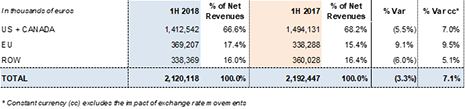

Barcelona, July 27, 2018.- Grifols (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS) reported EUR 2,120.1 million in revenues for the first half of 2018, a 7.1% increase at constant currency (cc) and a 3.3% decrease when taking into account exchange rate fluctuations, particularly the euro-dollar. The company consolidated its growth in all divisions and regions where it operates.

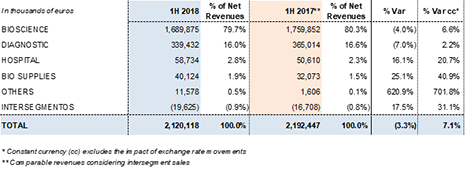

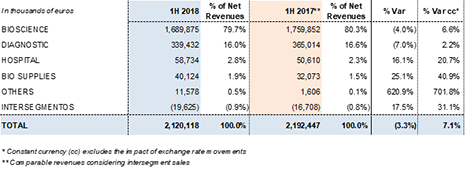

Demand for the main plasma proteins remains strong, as evidenced by higher sales of immunoglobulin, albumin and alpha-1 antitrypsin. The Bioscience Division reported sales of EUR 1,689.9 million, a 6.6%2 cc increase and 4.0% decline taking exchange rate variations into account.

The Diagnostic Division's revenues reached EUR 339.4 million, a 2.2%2 increase and 7.0% decline due to foreign currency exchange fluctuations. Sales of the division's NAT technology donor-screening solutions (Procleix® NAT Solutions) and blood typing business lines were the main engines of growth.

The Hospital Division reached EUR 58.7 million in revenues, an increase of 20.7%2 cc and 16.1% when factoring in the exchange rate. This upward trend was driven primarily by higher U.S. sales of Grifols' IV solutions, manufactured in the group's Murcia (Spain) plant, and the international expansion of the division's Pharmatech line, comprised by hospital pharmacy systems and equipment.

The Bio Supplies Division recorded revenues of EUR 40.1 million for the first six months of 2018, an uptick of 40.9%2 cc and 25.1% taking into account exchange rate variations.

