April 21, 2020

Grifols maintains its operational levels and continues to reinforce its commitment to society

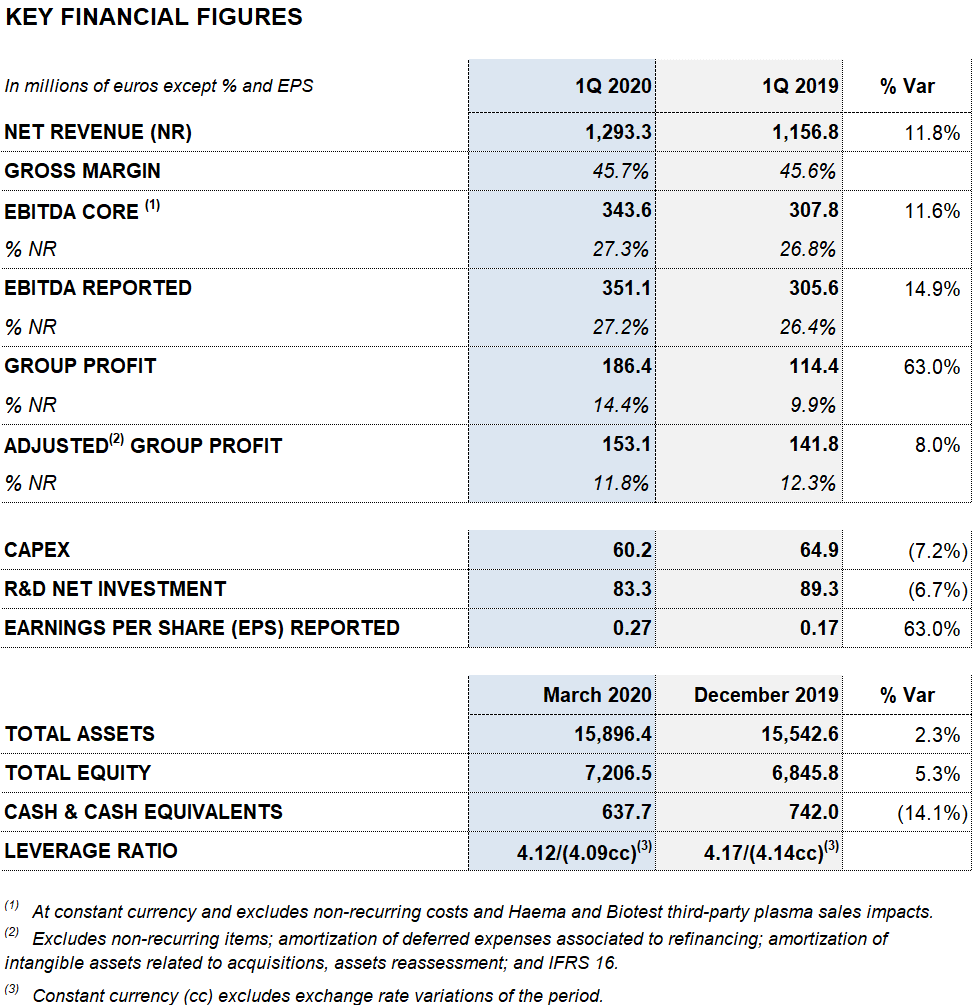

- Grifols increases its revenues by 12% to EUR 1,293 million

- The Bioscience Division leads growth, increasing revenues by 13.6% (10.9% cc) to EUR 1,040 million, driven mainly by the demand for strong key proteins, especially with immunoglobulins

- Diagnostic and Hospital Division revenues remain stable at EUR 168 million (1.4%; -0.3% cc) and EUR 31 million (0.6%; 0.8% cc), respectively. Bio Supplies revenues increase to EUR 64 million (24.5%; 21.9% cc)

