Guidelines for Recommendations for the Use of Therapeutic Apheresis in Clinical Practice.” To this end, these will undergo a thorough review in the medium term, without releasing interim recommendations .

In parallel, Grifols continues working on future patient reimbursement of the AMBAR treatment, preparing Health Economics & Outcomes Research (HEOR) studies and collaborating with therapy-evaluation committees of diverse medical organizations, including neurological and apheresis associations.

Grifols also supports research to discover and develop new therapeutic plasma proteins through Alkahest. This biotech firm currently has four candidates, including two related to potential treatments for AD patients in the advanced stages and another for those in mild and moderate stages.

CAPEX

Grifols intensified its capital investments in 2020, allocating EUR 308 million to expand and enhance its divisions’ production facilities. This amount is included in the 2018-2022 Capital Investment Plan and reaffirms Grifols’ commitment to growth and long-term vision.

In May, the company announced a EUR 130 million investment for the first phase of a project to expand its Barcelona industrial complex. Grifols acquired a 47,274 m2 plot with plans to build a purification and fill-and-finish facility for a new Bioscience Division product and a new R+D+i center, as well as expand the production and logistics capacity of the Diagnostic Division.

Also underway is the expansion of the fibrinogen and topical thrombin sealant production plant in Barcelona. Upon completion of the new purification and dosing facilities, this extension will increase production capacity to 3.3 million equivalent liters of plasma.

In the U.S., the company has plans to invest USD 350 million to build a new plasma fractionation plant, a plasma logistics warehouse and service infrastructures on its North Carolina installations. This complex recently completed the construction of a fractionation plant with a capacity to fractionate 6 million liters per year, which will launch productions this year and is expected to be fully operational in 2022.

Grifols also continues to advance on the world’s first purification, dosing and sterile filling plant of immunoglobulins in flexible bags, with a production capacity of 6 million equivalent liters of plasma per year. The company expects it to be operational in 2023.

Also noteworthy was the swift construction and launch of a facility dedicated to inactivating pathogens in convalescent plasma using methylene blue. The company also quickly adapted its Clayton emerging-diseases facility to produce an anti-SARS-CoV-2 immunoglobulin. These initiatives allowed the company to quickly respond to COVID-19, demonstrating once again its ability to effectively react and respond in the face of health emergencies.

The construction of a new albumin purification, dosing and sterile filling plant in Dublin (Ireland) also continues according to plan. The plant will have an annual production capacity of 6 million equivalent liters of plasma and incorporate a state-of-the-art sterile bag filling technology, owned by Grifols. The plant will build on the company’s efforts to boost its bag production capacity, initiated in Los Angeles (U.S.) plant in the first quarter of 2021.

Investments to increase its access to plasma remain a core strategic priority. In this regard, the company is working to expand its network of centers and increase the plasma-collection capacity of existing centers by incorporating more donation equipment, wherever possible. As of December 31, 2020 Grifols operates the largest plasma-center network in the world, with 312 centers.

At the same time, Grifols continues its plans to expand the sample testing capacity of its Austin (U.S.) laboratory. The company anticipates reaching a testing capacity of 36 million samples by 2023 thanks to its efforts to expand its U.S. and European facilities. The company is also moving forward to expand its plasma storage and logistics capacity, expecting to reach 12 million liters by 2023.

In 2020, the Diagnostic Division centered its efforts on expanding the manufacturing capacity of its immunohematology products, with plans to produce DG Gel® cards, red blood cells and antisera for the first time in the United States. These products will be manufactured in Grifols’ San Francisco (U.S.) facilities. Grifols has also been working on the expansion of the Diagnostic Division’s laboratory capabilities.

ACQUISITIONS AND CORPORATE TRANSACTIONS

Closing of the alliance with Shanghai RAAS to drive growth in China

In March 2020, Grifols and Shanghai RAAS closed a strategic alliance designed to increase the production, sale and development of plasma-derived products and leading-edge transfusion diagnostic solutions in China in adherence with international quality and safety standards.

Following this transaction, Grifols is now the largest shareholder in Shanghai RAAS while maintaining operating, political and economic control over its subsidiary, Grifols Diagnostic Solutions (GDS). Specifically, Grifols will have control over a 26.20% stake in Shanghai RAAS’s capital (economic and voting rights) in exchange for Shanghai RAAS having a non-majority share in Grifols Diagnostics Solutions (45% economic and 40% voting rights).

For Grifols, the agreement offers an opportunity to bolster its international expansion and build on its long-term, sustainable growth. At present, China is Grifols’ third-largest sales market.

Grifols closes the acquisition of production facilities in Canada and 11 plasma centers in the U.S.