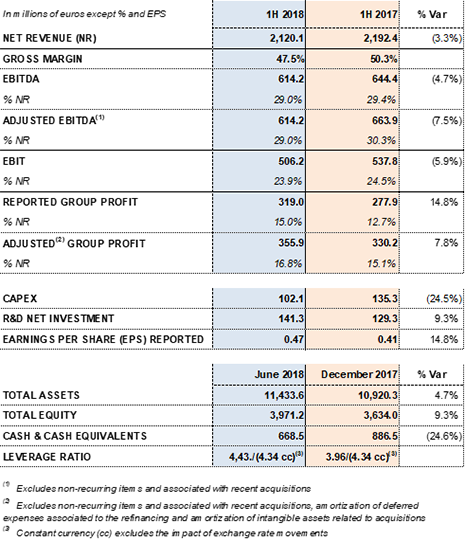

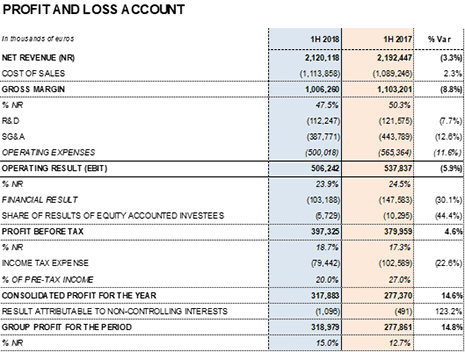

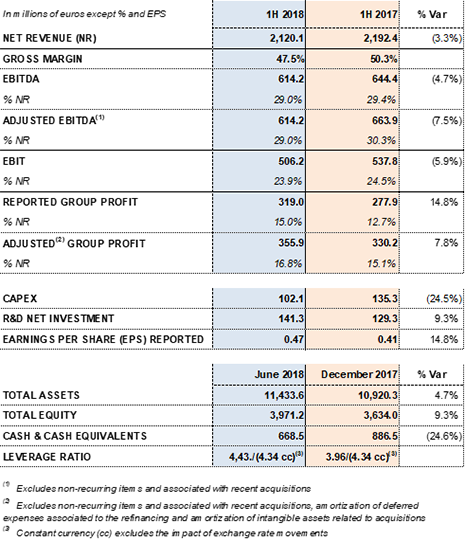

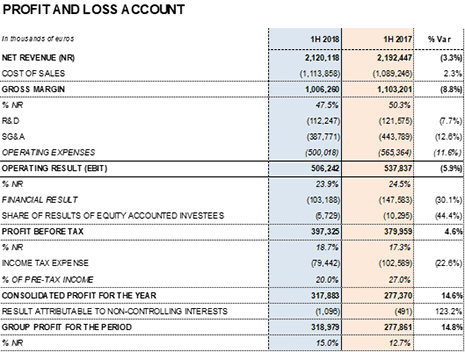

EBITDA totaled EUR 614.2 million and the EBITDA margin remains stable at 29.0%. The group continues to note the impact of higher plasma costs associated with its strategic long-term investment plan to increase and diversify its plasma supply. In alignment with this plan, Grifols aims to satisfy the projected growing demand for plasma proteins and remain on its path of sustainable growth.

Grifols' investment efforts have reinforced its leadership position in plasma donation centers. The company currently owns 225 centers: 190 in the U.S. and 35 in Europe following the acquisition of the German firm Haema. In addition, the execution of a call option for the remaining 51% of Interstate Blood Bank Inc. (IBBI), exercisable in 2019, will expand the group's network by 26 centers.

Net R+D+i investments totaled EUR 141.3 million, including both in-house and external projects. This figure represents a 9.3% increase compared to the same period last year.

As part of its integrated R+D+i strategy, Grifols continuously assesses the suitability of its diverse projects. To this end, the company decided to divest in TiGenix and tender its shares in a takeover bid by Takeda, resulting in a cash influx of EUR 70.1 million and gain of EUR 32.0 million. The transaction improved the financial result by 30.1% to EUR -103.2 million, compared to EUR -147.6 million for the same period in 2017.

The effective tax rate remains at 20% following the U.S. tax reform approved in December 2017.

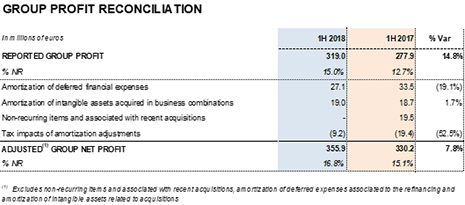

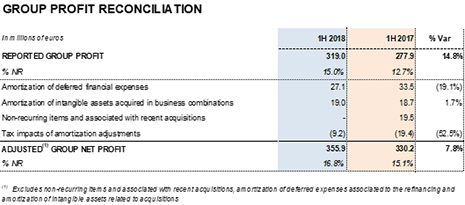

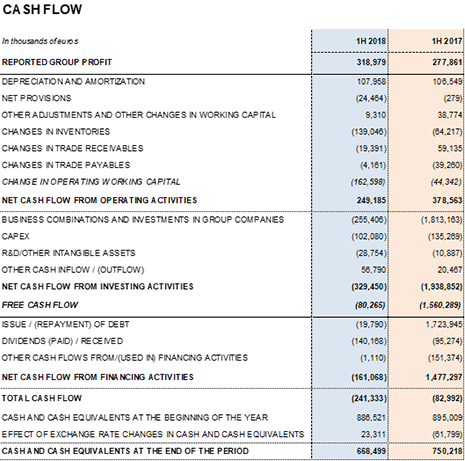

Net profit increased by 14.8% during the first half of 2018 to EUR 319.0 million, which represents 15.0% of total revenues.

