February 28, 2018

Grifols revenues exceed EUR 4,300 million and reported profit reaches EUR 663 million

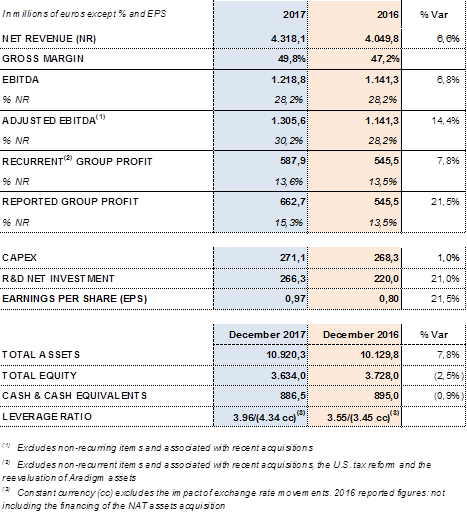

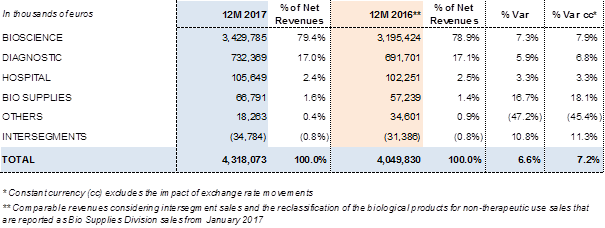

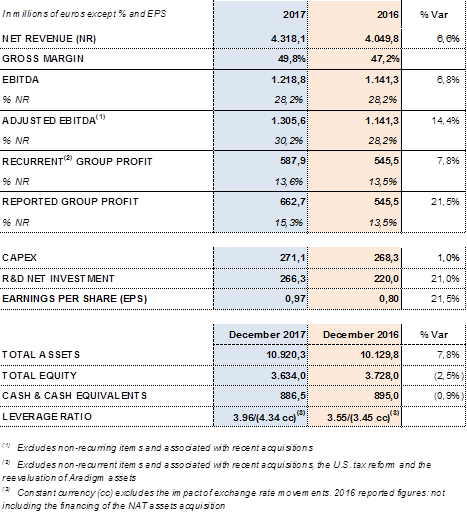

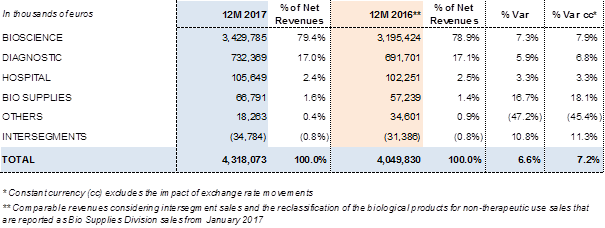

Barcelona (Spain), February 28, 2018.- Grifols (MCE:GRF, MCE:GRF.P, NASDAQ:GRFS) reported revenues of EUR 4,318.1 million for the fiscal year 2017, a 6.6% (7.2% cc) increase over the EUR 4,049.8 million for 2016. The company announced significant progress in all of its divisions and geographic regions.

The Bioscience Division achieved EUR 3,429.8 million4 in revenues in 2017, a 7.3% (7.9% cc) increase and higher-than-average5 annual growth relative to the past five years. The upward trend is evidence of Grifols' solid leadership position. Demand for main plasma proteins has remained very robust throughout 2017. The increase in volume has been the main driver of growth, with a moderately positive price contribution.

The Diagnostic Division earned EUR 732.4 million4 in sales in 2017, a 5.9% (6.8% cc) increase compared to the EUR 691.7 million reported in 2016. Grifols is a global leader in transfusion medicine, which is the division's main engine of growth.

The Hospital Division achieved EUR 105.6 million4 in sales in 2017, growing by 3.3% (3.3% cc). An upswing in sales in Spain and international expansion, led by its Pharmatech portfolio in both the U.S. and Latin America were the division's primary growth levers.

From January 2017, the Bio Supplies Division includes revenues previously reported in Raw Materials. The division achieved sales of EUR 66.8 million4 in 2017, compared to EUR 57.2 million in 2016 in comparative terms.