- Reported EBITDA increases by 15% to EUR 351 million, with a 27.2% margin

- Reported net profit stands at EUR 186 million

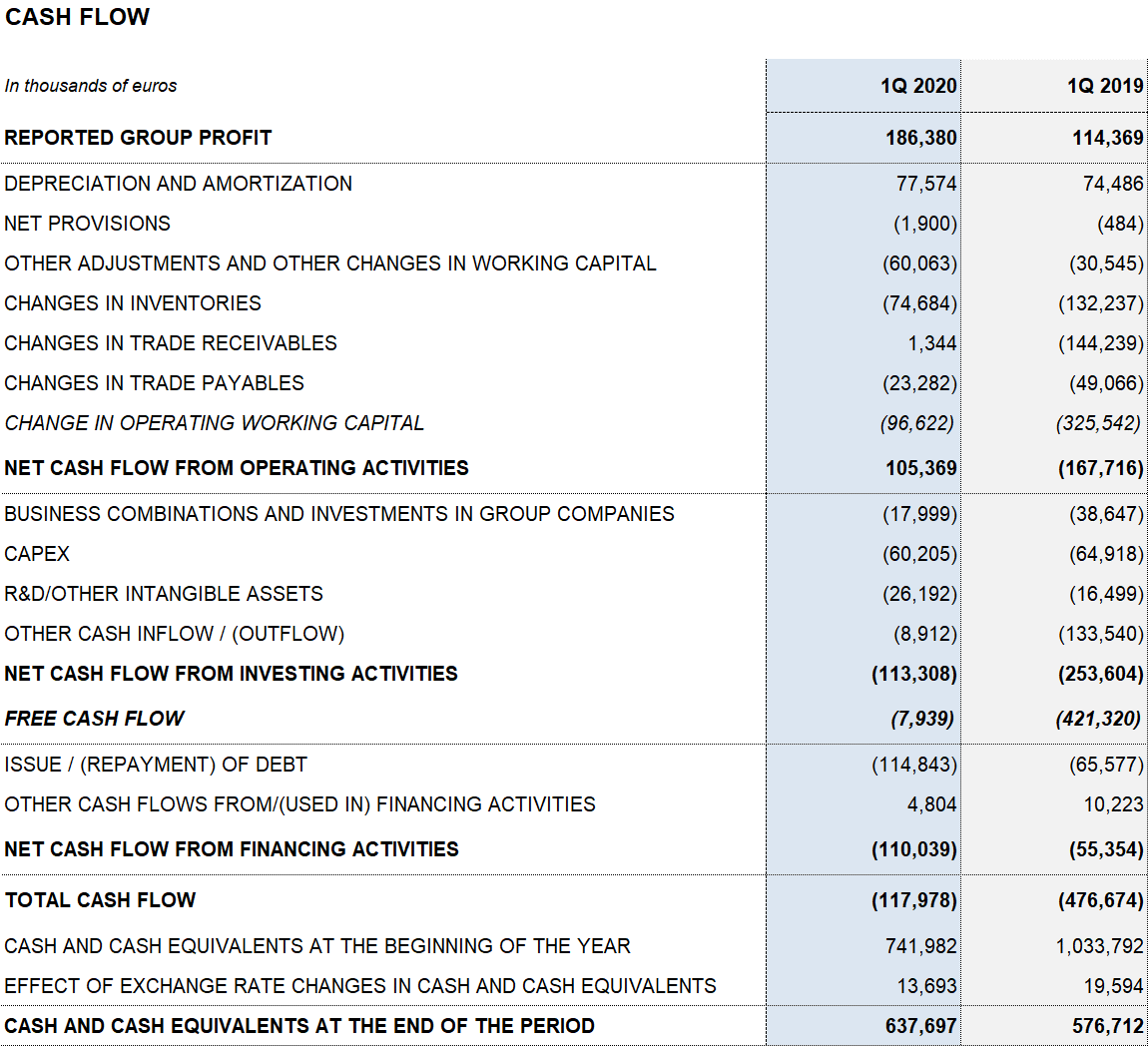

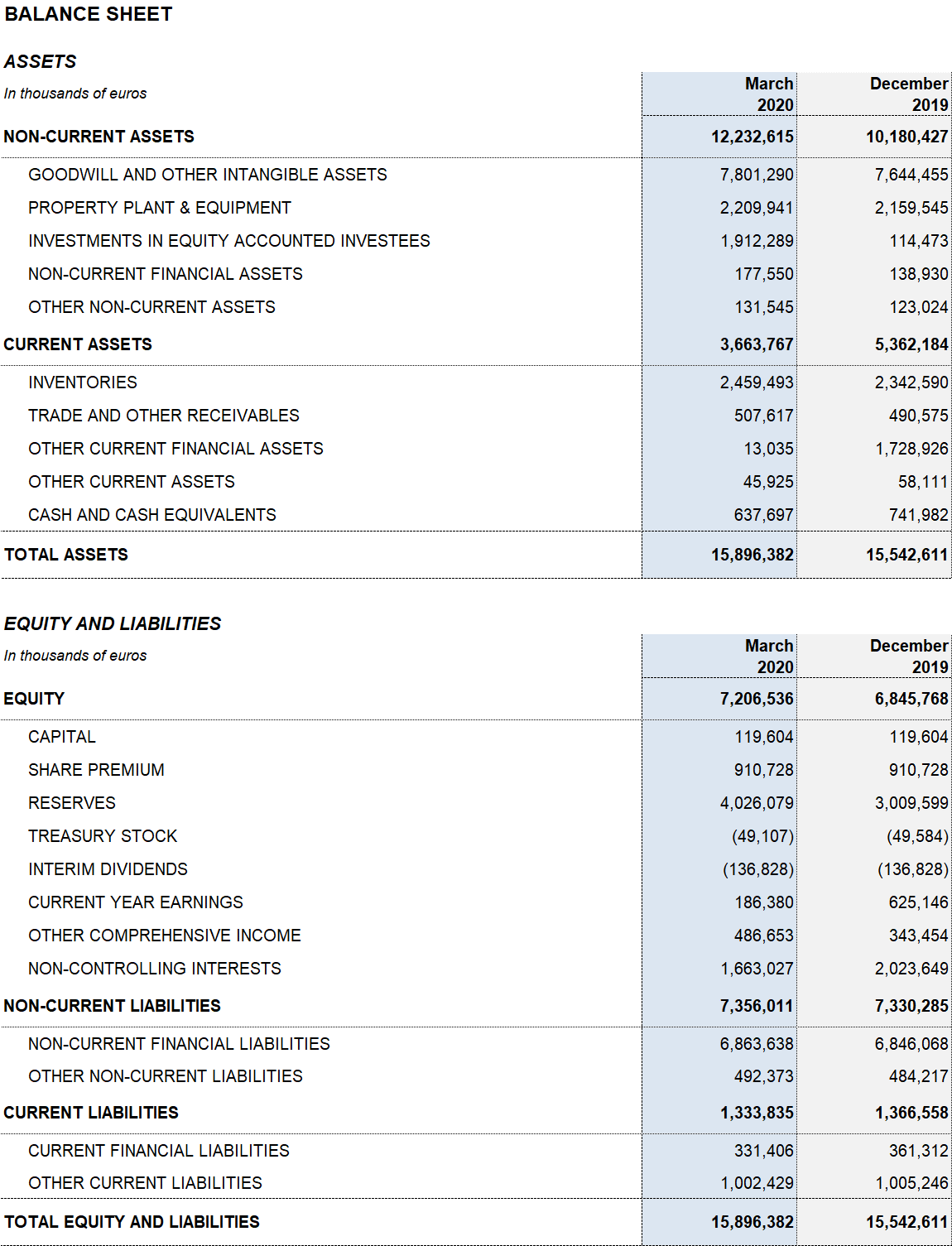

- Liquidity position totals to EUR 1,200 million. The net debt leverage ratio continues improving to 4.12x

- Grifols leads the development of an anti-SARS-CoV-2 immunoglobulin, a treatment using plasma from recovered COVID-19 patients, and a highly sensitive diagnostic test

- Grifols closes its strategic alliance deal with Shanghai RAAS to boost sales of plasma-derived medicines and transfusion diagnostic solutions in China