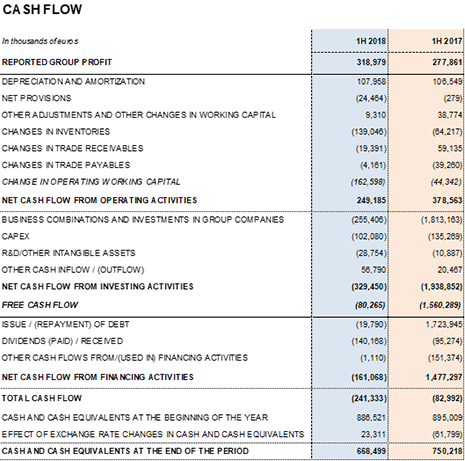

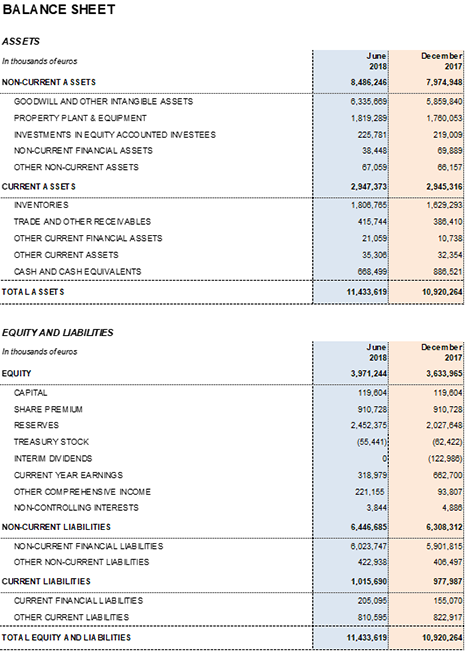

At the end of June 2018, Grifols' net financial debt totaled EUR 5,560.3 million, including EUR 668.5 million in cash and taking into account, among other transactions, the EUR 220.0 million acquisition of 100% of Haema's capital and EUR 142.1 million payout for the final 2017 dividend, approved in the General Ordinary Shareholders Meeting.

Total dividend allocations in 2017, including the final dividend paid in June 2018 (EUR 0.20 gross per share) and the interim dividend paid in December 2017 (EUR 0.18 gross per share), amounted to EUR 265.1 million. This record figure denotes a 21.5% increase compared to the previous year and confirms Grifols' commitment to generating and delivering shareholder value.

The net financial debt-to-EBITDA ratio was 4.43x (4.34x cc). Standard & Poor's (S&P) improved Grifols' credit scores by raising the rating on its senior secured debt to BB+. The corporate rating remains at BB and its outlook is "stable".

As of June 30, 2018, undrawn lines of credit totaled EUR 400 million and Grifols' liquidity position was roughly EUR 1,100 million.

Grifols' cash flow generation remains high and provides the necessary solvency to meet growth investments. Unlevered operating cash flow reached EUR 348.1 million in the first half of 2018, bearing in mind higher inventory levels stemming from greater sales volume and new plasma centers.

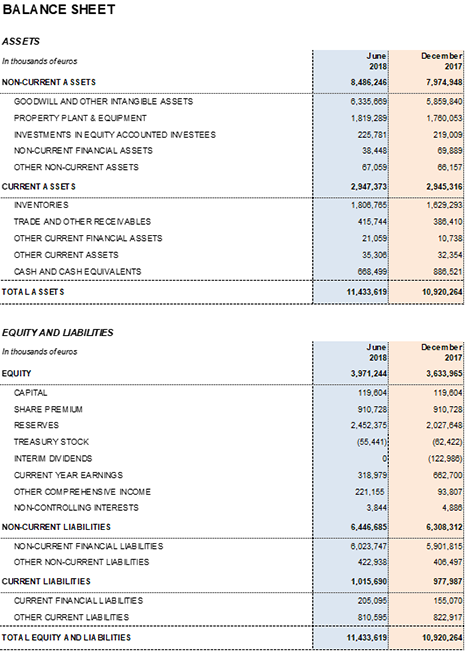

Key Financial Metrics for the First Half of 2018:

PERFORMANCE BY DIVISION

Grifols drives "One Grifols" strategy among its main divisions

Bioscience Division: 6.6% solid operating growth and strategic investments to meet rising market demand

Demand in the hemoderivatives sector is solid and maintains its upward trend. Grifols further consolidated the Bioscience Division's sales growth and continues to make inroads to increase and diversify its access to plasma.

The division recorded a 6.6%2 cc increase in revenue growth to EUR 1,689.9 million over the first half of the year. Higher sales volumes of the main plasma proteins (immunoglobulin, albumin and alpha-1 antitrypsin) and the favorable price impact in some markets offset the decline in factor VIII sales.

The euro-dollar exchange rate exerted a negative effect on the division's overall performance, resulting in a 4% decline compared to the same period last year.

Sales of immunoglobulin were the primary drivers of growth during this period. Demand for this plasma protein continues to grow, especially in the U.S. and European Union countries.

Grifols is the global leader in immunoglobulin sales. It boasts a solid position in the treatment of primary immunodeficiencies (PIDD) and leads the neurology area to treat diseases such as chronic inflammatory demyelinating polyneuropathy (CIDP).

Sales of alpha-1 antitrypsin grew significantly in the U.S. and European countries as a result of higher rates of diagnosis.