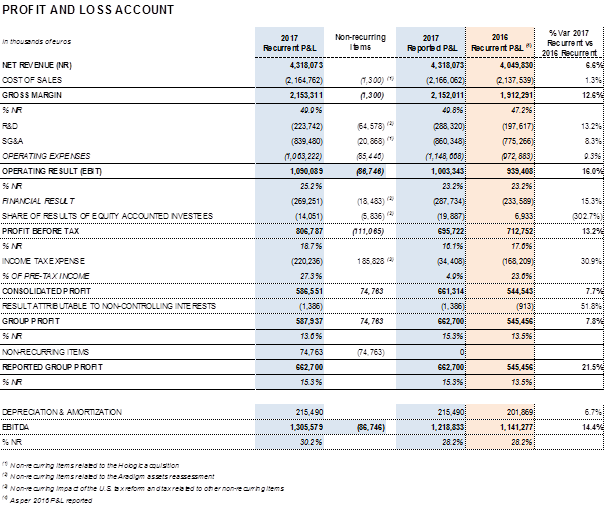

Adjusted EBITDA3 reached EUR 1,305.6 million, which represents 30.2% of revenues and a 14.4% upturn compared to the previous year. In 2016, EBITDA margin was 28.2%.

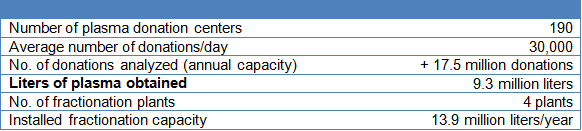

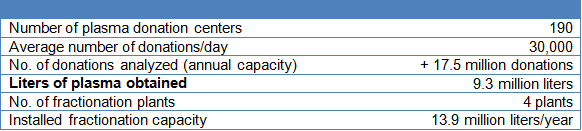

This significant increase in the EBITDA margin by 200 bps was motivated mainly by the impact of the share in the NAT donor-screening business acquired in January 2017. It also reflects the higher costs of plasma derived from the investment plan to open new plasma collection centers. Grifols is the global leader in plasma donation centers, with 190 centers as of December 31, 2017, 19 more than in 2016 and 40 more compared to the beginning of 2015 when the plan to expand plasma collection capacity began.

Net R+D+i investment rose in 2017. In comparative2 terms to 2016, it increased by 21.0% to EUR 266.3 million, 6.2% of revenues. Total net R+D+i resources reached EUR 310.8 million taking into account the acquisition of equity stakes in research companies.

The refinancing process allowed the company to optimize its financial structure and the financial costs arising from the higher levels of debt assumed after acquiring the share of the NAT technology donor-screening business, contributing to maximize profits. Comparable2 financial results were EUR 269.3 million, up from the EUR 233.6 million reported in the same period last year.

The normalized2 effective tax rate was 27.3%.

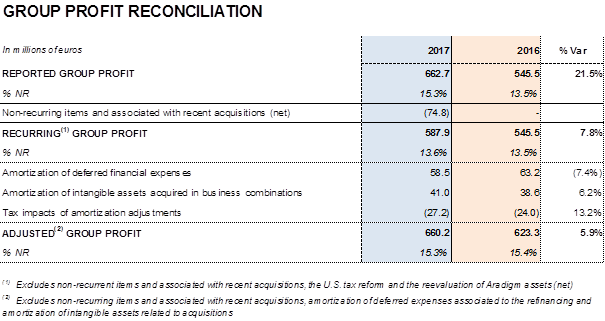

In comparative terms, recurring2 profits increased by 7.8% compared to 2016 to EUR 587.9 million and represented 13.6% of the group's revenues.

The U.S. tax reform approved on December 22, 2017 prompted Grifols to recognize non-recurring income that significantly affected its tax expense reported for 2017. The reduction from 35% to 21% on the U.S. Federal Corporate Income Tax Rate (effective starting January 1, 2018) has required a revaluation of Grifols U.S. deferred tax assets and liabilities. The net positive effect on the group's 2017 results is EUR 171.6 million.

In accordance with the conservatism principle, the company also recognized a total impact of EUR 80.0 million derived from the reevaluation of assets associated with its equity stake in the U.S. firm Aradigm. Aradigm's main asset was obtaining the FDA approval to market its LinhaliqTM. Non-approval has led Grifols to recognize the total impairment of the assets associated with Aradigm (equity stake, intangible assets and financial assets).

In addition, in alignment with the impact recognized in previous quarters, Grifols incurred EUR 23.1 million non-recurring gross costs resulting from the acquisition and subsequent integration of its share in the NAT technology donor-screening business.

Taking into account the aforementioned factors, Grifols' reported profit was EUR 662.7 million, an increase of 21.5% compared to 2016. Earnings per share (EPS) stood at EUR 0.97 per share with an increase of 21.5%.