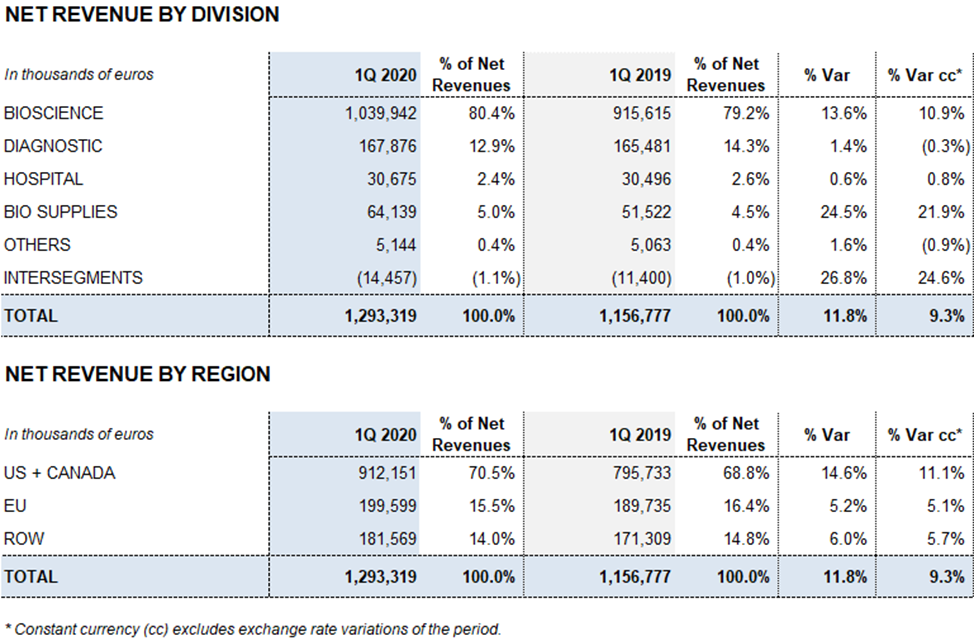

Barcelona, April 21, 2020.- Grifols (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS) reports solid results in the first quarter of 2020. The company grew by 11.8% (9.3% cc1) to EUR 1,293 million in revenues.

Amid the current global health crisis caused by COVID-19, Grifols’ plasma centers, industrial and commercial sites remain operational, making possible the continued production and supply of plasma-derived medicines, and diagnostic and hospital solutions with the fewest delays possible.

The Bioscience Division continues to lead the company’s growth. The division’s sales grew by 13.6% (10.9% cc) to EUR 1,040 million. The Diagnostic Division and the Hospital Division revenues remained stable at EUR 168 million (1.4%; -0.3% cc) and EUR 31 million (0.6%; 0.8% cc) respectively. The Bio Supplies Division grew by 24.5% (21.9% cc) to EUR 64 million.

