May 4, 2021

Grifols maintains its revenues and operational levels while enhancing its innovation strategy and securing its plasma supply

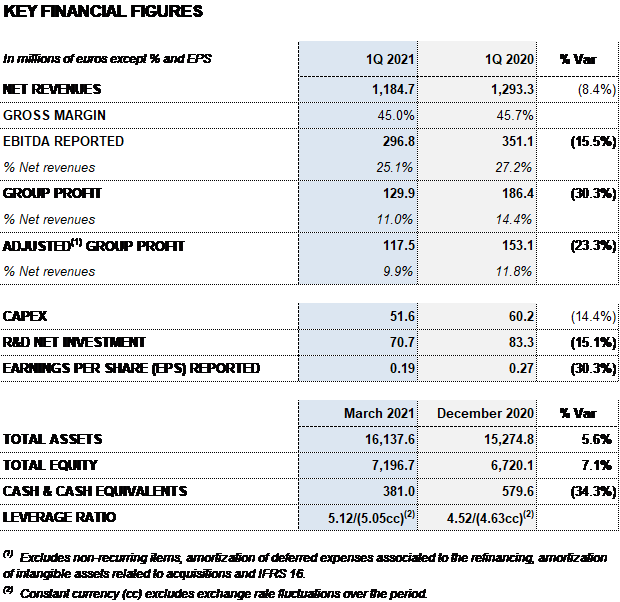

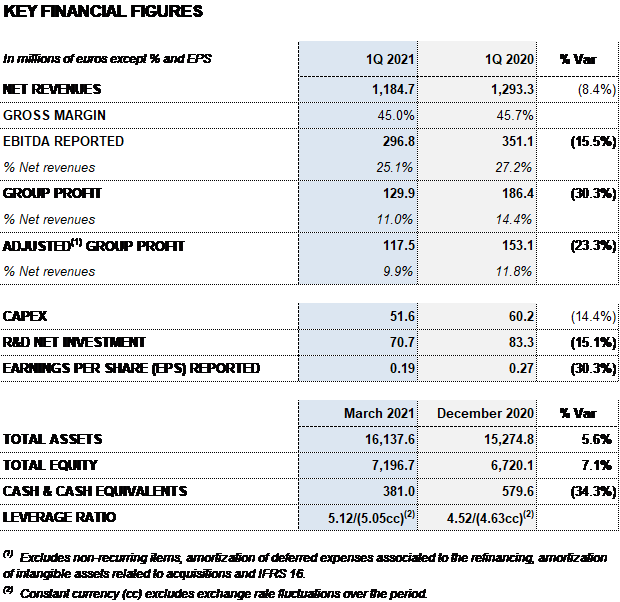

- Grifols reports EUR 1,185 million in revenues, an operational1 decline of 0.9%.

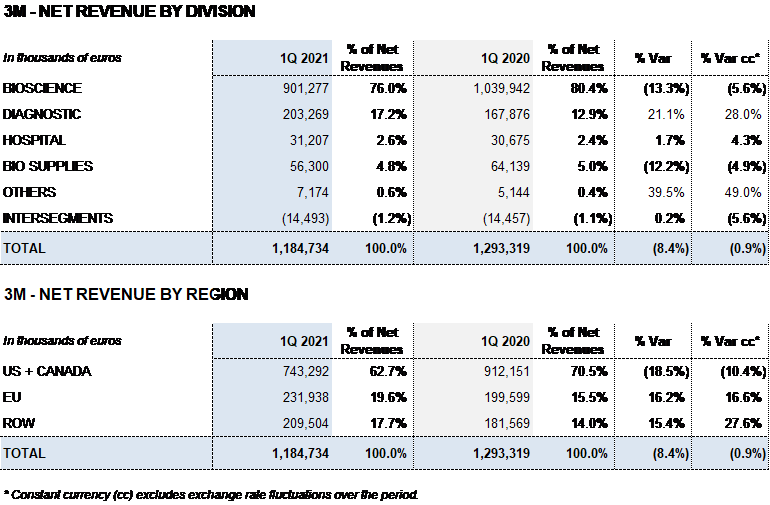

- Contributions from new products and price increases on specific plasma proteins partially offset lower sales volumes due to COVID-19 impacted lower plasma collections, bringing Bioscience Division revenues to EUR 901 million, an operational decline of 5.6%.