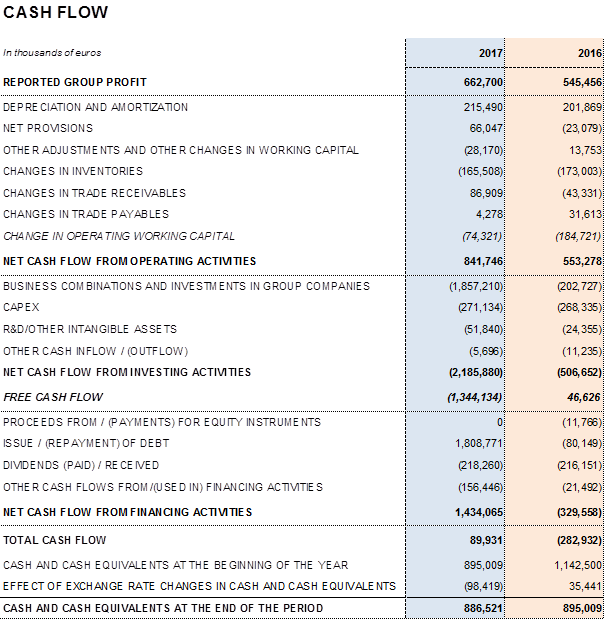

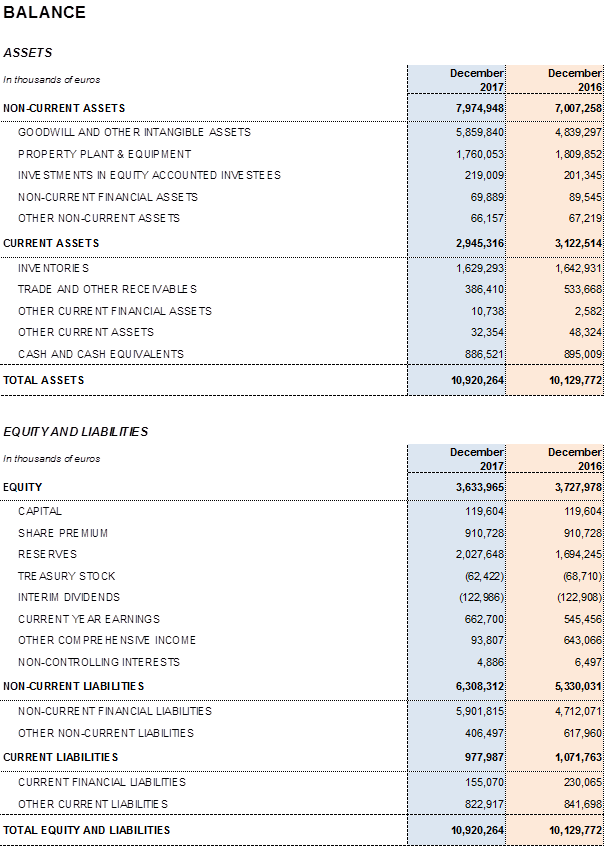

Grifols' net financial debt was EUR 5,170.4 million as of December 2017, including EUR 886.5 million in cash. The company has EUR 400 million available in undrawn credit lines, which increases its liquidity position to EUR 1,250 million.

The group's net financial debt over EBITDA ratio was 3.96x as of December 2017. This figure increases to 4.34x not taking into account the exchange rate impact.

Leverage management remains a priority for the company. In order to meet this objective, Grifols maintains high, sustainable levels of operational activities and strong net operating cash-flow, which increases by 43.3% to EUR 1,039.3 million compared to EUR 725.1 million in 2016.

The company's solid performance and positive cash-flow evolution have reinforced the balance sheet in 2017. Total consolidated assets as of December 2017 rose to EUR 10,920.3 million, compared to EUR 10,129.8 million reported in 2016. This positive variance is due mainly to the acquisition of the share in the NAT donor-screening unit; capital investments (CAPEX); the equity stakes acquired in Access Biologicals and GigaGen; and the stake's increase in Kiro Grifols that reached 90% of its share capital.

Optimizing the company's working-capital management has continued to play a key role in improving its solid financial position. Stock turnover stood at 275 days in 2017, compared to 281 days in December 2016, the result of improved inventory management and a strong sales environment for plasma proteins. The average collection period improved significantly, standing at 24 days (37 days in 2016) following the rollout of optimization measures. Meanwhile, the average payment period decreased from 61 days in 2016 to 53 in 2017.

Higher profits, improvements in the average collection period and inventory management, and enhanced financial management have together enabled Grifols to successfully face its planned investments. In 2017, the company increased the resources earmarked for investments to more than EUR 580 million: EUR 271.1 in capital expenditures and EUR 310.8 million in direct and indirect R+D+i investments, including the acquisition of equity stakes in research companies.

Total equity as of December 31, 2017 was EUR 3,634.0 million. The share capital includes 426,129,798 common shares (Class A), with a nominal value of EUR 0.25 per share, and 261,425,110 non-voting shares (Class B), with a nominal value of EUR 0.05 per share.

Two dividends were paid in 2017 for a total of EUR 218.3 million. In particular, in the second quarter of 2017, a second dividend, charged to 2016 earnings (gross amount of EUR 0.1356 per share), was paid out as a final dividend, while in December 2017 an interim dividend was paid on account of 2017 earnings (gross amount of EUR 0.18 per share). Grifols remains committed to dividend payments as a way to remunerate its shareholders.