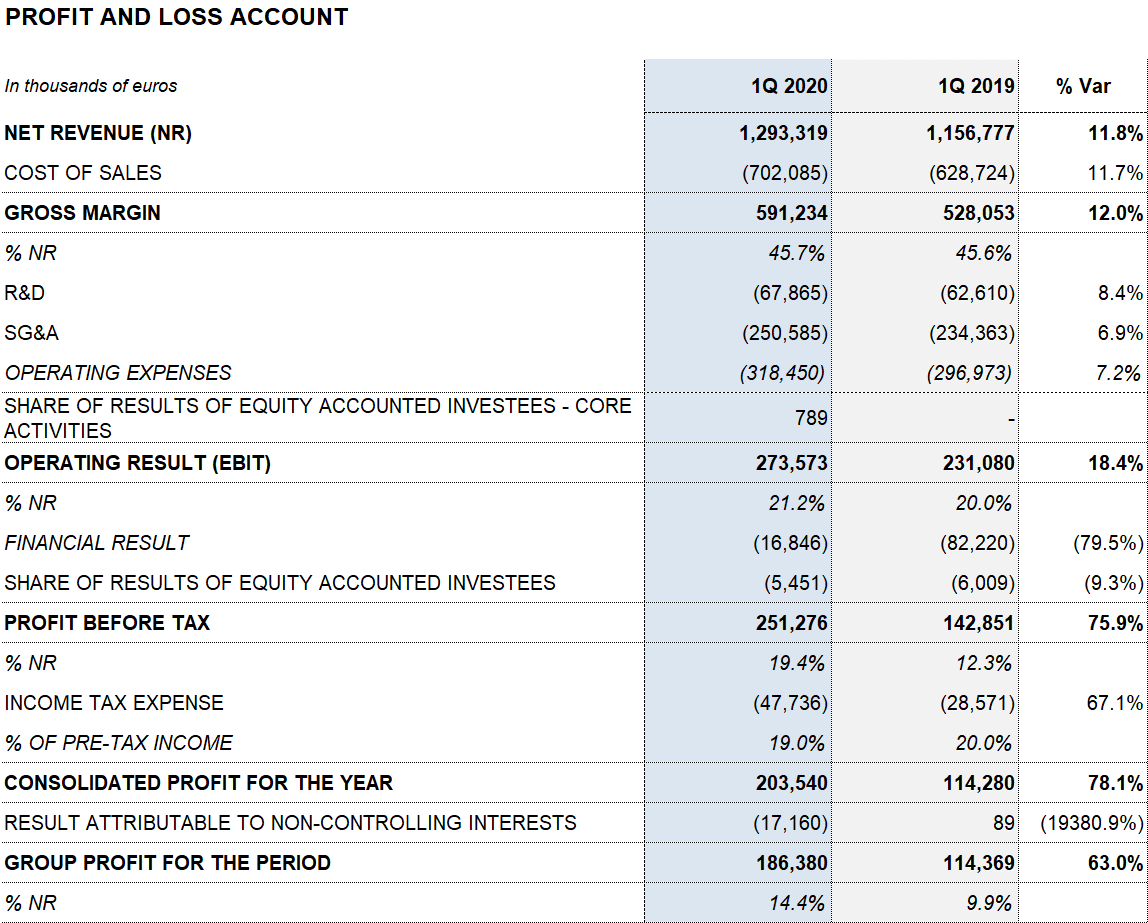

Reported EBITDA totaled EUR 351.1 million, denoting a 14.9% growth and a 27.2% margin (26.4% in 2019). Core EBIDTA2 amounted to EUR 343.6 million (EUR 307.8 million in the first quarter of 2019), representing 27.3% of revenues (26.8% in 2019).

Taking internal, external and investee projects into account, Grifols allocated a total of EUR 83.3 million (EUR 89.3 million in the first quarter of 2019) to net R+D+i investments.

Grifols is leading a clinical trial on the efficacy of an anti-SARS-CoV-2 hyperimmune immunoglobulin in collaboration with the U.S. Food and Drug Administration (FDA) and other health agencies. The company is also working with health authorities in the U.S., Spain and Germany to test the efficacy of direct plasma transfusions, previously inactivated by methylene blue, from recovered COVID-19 patients (convalescent plasma) as a treatment. At the same time, Grifols has developed a highly sensitive SARS-CoV-2 detection test.

The company allocated EUR 60.2 million to capital investments (CAPEX) in the first quarter. As part of its response to COVID-19, Grifols announced the expansion of its virus-inactivated plasma systems (methylene blue) in its Clayton (North Carolina, USA) industrial complex. This facility also has an isolated plant to manufacture anti-SARS-CoV-2 immunoglobulin.

Grifols’ investment levels in R+D+i and CAPEX highlight and reinforce its commitment to growth and long-term vision, in addition to its ongoing efforts to help mitigate the global health emergency triggered by the COVID-19 outbreak.

The company’s financial results totaled EUR 16.8 million. This figure includes a reduction of the financial expenses of EUR 21 million due to the refinancing process that was closed in November 2019. Additionally, it includes a EUR 11.4 million negative impact due to exchange differences, as well as the positive impact of EUR 56.5 million related to the closing of the Shanghai RAAS transaction.