In October 2020, Grifols closed its transaction with the South Korean firm, GC Pharma (Group) to acquire a plasma fractionation plant and an immunoglobulin and an albumin purification plant in Montreal (Canada) for USD 370 million. In a separate transaction, it acquired 11 U.S.-based plasma collection centers, property of Green Cross, for USD 90 million.

This acquisition is aligned with Grifols’ international sustainable growth strategy aimed at increasing the company’s plasma collection and fractionation capacity. This strategic acquisition will also strengthen Grifols’ presence in Canada, building on a legacy of partnership in Canada’s blood system.

Once it obtains the necessary licenses and authorizations, Grifols will become the only large-scale commercial manufacturer of plasma products in Canada, with a fractionation capacity of 1.5 million liters annually. Grifols expects to launch operations in these facilities in 2023, manufacturing IVIG and albumin to supply the Canadian market.

Strategic alliance between Grifols and the Egyptian government to boost plasma-derived medicines in the Middle East and Africa

In November 2020, Grifols and the Government of Egypt, through the National Service Projects Organization (NSPO), signed a strategic agreement to further develop the Egyptian plasma-derivatives market and promote its self-sufficiency. The operation will ensure national security needs and help strengthen the healthcare system in Egypt.

Under this joint venture, owned by NSPO (51%) and Grifols (49%), the parties will join their industrial expertise and financial efforts for the development, construction and operation of 20 plasma collection centers throughout Egypt (with an initial capacity to collect 600,000 liters of plasma per year); manufacturing facilities, including a fractionation plant (with a capacity to fractionate up to 1 million liters of plasma per year) and a purification and fill-and-finish plant; a warehouse and an analysis laboratory. The plasma centers and manufacturing facilities are expected to be operational at the end of 2025.

This partnership will position Grifols as a strategic ally of the Egyptian government and promote its commitment to helping countries reach higher levels of self-sufficiency in the manufacture and procurement of plasma-derived therapies.

The transaction will also bolster its presence in the Middle East and Africa, building on its already-solid presence in the United States and Europe and important inroads in China, all core areas of its growth plan.

Acquisition of Alkahest to enhance innovation efforts

In 2020, Grifols acquired Alkahest’s remaining stock for USD 146 million, bringing its ownership to 100%. The company began investing in Alkahest in 2015.

The Silicon Valley-based biotechnology company was founded upon research into the therapeutic use of plasma proteins in age-related diseases. To perform this research, the company is using its omic capabilities as a main discovery tool that enables a complete understanding of the human plasma proteome. In addition, Alkahest works on the clinical development of specific plasma fractions and protein inhibitors.

Alkahest has built a unique proteomic platform of targets that will allow the company to unlock new therapeutics and diagnostics; develop new plasma proteins; new indications for currently licensed plasma proteins; biomarkers for diagnostics, recombinant proteins and antibodies; as well as small-molecule drugs.

Understanding the plasma proteome is the key to Alkahest’s comprehensive discovery and development platform that delivers transformational therapeutics. Alkahest focuses on proteins with biological impact that change with age.

Alkahest has identified more than 8,000 separate proteins to date. Using advanced techniques of molecular analysis at the cellular level, an array of new products are expected to enter Grifols’ discovery and development pipeline and bring new therapeutic medicines to market.

Acquisition of remaining 49% stake in MedKeeper

In November 2020, Grifols acquired the remaining 49% stake in MedKeeper for USD 60 million.

Since 2018, Grifols has owned a 51% equity stake of this U.S.-based technology firm, dedicated to developing and commercializing mobile and web-based technology solutions that enhance quality assurance standards and operational productivity, as well as monitor and track compounding activities.

With this transaction, Grifols complements and strengthens Pharmatech, the Hospital Division’s core business line, boosting its expansion and footprint in the U.S. market.

WORKFORCE: COMMITMENT, EMPLOYMENT QUALITY AND CONTINUOUS TRAINING

The exceptional circumstances triggered by the COVID-19 pandemic brought out the best in Grifols’ team in 2020, especially employees working in plasma centers and production facilities. Thanks to their dedication, the company has been able to guarantee the supply of life-enhancing therapies, products and services to patients who need them.

Grifols’ talent pool has always been its top priority. Throughout the pandemic, the company has been – and will be in the future – fully committed to its employees. COVID-19 has transformed the way the company works and accelerated changes in how it manages its teams and talent. Guided by senior management, Grifols prioritized the safety and physical and emotional well-being of its employees and made important strides in embracing a more humane style of leadership, which has led to greater collaboration and innovation.

As of December 31, Grifols had a pool of 23,655 employees. Nearly 4,300 people work in Spain, more than 16,600 in the U.S. and 2,760 in other countries where the company is present (ROW).