Key financial metrics 2017:

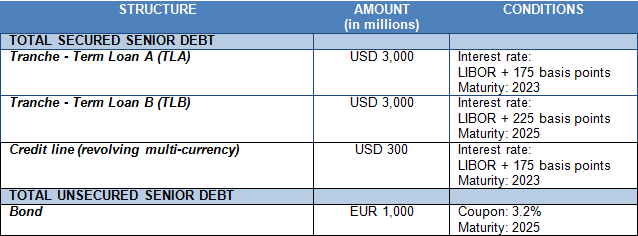

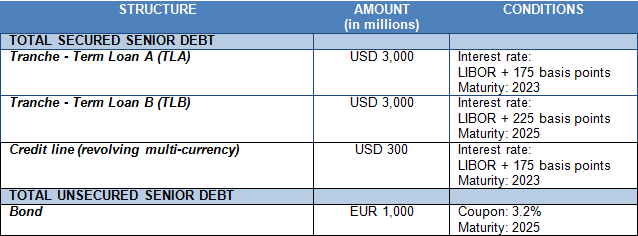

The debt refinancing process notably improves all financial conditions, optimizing and strengthening Grifols financial structure

Grifols refinanced its debt in 2017 for a total of approximately USD 7,300 million. This includes tranches A and B, an undrawn credit line, the additional USD 1,700 million initial term loan to partially finance the acquisition of the share of the NAT donor-screening business, and the corporate bond.

The successful completion of the refinancing process has enhanced the company's financial structure, improved its average cost of debt and lengthened its maturity profile.

Below is an outline of Grifols' financial structure and conditions after finalizing the refinancing process:

Grifols signed a new EUR 85 million loan with the European Investment Bank (EIB) to support R+D+i investments. The EIB's favorable financial conditions include a fixed interest rate, maturity in 2027 and a two-year grace period.

PERFORMANCE BY DIVISION:

LEADERSHIP OF THE MAIN BUSINESS UNITS

Bioscience Division: Growth above the average of the last 5 years5

Demand for main plasma proteins has remained very robust throughout 2017. Grifols main products continue to lead the global sales of plasma proteins.

The Bioscience Division achieved EUR 3,429.8 million4 in revenues in 2017, a 7.3% (7.9% cc) increase, above the average of the past five years. The increase in volume has been the main driver of growth, with a moderately positive price contribution. The geographic mix has had a negative impact on revenues due to higher sales volumes of blood clotting factors in emerging markets.

Immunoglobulin volume sales continued to be robust throughout the year, especially in the United States and main European markets, as well as growing contribution of specific countries such as Australia and Turkey, evidencing the global expansion efforts.

Global demand for this plasma protein, used to treat neurological conditions such as chronic inflammatory demyelinating polyneuropathy (CIDP), is growing in core geographies like the United States, where Grifols is the market leader. The company also continues to promote diagnostic programs to identify patients with immunodeficiencies that could benefit from immunoglobulin therapies.

Grifols is the market leader in alpha-1 antitrypsin, whose sales continue to fuel the division's growth. Higher rates of diagnosis of alpha-1 antitrypsin deficiency, particularly in the United States, Canada and several European countries, have driven higher sales of this protein. Demand also grew in certain Latin American countries, although more incipiently. Grifols' sales strategy focuses on boosting sales in these core markets while progressively expanding its global impact.

Sales of albumin continue to drive the division's growth, especially in China, the European Union (EU) and Latin America. Brazil, Indonesia and several Middle Eastern countries also saw a pick-up in sales thanks to the division's solid commercial efforts to reinforce its presence.

Sales volume of factor VIII continues to grow in a competitive price environment subject to public tenders in certain emerging countries.

Specialty proteins developed by Grifols also evolved positively in 2017. Of note are hyperimmune immunoglobulin sales and the agreement signed with Spain's Ministry of Health to supply tetanus and diphtheria vaccines from 2017. Grifols markets this vaccine through an accord with MassBiologics of the University of Massachusetts Medical School in the U.S.

Grifols' continued working to create growth opportunities and strengthen its business projection in 2017. Among the initiatives to improve the diagnosis of diseases related to plasma proteins, Grifols developed a latest-generation genetic test capable of simultaneously analyzing the most prevalent mutations associated with alpha-1 antitrypsin deficiency. The test has FDA approval and carries the CE marking for its commercialization in several European countries. Its development through Progenika Biopharma, a group company headquartered in Bilbao (Spain), spotlights the complementarity strategy among Grifols divisions.