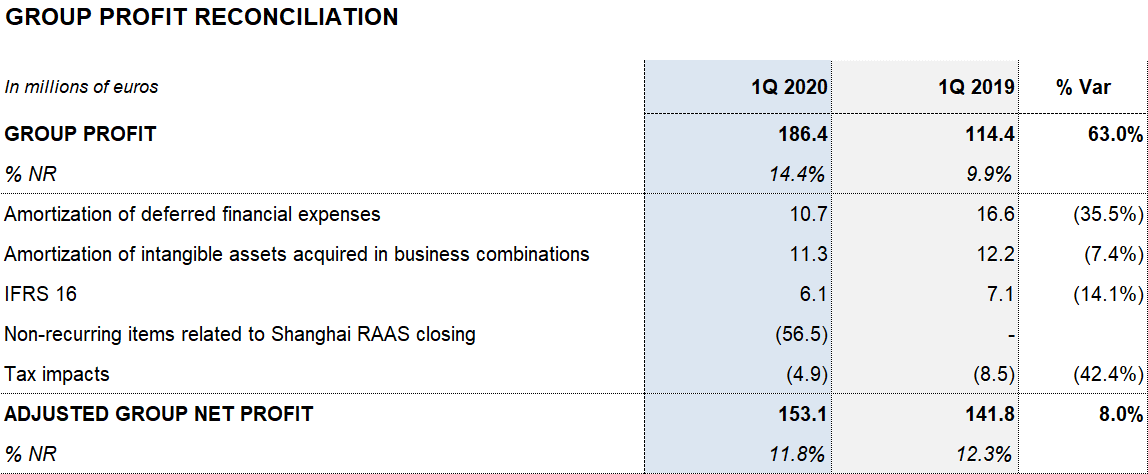

Reported net profit stands at EUR 186.4 million due to the solid operating performance and lower financial results.

Excluding the impact of IFRS 163, Grifols’ net financial debt stands at EUR 5,803.6 million and its net financial debt over EBITDA ratio improved to 4.12x. As shown by the progressive deleveraging over the last quarters, debt management remains a key priority for the company.

Grifols has the necessary resources and liquidity to fulfill its short and medium-term obligations. As of March 31, 2020, the company had EUR 638 million in cash positions and approximately EUR 570 million in undrawn lines of credit, placing its liquidity position above EUR 1,200 million.

In addition, in light of the COVID-19 outbreak, Grifols is preemptively taking all necessary measures to further bolster its already-solid liquidity position.

REVENUE PERFORMANCE

Bioscience Division

The Bioscience Division continues its role as Grifols’ main growth driver with an upward trend, increasing revenues by 13.6% (10.9% cc) to EUR 1,040.0 million

Demand for immunoglobulin in the U.S., Canada and several European Union (EU) countries remain very solid, attaining double-digit growth. Grifols expanded its product portfolio with the U.S. market launch of its 20% subcutaneous immunoglobulin (Xembify®) in the last quarter of 2019.

Alpha-1 antitrypsin remains one of the company’s main engines for growth and has held its sales growth in countries such as the U.S. The number of diagnosed patients continues to rise thanks to concerted efforts to develop new diagnostic solutions.

Albumin sales were affected by the exports to China in the first two months of the year due to the COVID-19 outbreak. However, the underlying demand for albumin in the Chinese market has significant growth potential for the division.

Sales of factor VIII continue the positive trend initiated in the last quarter of 2019. The decision to position FVIII/VWF products as treatments to prevent and treat bleeding episodes, as well as prevent and eradicate inhibitors, along with the favorable impact of certain tenders, all contributed to higher sales.

Grifols also continues to drive its specialty proteins to offer a differential product portfolio, particularly with immunoglobulins. The company is currently leading the development of a specialty anti-SARS-CoV-2 hyperimmune immunoglobulin.

The first quarter also recorded higher sales of biological sealant, a product combining two plasma proteins (human fibrinogen and thrombin) developed and manufactured by Grifols to manage bleeding during surgical interventions. Launched in the last quarter of 2019, this sealant is marketed and distributed by Ethicon under the name VISTASEALTM.

Diagnostic Division

The Diagnostic Division recorded revenues of EUR 167.9 million, with 1.4% (-0.3% cc) growth. Especially noteworthy was the consolidation of sales of the blood typing line as the main growth driver.