Grifols maintains its leadership position in alpha-1 antitrypsin sales and expanded its product portfolio. The new liquid alpha-1 formulation (Prolastin®-C Liquid) was approved by the U.S. Food and Drug Administration (FDA) and is scheduled for launch in the second half of 2018. This new formulation, along with the new FDA-approved genetic diagnostic test developed by the Diagnostic Division, will contribute to improving the diagnosis and treatment of alpha-1 antitrypsin deficiency.

Albumin sales notably increased, especially in China, the U.S. and European countries.

Plasma-derived Factor VIII sales followed the same trend as the first quarter of 2018. Demand has dropped significantly as a result of declining use to treat patients with inhibitors in immune tolerance induction (ITI) therapy.

Despite this downturn, the company continues to advocate plasma-derived factor VIII as the best treatment option to eradicate inhibitors, which affect an estimated 35% of hemophilia A patients3 . On the other hand, Grifols continues to reinforce its position to treat previously untreated patients (PUPs) with severe hemophilia A, especially in the United States.

Grifols remains committed to expanding its line of specialty proteins, which allow the company to build a differential product portfolio for patients, as well as optimize production capacity and raw materials costs.

In the hyperimmunoglobulins segment, Grifols expanded its product portfolio with the development of two new formulations: intramuscular immunoglobulin (GamaSTAN®) to treat patients exposed with the hepatitis A virus and measles, scheduled to launch in the second half of the year; and anti-rabies immunoglobulin (HyperRAB®), introduced last May in the U.S. to treat patients for rabies exposure. Both earned FDA approval in the first half of 2018.

Diagnostic Division: continuous innovation leads to a broader product portfolio, with 5 new FDA-approved products

Diagnostic Division revenues reached EUR 339.4 million, representing a 2.2%2 cc increase and a 7.0% decline taking into account exchange rate variations.

Transfusion medicine continues to be the main driver of growth. Sales of NAT technology for plasma and blood donation screening (Procleix® NAT Solutions) remained robust.

The company continues its efforts to enhance its product portfolio with the development of new reagents. In the second quarter of the year, the FDA approved two new Procleix® Panther diagnostic tests, one that simultaneously detects two types of the human immunodeficiency virus (HIV-1 and HIV-2) and hepatitis B and C, and another that detects the West Nile virus. The market launch is scheduled for the second half of 2018.

Sales of the division's blood typing line rose significantly, especially analyzers (Wadiana®, Erytra® and Erytra Eflexys®) and reagents (DG-Gel® cards). A solid sales strategy in the U.S. and Europe fueled this strong performance. A year following its launch in Europe, Middle East and Africa more than 100 units of Erytra Eflexys® have been sold in the region of which 60% are conversions from competitors.

The company began marketing its new line of conventional antisera in the U.S., used to determine blood types and carry out manual pre-transfusion blood compatibility tests, after earning FDA approval in the second quarter of 2018. This FDA approval marks an important milestone since it allows the division to expand and complement its blood-typing product portfolio.

In addition to the positive strides in transfusion medicine, Grifols fortified its position in specialty diagnostics after earning new approvals that widen its product portfolio. In the first half of 2018, the FDA approved two new diagnostic tests to detect autoimmune diseases. These diagnostics utilize the HELIOS system developed by Aesku and distributed by Grifols.

Moreover, in May 2018, Grifols' Immunohematology Center in San Marcos, Texas (U.S.) enhanced its catalogue of transfusion tests with a blood compatibility test used for certain cases for multiple myeloma patients.

Hospital Division: global expansion boosts growth by more than 20% cc

The Hospital Division increased its revenues by 20.7%2 cc (16.1%) to EUR 58.7 million. The division reported higher sales in all of its business lines, most notably IV solutions following the distribution of Grifols' physiological saline solution in the U.S., as well as their usage in Grifols' network of plasma donation centers to restore circulatory volume. This will increase the vertical integration of the process and its quality and regular supply. Grifols' IV solutions are manufactured in the Murcia (Spain) plant.

Sales of the Pharmatech line, comprised by hospital pharmacy solutions and reinforced with the acquisition of MedKeeper, grew considerably in the U.S. and in certain Latin American markets. Regulatory changes in hospital pharmacy and compounding operations in the U.S. represent a significant market opportunity for Grifols, a recognized supplier of integrated solutions that enhance the efficiency and control of hospital pharmacy services.

Bio Supplies División

This division focuses mainly on sales of biological products for non-therapeutic uses and overseeing manufacturing agreements with Kedrion, which led to an increase in sales to EUR 40.1 million compared to EUR 32.1 million reported in the same period in 2017.