In 2017, Grifols reaped the benefits of years of continuous research and development by receiving two important regulatory approvals. The FDA approved the liquid formulation of alpha-1 antitrypsin (Prolastin®-C Liquid), the first liquid replacement therapy to treat alpha-1 antitrypsin deficiency manufactured in the United States. The Division's new biological sealant VeraSeal® (fibrinogen and human thrombin) also received approvals from the FDA and EMA, enhancing the groups' portfolio of plasma-derived products.

In 2017, the volume of plasma obtained was roughly 9.3 million liters. The key activity indicators in 2017 are as follows:

Diagnostic Division: growth driven by the NAT business

The group continues to consolidate its position in the in-vitro diagnostics sector, continuing as global reference in blood and plasma testing systems.

The Diagnostic Division earned EUR 732.4 million4 in sales in 2017, a 5.9% (6.8% cc) increase compared to the EUR 691.7 million reported in 2016. The EBITDA margin of the division reached 40.4% in 2017 from 18.7% in 2016, in line with the forecast after acquiring the share of the NAT technology donor-screening business.

Sales of NAT donor-screening systems (Procleix® NAT Solutions), used to screen blood and plasma donations, were the Division's leading source of revenues. Additional revenue streams included sales of the Zika virus blood screening tests in the United States and greater market penetration in the Asia Pacific region, particularly in Japan, China, Saudi Arabia, Israel and Singapore.

Among the 2017 milestones that will encourage growth of this business line are the Zika virus blood test, which obtained the CE marking, and a new test, approved as an IND by the FDA, to detect babesiosis, a tick borne disease.

The Division also significantly increased its sales of antigens used to manufacture diagnostic immunoassays and marketed as part of the joint business agreement with Ortho Clinical Diagnostics. The group also extended its agreement with OraSure Technologies, a leader in diagnostic tests for infectious diseases, for five years.

The blood typing and immunohematology line have increased the division's revenues. Sales of blood typing reagents were exceptionally strong in China as a result of the commercial efforts implemented in this key region, as well as in the U.S., a market where Grifols has substantial growth potential. This upward trend was also seen in certain European countries, including Hungary, Italy, Switzerland, Spain and France. Geographic expansion is one of the main drivers of growth that will be complemented with new products. Among those new products, the Erytra Eflexis® analyzer, to perform pre-transfusion compatibility tests using DG Gel® technology that has obtained the CE marking. The instrument was officially launched during Q2 2017 in countries accepting CE mark products and it has been extremely well received by customers.

Specialty diagnostics revenues remained stable. The company continues to concentrate its efforts on developing tests for personalized medicine through Progenika Biopharma. In 2017, a new diagnostic test based on human DNA (ID RhD XT) obtained the CE mark. The test detects the D factor, which is especially important in pregnant women. The group also launched PromonitorQuick®, a point-of-care diagnostic kit that detects anti-infliximab antibodies that appear as a response against biological drugs.

In line with the corporate strategy to expand into new markets, Grifols strengthened its hemostasis business with a global distribution agreement with Beckman Coulter, a leading supplier of diagnostic solutions. The market launch for these Grifols coagulation products in Europe is expected from 2018.

The division significantly increased its production output in 2017 and maintained high levels of efficiencies in its production facilities.

The Hospital Division strengthens its internationalization

The Hospital Division achieved EUR 105.6 million4 in sales in 2017, growing by 3.3% (3.3% cc) compared to EUR 102.3 million reported in 2016. An upswing in sales in Spain and global expansion efforts in the U.S. and Latin America were the division's main engines of growth.

The Hospital Division maintains its leadership position in Spain as a supplier of IV solutions and leads the introduction of hospital logistics' automation systems in Spain and Latin America.

The Pharmatech line, which comprises solutions for hospital pharmacies, continued to grow, while working to increase its presence in the U.S. market. In January 2018, the group announced the acquisition of a 51% stake in the U.S. firm MedKeeper, a technology firm that develops and markets mobile and web-based applications for hospital pharmacies.

IV Therapy and Nutrition lines showed a positive trend. Also notable was the positive tendency of new third-party manufacturing contracts in the U.S.

The division's global expansion was reinforced by the FDA approval of Grifols' 500-ml physiological saline solution in polypropylene bags (0.9% sodium chloride), manufactured in its Murcia (Spain) plant, allowing the division to market this product in the U.S. market. The FDA approval also ensures the group's self-sufficiency since it will also be used in the Grifols U.S. plasma collection centers to restore the circulatory volume in donors.

The FDA approval opens up the possibility of new future authorizations for other products manufactured in the Murcia and Barcelona facilities. Moreover, it promotes the internationalization of division and confirms its strategy of fostering the complementary of products and services among its divisions.

Bio Supplies Division: a new division to promote sales of biological products for non-therapeutic use

The Division records sales of biological products for non-therapeutic use and other biological products, as well as those related to the fractionation and purification agreements signed with Kedrion. The division achieved sales of EUR 66.8 million4 in 2017, compared to EUR 57.2 million in 2016 in comparative terms.