The sale of NAT systems (Procleix® NAT Solutions), which uses Transcription Mediated Amplification (TMA) to screen blood and plasma donations, continues to serve as the division’s main line of business. TMA is widely used in transfusion centers, blood banks and plasma centers around the world due to its high analytic sensitivity and ability to automatically adapt to large sample volumes.

As a leading diagnostics company in this type of solutions, Grifols has also developed a specific diagnostic test to detect SARS-CoV-2.

Sales of the blood typing line, which includes both analyzers (Erytra®, Erytra Eflexis® and Wadiana®) and reagents (DG-Gel® cards, red blood cells and anti-serums), grew in all regions, especially in the U.S. and Turkey.

Hospital Division

The Hospital Division reported EUR 30.7 million in revenues, with a stable 0.6% (0.8% cc) growth. The IV therapy in conjunction with medical devices and contract manufacturing services has been the main driver of growth this quarter.

Bio Supplies Division

Revenues from the Bio Supplies Division totaled EUR 64.1 million in the first quarter, growing by 24.5% (21.9% cc) quarter-over-quarter.

The division’s main areas of focus include the sale of biological products for non-therapeutic use, which continues to outperform, and Haema and Biotest third-party plasma sales, which reached EUR 36.7 million in the first three months of 2020.

CORPORATE TRANSACTIONS

- Close of the strategic alliance deal with Shanghai RAAS to drive growth in China

Grifols and Shanghai RAAS closed their strategic alliance deal, which will boost the production, sale and development of plasma-derived products and leading-edge transfusion diagnostic solutions in China in accordance with international quality and safety standards.

Following this transaction, Grifols is now the largest shareholder in Shanghai RAAS while maintaining operational, political and economic control over its subsidiary, Grifols Diagnostic Solutions (GDS). Specifically, Grifols will control a 26.20% stake in Shanghai RAAS’s capital (economic and voting rights) in exchange for a non-majority share in Grifols Diagnostics Solutions (45% economic and 40% voting rights) on behalf of Shanghai RAAS.

For Grifols, the agreement represents a singular opportunity to continue its global expansion and reinforce sustained and long-term economic growth as China is currently the company’s third-largest market.

No external financing was required to fund the transaction.

- Agreement reached with the Public Investment Fund of Saudi Arabia to boost self-sufficiency of plasma medicines in the region

Grifols and the Public Investment Fund of Saudi Arabia have executed a non-binding term sheet to jointly develop plasma centers and production facilities in Saudi Arabia, including two plants, one for plasma fractionation and another for protein purification. Grifols will also provide engineering and support services to guarantee the quality of the infrastructures and processes is in adherence with the strictest quality and safety standards.

The project will be executed through a joint venture held jointly between Grifols and the Public Investment Fund (PIF).

This unique collaboration will enable Grifols to build its presence in the region and help strengthen Saudi Arabia’s health system.

The leadership in the production of plasma medicines; the experience and position in developing and managing plasma centers and production facilities; and solid presence and expertise in the region were all key factors in PIF’s decision to choose Grifols as a strategic partner.

- Collaboration and license agreement with Rigel Pharmaceuticals

In January 2019, Grifols signed a collaboration and license collaboration with the U.S. pharmaceutical firm Rigel Pharmaceutical which provided us exclusive rights to market fostamatinib for the treatment of chronic immune thrombocytopenia (ITP) in adult patients who are refractory to other treatments in Europe and Turkey.

In January 2020, Rigel Pharmaceuticals received European Commission (EC) approval to market TAVLESSE® (fostamatinib). The launch of this therapy, expected in the second quarter of 2020, reinforces Grifols’ commercial strategy and reflects its firm commitment to continue expanding its product portfolio to benefit patients and provide more therapeutic options to healthcare professionals.

1Constant currency (cc) excludes exchange rate variations of the period.

2At constant currency and excludes non-recurring costs and Haema and Biotest third-party plasma sales impacts.

3On March 31, 2020, the impact of IFRS 16 on total debt was EUR 741 million.