Revenues by division and región:

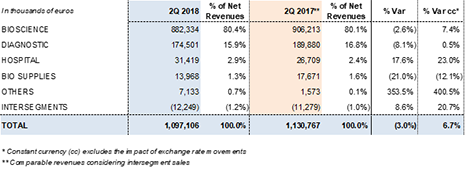

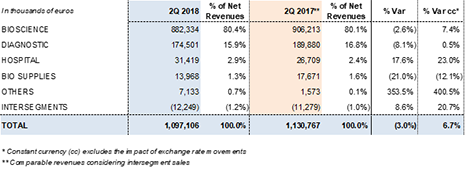

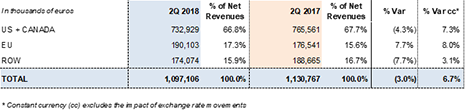

SECOND QUARTER 2018

Operating growth in Grifols' main divisions and geographic regions

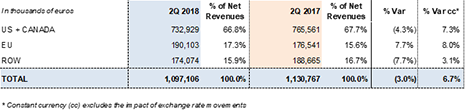

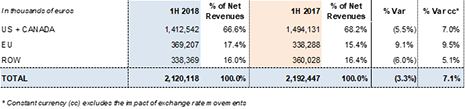

Grifols' revenues reached EUR 1,097.1 million in the second quarter of 2018, a 6.7%2 cc increase and 3.0% decline taking into account exchange rate variations. Sales grew in the main divisions and all regions where the company operates. Sales in the principal European Union markets (+8.0% cc and +7.7%), as well as in the U.S. and Canada (+7.3% cc and -4.3%) were especially strong.

The Bioscience Division led overall sales, with a 7.4%2 cc increase in revenues to EUR 882.3 million. Of note was the continued solid demand for immunoglobulin and alpha-1 antitrypsin in the U.S. and European countries, and higher sales of albumin in China, the U.S. and European countries.

Revenue growth of the Diagnostic Division moderated in the second quarter of 2018, reaching EUR 174.5 million. The division's sales were led by growth in NAT technology systems and blood typing solutions.

The Hospital Division grew by 23.0%2 cc (17.6%) to EUR 31.4 million, proof of its solid internationalization strategy and clear focus on the U.S. market.

Revenues by division and región:

INVESTMENT ACTIVITIES: ACQUISITIONS, CAPEX AND R+D+i

Haema acquisition

In alignment with Grifols' corporate strategy to expand and diversify its access to plasma, the company announced the acquisition of 100% share capital of Haema, the leading independent network of donation centers in Germany and largest transfusion service in the country. After fulfilling the conditions set for the transaction, Grifols acquired the firm for EUR 220 million.

The transaction includes the Haema business; 35 donation centers in nine states and three more under construction; a 24,000-square-meter building in Leipzig (Germany), home to the company's headquarters; and a main laboratory in Berlin (Germany). Haema collected approximately 800,000 liters of plasma in 2017.

Agreement with Boya Bio-Pharmaceutical

Grifols has entered into an agreement with Boya Bio-Pharmaceutical, a leading Chinese producer of plasma-derived medicines, to build and manage plasma donation centers in China.

The project investment totals EUR 50 million and Grifols will control 50% of the political and economic rights.

The plasma donation centers will be built and managed in adherence to the guidelines established by the China's National Health and Family Planning Commission, the FDA and the, European Medicines Agency (EMA), among others. Grifols will bring its experience and know-how to ensure that the construction and management of the centers meet the same high standards of quality as the rest of its global network.

In accordance with current Chinese legislation, the plasma collected in these centers will be supplied to Boya Bio-Pharmaceutical, although Grifols reserves the right to access up to 50% of the total volume when the applicable legislation allows.

Capital investments (CAPEX)

Grifols invested EUR 102.1 million over the first six months of the year as part of its on-going efforts to enhance and expand the production facilities of its four divisions. Capital investments progress as outlined in the 2016-2020 Capital Investment Plan, endowed with EUR 1,200 million to guarantee the company's long-term sustainable growth.

More than EUR 140 million in R+D+i investments in the first half

The company allocated EUR 141.3 million for R+D+i activities in the first half of 2018, taking into account net internal and external investments. This figure represents a 9.3% increase compared to the same period last year.

In terms of clinical trials, Grifols continues to research the potential benefits of albumin in the treatment of cirrhosis. Also of note is the completion of the AMBAR (Alzheimer Management By Albumin Replacement) phase IIb/III clinical trial for the treatment of Alzheimer's disease. The company plans to publish AMBAR's results in the fourth quarter of 2018.