Revenues by division:

REVENUES BY REGION: GROWTH ACROSS ALL REGIONS

Grifols generated more than 94% of its sales outside Spain. International expansion remains a strategic priority to stimulate the company's organic growth, although each division focuses on specific markets to optimize sales strategies.

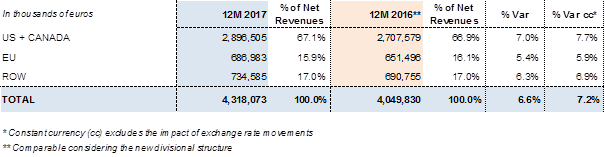

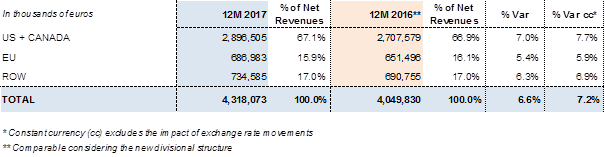

The United States has become a core market for the three main divisions. Revenues in the U.S. and Canada grew by 7.0% (7.7% cc) in 2017 to EUR 2,896.5 million6. Meanwhile, sales in the European Union rose by 5.4% (5.9% cc) to EUR 687 million6, headed by growth in countries like Spain, Germany, the United Kingdom and France. Sales in Rest of the World (ROW) also expanded, registering a 6.3% (6.9% cc) increase to EUR 734.6 million6. Especially noteworthy were the positive sales trends in China and Australia, which led the Asia Pacific region; growth in Latin America, especially Brazil; and the gradual market penetration in Turkey and the Middle East, including Saudi Arabia and Israel.

Revenues by region:

FOURTH QUARTER 2017

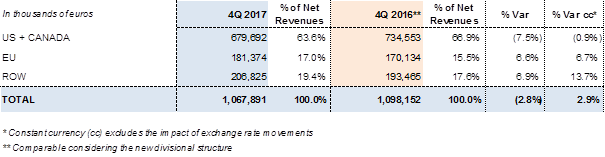

In the fourth quarter of 2017, Grifols obtained EUR 1,067.9 million in revenues, a 2.9% cc increase.

The Bioscience Division reported more than EUR 830 million4 in revenues in the fourth quarter. This growth has been negatively impacted (-4,2%/+1,5% cc) compared to revenues from the fourth quarter of 2016, when the division earned EUR 867.6 million, the second-highest quarterly revenues in its history.

Revenues from the Diagnostic Division increased by 2.6% (8.5% cc)4 in the last quarter of the year, while Hospital Division sales grew by 5.6% (6.8% cc)4 driven by a sales upturn of its Pharmatech line in the United States and third-party manufacturing contracts.

Revenues by division for the fourth quarter of 2017:

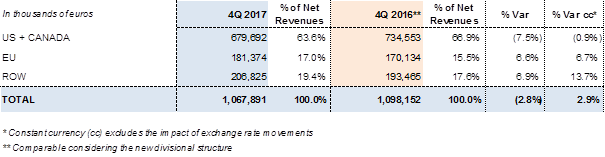

Sales growth in the U.S. and Canada remains solid, although impacted in comparative terms (-7.5%/-0.9% cc)6 in the fourth quarter 2016. Sales in the ROW (rest of the world) continue to increase, growing by 6.9% (13.7% cc) to more than EUR 206 million6. Sales in the European Union recovered their upward trend, growing over 6.6% (6.7% cc) to more than EUR 180 million6 in revenues compared to the same period last year.

Revenues by region for the fourth quarter of 2017:

INVESTMENT ACTIVITIES: R+D+i, CAPEX AND ACQUISITIONS

A broad range of R+D+i projects

The net R+D+i investments increased substantially in 2017. In comparative terms, they rose by 21.0% relative to 2016 to EUR 266.3 million, including in-house and external investments, and represented 6.2% of total revenues. Total resources allocated to R+D+i reached EUR 310.7 million, including the aforementioned investments and those made to acquire stakes in research companies.

As of 2017, Grifols is a majority shareholder in Araclon Biotech (73.22% equity stake); Progenika Biopharma (90.23% equity stake); Kiro Grifols (90% equity stake); and VCN Biosciences (81.34% equity stake). It also holds minority positions in Alkahest (47.58% equity stake); Aradigm Corp. (35.13% equity stake); AlbaJuna Therapeutics (30% equity stake); Singulex (19.33% equity stake); and GigaGen (43.96% equity stake).

PwC's "2016 Global Innovation 1000" listing mentions Grifols among the 1,000 global companies that most invest in R+D+i as a result of its holistic research strategy and long-term vision.