In 2020, of note is that 72% of new hires and 62% of promotions are women. The company continues to make progress to ensure that women are adequately represented in all professional categories. In 2020, the representation of women on Grifols' Board of Directors is at 31%, and 36% for female directors.

In broad lines, Grifols talent pool includes:

- 60% women and 40% men

- 98% of employees have permanent contracts

- 52% are 30-50 years old

- 93% full-time employees

- 88 nationalities reflected

Training and professional development is one of the main areas of action of Grifols’ human resource efforts. Grifols aspires to retain and develop its talent through an equal-opportunity policy with regard to remunerations, promotions, professional development and training.

Grifols aims to continuously develop its team to equip them with the skills and competencies they need to thrive in their roles, as well as prepare them for positions of greater responsibility. As part of this commitment, in 2009 Grifols established The Grifols Academy, which includes Professional Development Academy, the Academy of Plasmapheresis and the Academy of Transfusion Medicine.

Through the Grifols Academy, the company provides educational and professional development opportunities to its global workforce; reinforces its philosophy and corporate values; and provides resources and services to medical professionals dedicated to improving patient care. Grifols Academy partnered with College for America in 2015 to offer Grifols employees the chance to earn college degrees.

Despite the pandemic, Grifols continued to dedicate resources to the continuous development of its talent pool. Leveraging virtual platforms, Grifols workforce completed two million training hours, representing an average of 99 hours per person. Of the training hours provided, women received 64% and men received 36%. All in all, the company increased the total number of training hours on health, safety and environmental issues, imparting more than 116,000 hours in 2020, including specific initiatives to better manage and mitigate the effects of COVID-19.

ENVIRONMENT AND CLIMATE CHANGE

Grifols makes concerted efforts to minimize its environmental footprint. The company has a range of policies and guidelines to ensure an efficient use of all resources and promote sustainable development.

At present, 75% of Grifols’ total production is manufactured in ISO-14001-certified facilities.

Grifols’ environmental management is based on the concept of a circular economy. To this end, the company prioritizes waste reduction and the efficient use of material resources, water and energy, while considering the life cycles of its diverse products and services.

This strategy supports the transition toward a low-carbon economy to reduce the impact of climate change. Grifols’ management of climate-related risks and opportunities based on Task Force on Climate-Related Financial Disclosures (TCFD) guidelines – focus on four main areas: governance, risk management, strategy, and the establishment of objectives and metrics.

Despite the global challenges of 2020, Grifols allocated significant resources to environmental activities to bolster its environmental performance and advance its 2020-2022 Environmental Program objectives.

In addition to its environmental programs, Grifols established six main environmental commitments for 2030 as part of its core lines of action. These include reducing greenhouse gas emissions per unit of production by 40%; increasing energy efficiency per unit of production by 15% through the systematic application of eco-efficiency measures in new projects and existing facilities; and consuming 70% of electricity using renewable energies, among others.

The outbreak of COVID-19 provoked mobility restrictions for most of the world's population, leading to a dramatic reduction of CO2 emissions. In Grifols’ case, the pandemic significantly reduced airline travel, which fell by 72%, and increased remote connections by 369%. Overall, the implementation of work-from-home initiatives led to a 13% reduction in Grifols' total CO2 emissions in 2020.

In 2020, the joint consumption and emissions of Grifols’ manufacturing plants in Spain, the U.S. and Ireland were as follows:

- Energy consumption decreases by 3% in relation to sales:

- Electric consumption: 428 million kWh, a 5% increase

- Gas consumption: 421 million kWh, down by 4%

- 4% reduction in water consumption to 3 million m3

- Total associated emissions: 287,992 T CO2e, down 13% compared to 2019

Grifols invested EUR 23 million in environmental initiatives in 2020, a 7% increase over the previous year. Forty percent (40%) was channeled to projects aimed at reducing energy consumption and atmospheric emissions. In terms of environmental expenditures, 73% relate to waste management processes in Grifols’ global facilities.

Including both expenses and investments, 66% of resources were allocated to waste management; 26% to water cycle resources; and the remaining 8% to efforts to reduce atmospheric emissions, energy and others.

In reflection of its efforts to combat climate change, Grifols participates annually in the Carbon Disclosure Project (CDP), which assesses the firm’s corporate strategy and climate change performance. Grifols improved its valuation in 2020, earning an “A-” management rating.

1Operating or constant change (cc) excludes the exchange rate variations of the year.

2Excludes non-recurring impacts, including the impacts of COVID-19; amortization of deferred financing costs related to refinancing, amortization of intangibles associated with acquisitions; and IFRS 16.

3As of December 31, 2020, the impact of IFRS 16 on debt totaled EUR 733 million.