- The Diagnostic and Hospital Divisions report solid sales revenues of EUR 203 million (28.0% cc) and EUR 31 million (4.3% cc), respectively. Bio Supplies Commercial continues to grow by double digits.

- EBITDA totals EUR 322 million, excluding the impact of exchange rate variations. EBITDA margins at 25.1%. Grifols’ gross margin stands at 45.0%.

- Grifols continues to strengthen its innovation strategy: Alkahest and GigaGen place Grifols on the leading edge of bioscience, while diversifying and reinforcing its R+D+i pipeline.

- Grifols accelerates the execution of its expansion plan to immediately access an additional 1.4 million liters of plasma per year, while moving forward with the opening of new centers.

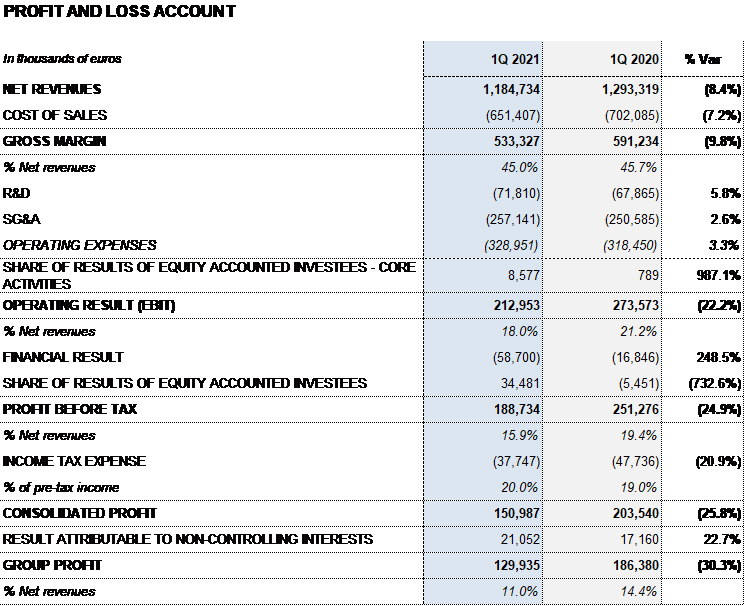

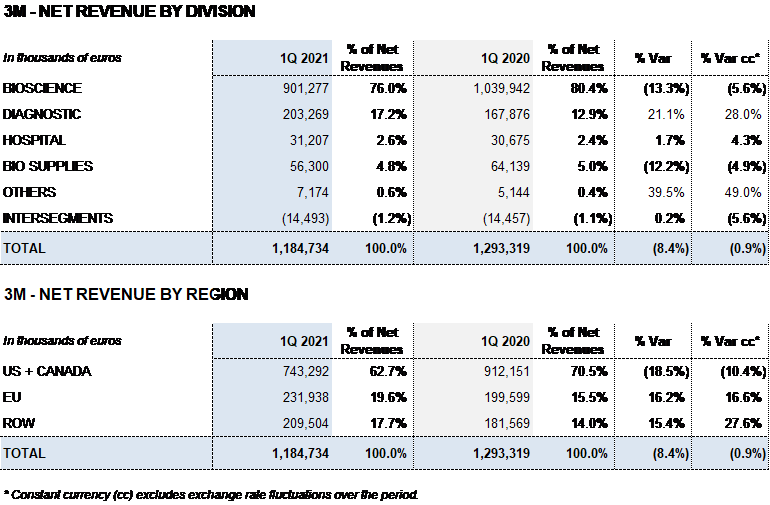

Barcelona, May 4, 2021.- Grifols (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS) reported EUR 1,184.7 million in revenues in the first quarter of 2021, a decline of 0.9% cc and 8.4% taking into account exchange rate variations.

The company maintained its operational levels in the first quarter despite these unprecedented times, limiting COVID-19-related impacts through contributions from new products, continuous efforts to increase plasma donations, effective inventory management, and the expansion of Grifols’ plasma collection capacity.

Grifols advances in the execution of its expansion plan to increase its plasma supply by acquiring several plasma collection centers in the first quarter. These transactions enabled the company to instantly leverage an additional 1.4 million liters of plasma, approximately, per year.

Grifols’ plasma collection levels in Germany were strong in the first quarter, achieving higher volumes than those recorded in the same period in 2020 and 2019.

In the United States, plasma donations are gradually recovering. Of note was the trend observed in January, February and April in the wake of the country’s vaccination rollouts and the easing of COVID-19 restrictions, while taking into account the mitigating effect of stimulus incentives issued in March and December.