Among the main projects in 2017, highlight:

Alzheimer's research: Grifols has supported Alzheimer's research since 2004 when it began its first research studies. The research projects currently underway address three main lines: plasma proteins treatment, prevention, and early diagnosis. The company has expanded its research in this field to include new possible therapies for other aging-related conditions.

To date, Grifols has focused its Alzheimer's research through in-house projects such as AMBAR (Alzheimer Management by Albumin Replacement) and through investee companies like Araclon Biotech and Alkahest.

AMBAR aspires to stabilize the progress of Alzheimer's disease by extracting plasma from the patient using the plasmapheresis technique and replacing it with Grifols albumin solution (Albutein®), a process known as plasma exchange.

In the Bioscience Division efforts focused on developing a 20% concentration subcutaneous immunoglobulin, as well as in using Gamunex® to treat (maintenance) myasthenia gravis (MG), a chronic autoimmune neuromuscular disease that leads to varying degrees of skeletal muscle weakness.

There has been further progress on the PRECIOSA study, centered on the use of albumin to treat cirrhosis. The APACHE study also continues to make inroads to explore albumin therapies for patients diagnosed with acute-on-chronic liver failure.

In the Diagnostic Division, R+D projects aim to expand the portfolio of integral solutions for blood and plasma donation centers and foster innovation in transfusion medicine. In specialty diagnostics, clinical trials have initiated in the United States to boost the portfolio of blood clotting tests and devices. The division also continues its efforts to broaden its biologic drugs monitoring business line. Grifols expects FDA approval for several products of its hemostasis line in 2018.

The Hospital Division's R+D projects focus on developing in-house and third-party initiatives for the Pharmatech line, comprised by i.v. Tools and hospital logistics solutions. The division's R+D objectives promote its global expansion while addressing the specific needs of the Bioscience Division in alignment with Grifols strategy to cultivate synergies among its business lines through the development of complementary products and services.

Capital investments (CAPEX)

Grifols invested EUR 271.1 million in 2017 to expand and enhance the production capacities of all three of its main divisions. This figure is included in the 2016-2020 Capital Investment Plan, with EUR 1,200 million allocated, to ensure the group's long-term sustainable growth.

Grifols continued its capital investment plans to expand, renovate, relocate and open new plasma donation centers. The company aspires to continue consolidating its network of centers, which comprised 190 plasma donation centers as of December 2017 and meet its planned target.

In Bioscience Division, investments to increase protein fractionation and purification capacity have continued as planned. In 2017 the construction of a new plant in the Barcelona dedicated to the purification, dosage and sterile filling of alpha-1 antitrypsin was completed. The company invested EUR 45.4 million to build the plant, which is currently in the validation process. Once operative, it will boast a capacity to produce 4.3 million liters of plasma equivalent of this protein in two formulations, lyophilized (Prolastin-C®) and liquid (Prolastin-C® Liquid).

The construction of a new purification, dosage and sterile filling plant of albumin in Dublin, Ireland, with a planned investment of more than USD 80 million, continues according to plan, and the North Carolina (United States) site has initiated the construction of a new plasma fractionation plant with a capacity of 6 million liters of plasma. Grifols plans to invest USD 90 million to build this fractionation plant. The new installation is expected to be operative at the beginning of 2022.

In the Diagnostic Division, the validation process and launch of the new antigens plant in Emeryville, (California, U.S.) continues as planned. The first validation batches of antigens have been carried out. The project totals USD 90 million. The company intends to submit the documentation for the plant and other licensed products for FDA approval in 2018. The production plant in Brazil, dedicated to the manufacture of collection, separation, storage and transfusion bags for blood components and it is in the approval process.

The Hospital Division's capital investments focused on increasing the production capacity and efficiency of its i.v. line to meet the anticipated growing demand in new markets. Resources have been allocated to the Barcelona complex to increase the plant's production capacity, including both the manufacture of its own products and third-party products. In the Murcia industrial site, the last production line of intravenous bags came into operation. The expansion required a EUR 5 million total investment.

On a corporate level, Grifols inaugurated a new 10,000 square-meter office building in Clayton (North Carolina, U.S.) with capacity for 500 employees. The company also relocated its head offices in Brazil to a new 1,300 square-meter building that includes offices and a distribution warehouse.

ACQUISITIONS

-

Acquisition of the share in the NAT technology donor-screening unit

On January 2017, Grifols completed the transaction of Hologic's share in the NAT donor-screening unit for a final purchase price of USD 1,865 million. The agreement included activities related to the research, development and production of reagents and instruments based on NAT technology. A production plant in San Diego (California, U.S.) in addition to development rights, licenses to patents and access to product manufacturers, are among the assets acquired.