CORPORATE RESPONSIBILITY

Talent: greater job creation, training and professional development

The Grifols' team grew to 18,664 employees over the first half of the year, a 2% increase compared to the same period in 2017. For administrative purposes, these figures do not include the approx. 1,100 Haema employees who now form part of Grifols following the acquisition agreement. The most significant growth was in Spain, where Grifols' expanded its workforce by 4.2% to 3,798 people. The talent pool grew in North America grew by 1.4% to 13,861 employees and by 2.6% in ROW (rest of the world) to 1,005 employees.

The average seniority of Grifols' personnel is 5.9 years and the average age is 37.8; more than 58% of employees are younger than 40. In terms of gender, women make up 58% of the workforce, while men comprise 42%.

Grifols continues its efforts to attract and retain talent. Occupational health and safety, and continuous training and development were the main areas of focus for the first half of 2018. Training and development initiatives centered on technical training programs, onboarding initiatives for new employees, performance reviews and leadership development.

Safety initiatives included a behavior-based management program that aims to interweave safety issues organization-wide, as the company works toward standardizing safety and health programs throughout the group.

Environmental management

Environmental management is one of the main pillars of the group's corporate responsibility actions.

Grifols continues to make significant progress on its 2017-2019 Environmental Plan, whose principal objectives include reducing the consumption of electricity, natural gas and water, in addition to improving waste management and recovery.

In the first half of 2018, external audits based on the ISO 14001 standard were carried out in the Diagnostic Division's facilities in Emeryville, California (U.S.) with satisfactory results. More than 75% of Grifols' production plants are ISO-14001-certified. In addition, the plants in Spain and the United States have adopted the new 2015 version of this international environmental management standard.

Worth highlighting are two recent environmental accolades awarded to Grifols' manufacturing complex in Clayton, North Carolina (U.S.). These facilities earned the highest distinction possible in the Environmental Stewardship Initiative, which promotes the development and implementation of innovative solutions that reduce the impact on the environment beyond mere legal compliance. The Clayton complex's office building also became the first in Johnston County to receive the Leadership in Energy and Environmental Design (LEED) in the Silver category for its socially responsible design.

Transparency: Grifols voluntarily discloses transfers of value to health professionals and healthcare organizations

In 2015, Grifols voluntarily adopted the Code of Conduct on Industry Interactions with Healthcare Professionals and Healthcare Organizations of the European Federation of Pharmaceutical Industries and Associations (EFPIA) in alignment with its commitment to transparency. For the third consecutive year, the company disclosed all payments and other transfers of value to health professionals and health sector organizations in 33 European countries, including Spain.

In Europe, Grifols' transfer of value totaled EUR 11.7 million in 2017, compared to EUR 11.8 million in 2016. The group's R+D+i activities in Spain accounted for 60% of total transfers of value in Europe.

Although EFPIA applies to medicines, Grifols voluntarily expanded its scope to include transfers unrelated to medications and those made by its three main divisions. Grifols applies this policy of transparency in the United States as stipulated by the regulatory body (Centers for Medicaid and Medicare Services, or CMS).

Committed to patients: more than 25 million international units of clotting factors donated to the World Federation of Hemophilia (WFH)

Grifols has collaborated with the World Federation of Hemophilia (WFH) for more than a decade, supporting its efforts to improve access to treatment for bleeding disorders around the world.

The donation forms part of Grifols' 2014 commitment to donate at least 200M IU of factor VIII to the WFH Humanitarian Aid Program over a span of eight years. To date, this initiative has improved access to care and treatment for patients with bleeding disorders in 47 developing countries.

Investor and Analyst annual meeting

The company hosted its annual investor and analyst meeting in Barcelona in June 2018. Grifols executives summarized results of the different divisions and outlined the group's capex plans, primary research projects and financial performance.

Grifols included in the FTSE4Good index

Grifols was selected for inclusion in the FTSE4Good sustainability index, specifically, the FTSE4Good Global, FTSE4Good Europe and FTSE4Good Ibex índices.

The sustainability indices or ESG indices rate companies on their environmental, social and corporate governance (ESG) performance, in addition to their financial indicators.

1Constant currency (cc) excludes exchange rate variations.

2Comparable revenues considering inter-segment sales.

3Source: Oldengurg J, et al. Haematologica 2015; 100(2):149-156