In recent years, Grifols has forged a solid global network of 351 plasma donation centers, operating 296 centers in the United States and 55 in Europe, including Germany, Austria and Hungary. Grifols’ plasma centers network represents a significant competitive advantage, enabling the company to expand and diversify its plasma supply.

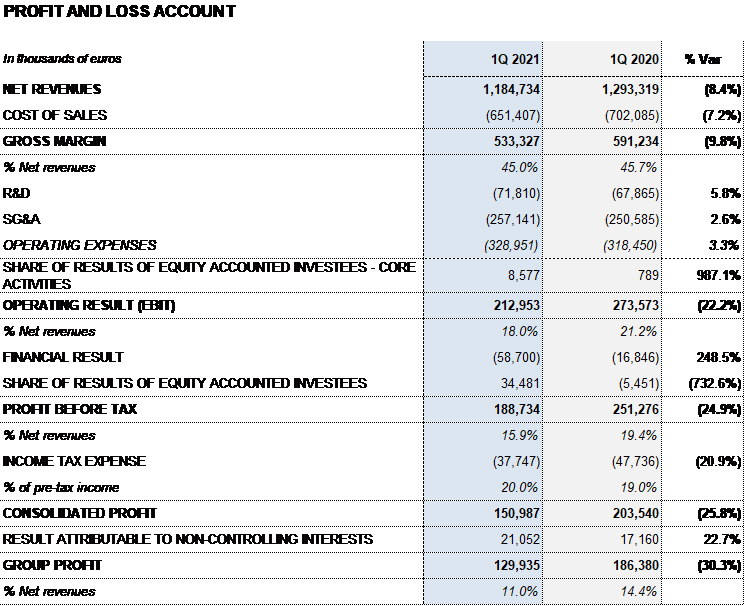

Bioscience Division revenues fell by 5.6% cc (-13.3%) to EUR 901.3 million due to lower plasma collections obtained in the second and third quarters of 2020. This decline was offset by mid-single digit price increases on some of the main plasma proteins and contributions from new products (XEMBIFY®, VISTASEALTM and TAVLESSE®).

The Diagnostic Division accelerated its growth, increasing by 28.0% cc (21.1%) to EUR 203.3 million in revenues. Sales of the TMA (Transcription-Mediated Amplification) molecular test, used to detect the SARS-CoV-2 virus, were noteworthy. Additionally, underlying growth of the NAT donor-screening lines (Procleix® NAT Solutions) and recombinant proteins, used to produce diagnostic immunoassays, were growth drivers for the division.

The Hospital Division grew by 4.3% cc (1.7%) to EUR 31.2 million, showing signs of recovery.

The Bio Supplies Division attained EUR 56.3 million in sales, declining 4.9% cc (-12.2%) due primarily to a drop in third-party plasma sales. Sales of biological products for non-therapeutic use sustained their double-digit operating growth.