-

Acquisition of a 49% stake in Access Biologicals

Grifols invested USD 51 million for a 49% stake in Access Biologicals, a U.S. firm headquartered in San Diego (California U.S.). Founded in 2006, Access Biologicals is an industry leader in the manufacture of biological products including specific sera and plasma reagents that are used by biotechnology and biopharmaceutical companies for in-vitro diagnosis, cell culture, and research and development in the diagnostic field.

The agreement includes an option to acquire the remaining 51% of the share capital within a five-year timeframe. In addition, as part of the acquisition, Grifols signed a supply contract with Access Biologicals to sell Grifols biological products for non-therapeutic use.

-

Acquisition of six Kedrion plasma centers

In February 2017, Grifols' acquisition of six plasma centers from Kedplasma for USD 47 million became effective.

-

Acquisition of a 44% stake in GigaGen

Grifols acquired a 43.96% equity stake in GigaGen Inc. for USD 35 million. GigaGen is a biopharmaceutical company based in San Francisco (California, U.S.) specialized in the development of pre-clinical biotherapeutics.

In addition, Grifols and GigaGen have entered into a research and collaboration agreement whereby, in exchange of a collaboration fee of USD 15 million, GigaGen will carry out research activities to develop recombinant polyclonal immunoglobulin therapies derived from human B cells for the treatment of human diseases.

-

Increase in the stake of Kiro Grifols to 90%

Grifols increased its capital stake in Kiro Grifols to 90%, acquiring 40% for EUR 12.8 million.

Kiro Grifols is a technology company that develops automation systems for the hospital sector, in particular, instruments and devices to automate and monitor key steps in hospital processes, especially in the hospital pharmacy.

-

Acquisition of a 51% stake in the U.S. technology firm MedKeeper

Following the close of the fiscal year, Grifols reinforced its Hospital Division by acquiring a 51% stake in the technology firm MedKeeper. The price paid totals USD 98 million. MedKeeper is a technology firm that develops and markets mobile and web-based technology solutions for the management of hospital pharmacies. The acquisition complements Grifols' Pharmatech line and enhances its presence in the U.S. market

CORPORATE RESPONSIBILITY

Human Resources: more employees and more training

The Grifols workforce increased to 18,300 employees in 2017, a 23% increase compared to the previous year. The number of employees in Spain continued its upward trend, growing by 6.3% compared to 2016, to 3,649 positions at the close of 2017. Also of note is the 29% growth in the United States, where the company has incorporated more than 3,100 employees. Meanwhile, the Grifols workforce in the ROW (rest of the world) grew by 10%.

Continuous training and development form the cornerstones of Grifols' human resources efforts. The company promotes talent management and employee retention through an equal pay policy, promotion, professional development and the implementation of specific technical-scientific training, as well as the development of business and managerial competencies. In 2017, professional development initiatives exceeded 590,000 hours and an average of more than 36 training hours per employee.

As a result of its firm commitment to its talent pool, Grifols was distinguished among the best 500 global companies to work for by Forbes magazine. The mention of Grifols on this worldwide ranking confirms its status as an exceptional global employer and a staunch advocate of workplace diversity.

Environmental management

Environmental management is one of the pillars of the group's corporate responsibility. It is supported by the tenets of the Environmental Policy, approved by the company.

Investments in environmental assets in 2017, including those related to waste, water cycle and atmospheric emissions and energy, amounted to EUR 8.5 million, and the expenses attributed to environmental management totaled EUR 13.6 million.

Fiscal year 2017 was the first year of the 2017-2019 Environmental Program. The main objectives outlined include reducing the annual consumption of electricity, natural gas and water in the group's production centers, as well as improving waste management and increasing its recovery.

Every year, Grifols takes part in the Carbon Disclosure Project (CDP), a program that evaluates companies' organizational strategy and performance with regard to climate change. The score obtained this year was the same "B management" mark as in the previous year.

ABOUT THE FINANCIAL INFORMATION: The financial information included in the "2017 Grifols Performance Summary" corresponding to year 2017 enclosed in this document is part of the company's financial information.

ABOUT THE NON-FINANCIAL INFORMATION: Grifols has carried out a materiality analysis as a means to identify the most relevant economic, environmental and social impacts of the group's value chain and its influence on stakeholders' decisions. This information is updated annually and reported in the Grifols' Corporate Responsibility Report.

All documents are available on Grifols corporate website at www.grifols.com

2017 Grifols Performance Summary

1Constant currency (cc); excludes exchange rate variations.

2Excludes non-recurrent items and associated with recent acquisitions, the U.S. tax reform and the reevaluation of Aradigm assets.

3Excludes non-recurrent items and associated with recent acquisitions.

4Comparable net revenues considering intersegment sales and the reclassification of biological products for non-therapeutic use sales that are reported as Bio Supplies Division sales from January 2017.

5Average of the Bioscience Division constant currency growth rates from 2012 is 6.3%.

6Comparable considering the new divisional structure.