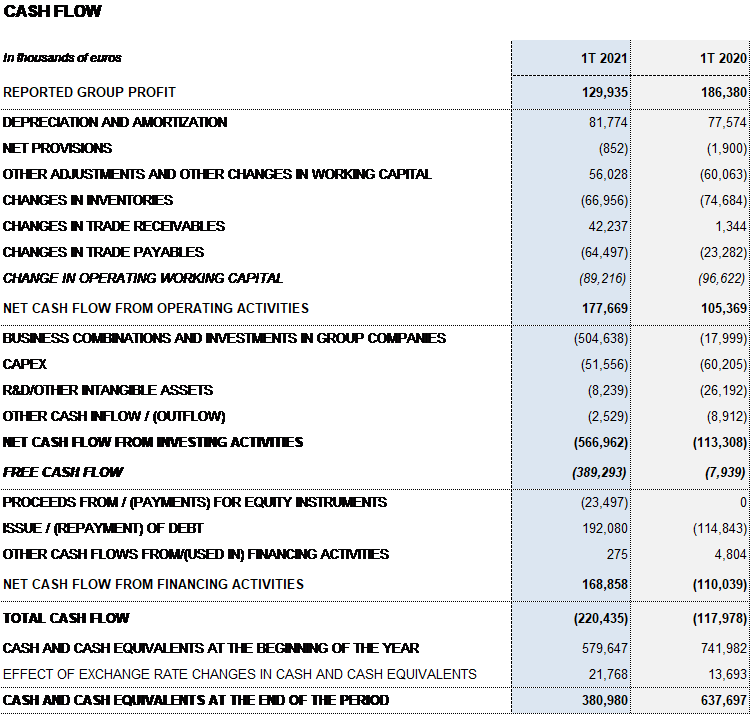

The gross margin remained stable at 45.0% over revenues (45.1% in the fourth quarter of 2020 and 45.7% in Q1 2020). EBITDA totaled EUR 296.8 million and EUR 321.7 million excluding exchange rate variations. EBITDA margin stands at 25.1% (26.0% in the fourth quarter of 2020 and 27.2% in Q1 2020).

Grifols remains firmly committed to its innovation strategy, one of its fundamental corporate pillars. In this regard, its capacity to innovate plays an integral role in its sustainable growth plan.

Grifols’ R+D+i pipeline is keenly focused on exploring diseases management beyond plasma-derived therapies. The company’s total net investment in R+D+i amounts to EUR 70.7 million, representing 6.0% of total revenues. The company’s R+D+i allocations reflect its incremental efforts to support the integration and development of both Alkahest and GigaGen projects.

In the first quarter of 2021, Alkahest presented the findings of the phase II clinical trial of its therapeutic plasma fraction candidate, GRF6021 at the 15th International Conference on Alzheimer’s and Parkinson’s Diseases (AD/PD 2021). The GRF6021 study included subjects with Parkinson’s disease and cognitive impairment, demonstrating the treatment’s positive effects on cognitive endpoints, as well as its safety and tolerability. Alkahest will further study the efficacy of GRF6021 to promote its clinical development.

Through GigaGen, Grifols is also advancing on the discovery and early development of recombinant biotherapeutic solutions, including the world’s first recombinant polyclonal immunoglobulin. These efforts will contribute to strategically enhancing Grifols’ portfolio of cutting-edge therapies.

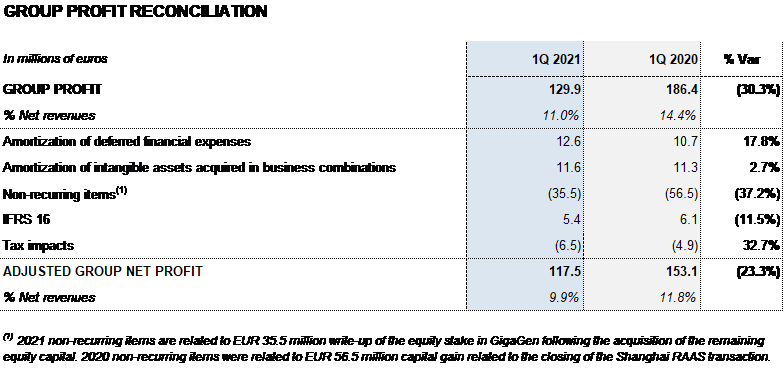

The company’s financial results totaled EUR 58.7 million in the first quarter; EUR 73.3 million reported in the same period last year, excluding the positive accounting impact of EUR 56.5 million from the closing of the Shanghai RAAS transaction registered in that period.

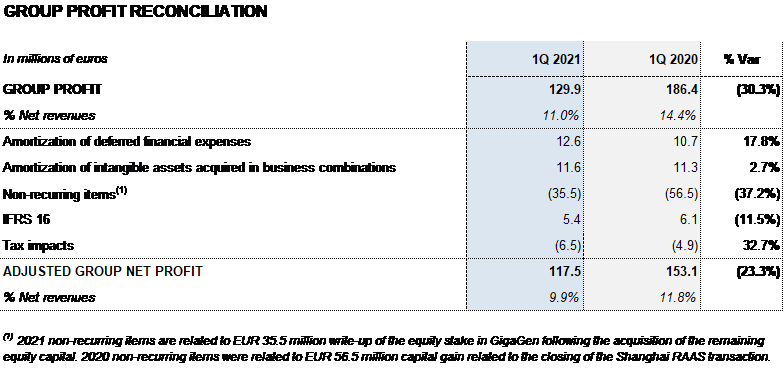

Equity-accounted investments in investees primarily included the updating of equity holdings in GigaGen (EUR 35.5 million) following the recent agreement to acquire its remaining shares.

Net profit in the first quarter totaled EUR 129.9 million.

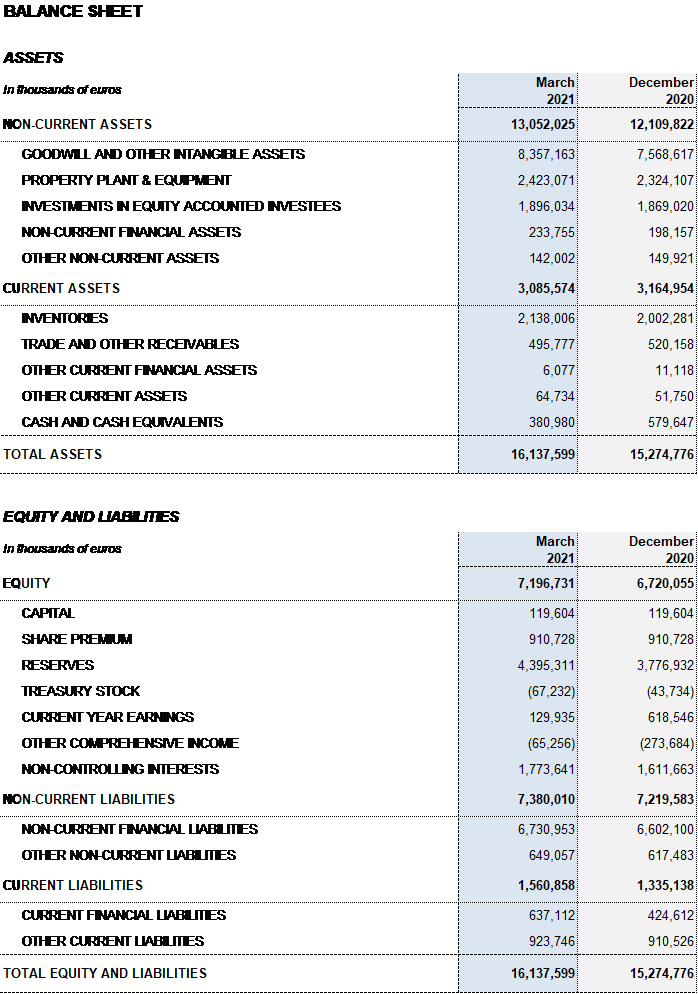

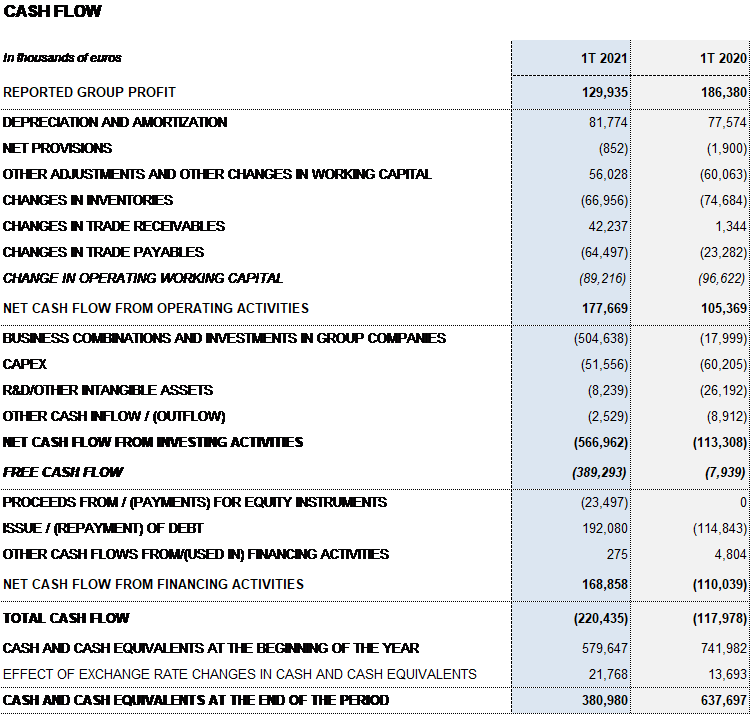

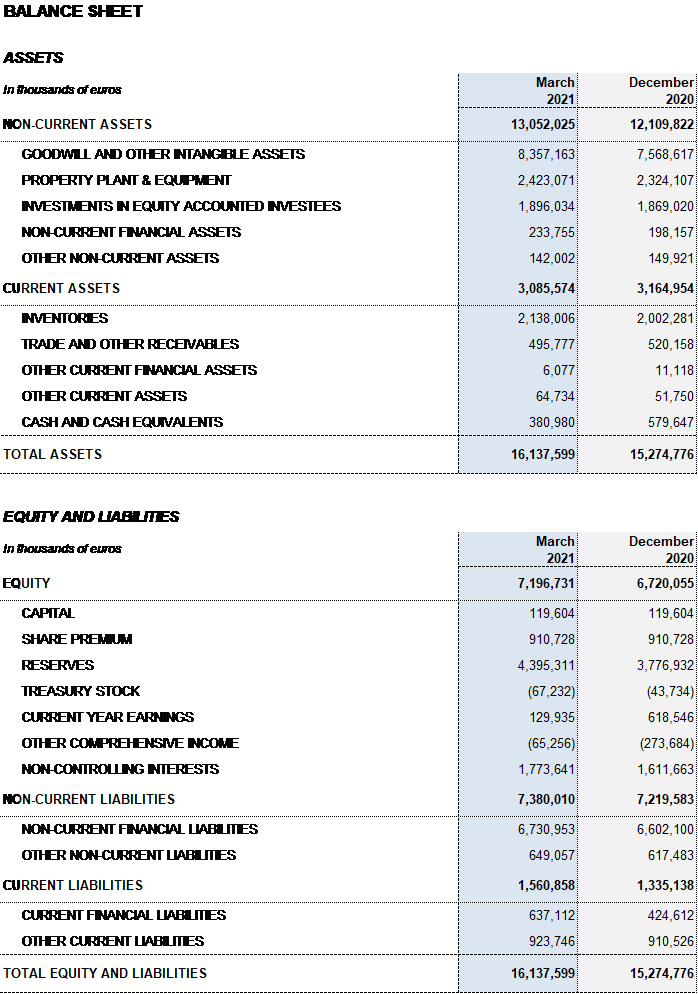

Excluding the impact of IFRS 162, Grifols’ net financial debt amounted to EUR 6,200.5 million and net financial debt over EBITDA ratio stood at 5.1x as a result, mainly, of the EUR 505 million paid for the BPL, Kedrion, Alkahest and GigaGen transactions. Debt management is a key priority for the company, which is making determined efforts to decrease its debt levels.

Grifols has resources and liquidity to fulfill its short- and medium-term obligations. As of March 31, 2021, the company had EUR 381 million in cash positions and approximately EUR 672 million in undrawn lines of credit, placing its liquidity position in excess of EUR 1,000 million.

After the refinancing process completed in November 2019, Grifols does not face significant maturities or debt repayments until 2025.

PERFORMANCE BY DIVISION

Bioscience Division

The Bioscience Division earned EUR 901.3 million in revenues (-5.6% cc and -13.3%). Global demand of the main plasma proteins remains very solid. Lower sales of plasma-derived medicines were partially offset by mid-single digit price increases on some of the main plasma proteins, as well as contributions from new products such as Xembify®, VISTASEALTM and TAVLESSE®.

Demand for immunoglobulins remains solid, led by the U.S., Canada and several markets in the European Union (EU) and Latin America. Albumin sales remained robust driven by growth in China, whose underlying demand holds significant potential for the division.

To better serve the needs of its hospital and pharmacy customers, in April Grifols initiated the U.S. market launch of ALBUTEIN FlexBagTM 25%, designed for added convenience, ease of use and durability.

Alpha-1 antitrypsin continues to fuel the division’s performance. Demand remained steady in the United States and higher in some European markets such as France. Despite the pandemic, the company continued its efforts to increase the rate of diagnosis and broaden its use in other countries. In this regard, worth mentioning is the product approval by Japanese health authorities in the first quarter. Grifols will join forces with a leading Japanese partner-distributor to commercialize this product, whose launch is expected in the coming months.

In terms of new product releases, the company recorded strong sales of XEMBIFY® and its biological sealant, a surgical bleeding-control solution developed and manufactured by Grifols using a combination of two plasma proteins (fibrinogen and thrombin). Also worth noting are solid European sales of TAVLESSE® (fostamatinib), a medication used to treat chronic immune thrombocytopenia (ITP) in adult patients who are refractory to other treatments. TAVLESSE® is marketed under an agreement with Rigel Pharmaceuticals.

Diagnostic Division

The Diagnostic Division attained EUR 203.3 million in revenues, growing by 28.0% cc and 21.1% considering exchange rate variations. Grifols’ NAT systems (Procleix® NAT Solutions), which incorporate Transcription Mediated Amplification (TMA) systems to screen blood and plasma donations, were the driving forces of this underlying growth. An upswing in sales of Grifols’ specialty diagnostic test to detect the SARS-CoV-2 virus, particularly in Spain, sparked higher demand for this business line.

Sales of recombinant proteins, used to manufacture diagnostic immunoassays, positively contributed to the division’s revenues. The blood-typing line, which includes both analyzers (Erytra®, Erytra-Eflexis® and Wadiana®) and reagents (DG-Gel®, red blood cells and antiserums), reported an upward trend.

In parallel, the division obtained important CE authorizations, which will boost the market expansion of certain products in Europe. These include CE marks for Procleix UltrioPlex E assay – a nucleic acid test designed to simultaneously detect the presence of HIV-1, HIV-2, hepatitis B virus (HBV), hepatitis C virus (HCV) and hepatitis E virus (HEV) – and the Procleix Babesia assay, which detects the presence of several clinically relevant species of Babesia parasites.

Also of note was the European market launch of a two-test point-of-care (POC) system for monitoring a patient’s level of infliximab, a medication used to treat a range of chronic inflammatory conditions, as well as to measure antibody levels that could reduce the drug’s efficacy.

Hospital Division

The Hospital Division saw a recovery and an increase in revenues to EUR 31.2 million, growing by 4.3% cc and 1.7% taking exchange rate variations into account.

Especially noteworthy were the first-quarter sales of third-party manufacturing services and the Pharmatech line, comprised by the inclusiv® portfolio of integrated technology, software, and intravenous solutions designed to improve the safety, efficiency and control of hospital pharmacy operations.

Bio Supplies Division

The Bio Supplies Division registered EUR 56.3 million in sales in the first quarter of the year, an operational decline of 4.9% cc and 12.2% compared to the same period last year. This decrease mainly stemmed from a fall in third-party plasma sales.

On the other hand, Bio Supplies Commercial revenues, which consist of sales of biological products for non-therapeutic use, grew significantly in the first three months of 2021, with a 12.1% cc upturn in sales.

CORPORATE TRANSACTIONS

- Acquisition of 32 plasma centers in the United States: access to nearly 1.4 million additional liters of plasma per year

Grifols closed the acquisition of 32 plasma centers in the United States in the first quarter of 2021, further consolidating the leadership of its global network. The company currently operates 351 centers: 296 in the United States and 55 in Europe.

Specifically, in March 2021, Grifols acquired 25 U.S.-based centers from BPL Plasma Inc. for USD 370 million, giving it immediate access to an additional 1 million liters of plasma per year.

In April 2021, the company also invested USD 55 million to acquire seven U.S.-based plasma centers from Kedrion. These centers will provide roughly 240,000 million liters of plasma per year.

Both operations were financed with Grifols’ own resources without issuing debt. These acquisitions reflect the company’s commitment to boost its plasma supply through organic and inorganic growth.

As part of its organic efforts, Grifols anticipates opening 15 to 20 new plasma centers in 2021. Following the strategic alliance signed with the Egyptian government in November 2020, the company also plans on opening several plasma centers in Egypt in 2021. The joint venture recently inaugurated new administrative headquarters in New Cairo.

- Acquisition of the remaining 56% share capital of GigaGen

Within the framework of its integrated innovation strategy, Grifols acquired the remaining 56% share capital of GigaGen Inc. for USD 80 million. GigaGen is a U.S. biotech company dedicated to the discovery and early development of recombinant biotherapeutic medicines. Its research focuses on finding new biological treatments based on antibodies derived from millions of immune system cells obtained from donors.

The company has several projects in its research pipeline, including the development of the world’s first recombinant polyclonal immunoglobulin and a portfolio of immuno-oncological therapies.

GigaGen brings a diversified project portfolio to develop recombinant polyclonal antibodies, including its lead asset GIGA-2050, a recombinant hyperimmune immunoglobulin to treat COVID-19. The phase I clinical trial on GIGA-2050 is expected to launch in the U.S. in the spring of 2021 following its approval by the Food and Drug Administration (FDA) as an Investigational New Drug (IND).

1Operative or constant currency (cc) excludes exchange rate variations reported in the period.

2At March 31, 2020, the impact of IFRS 16 on debt totaled EUR 786.5 million.