July 30, 2020

Grifols revenues grow 10.5% to EUR 2,677 million driven by the Bioscience Division

- Grifols has kept its plasma centers, supply of products and services, and manufacturing facilities operational while reinforcing its social commitment by mobilizing human resources, R+D initiatives and capital investments as part of its continued support in the fight against COVID-19

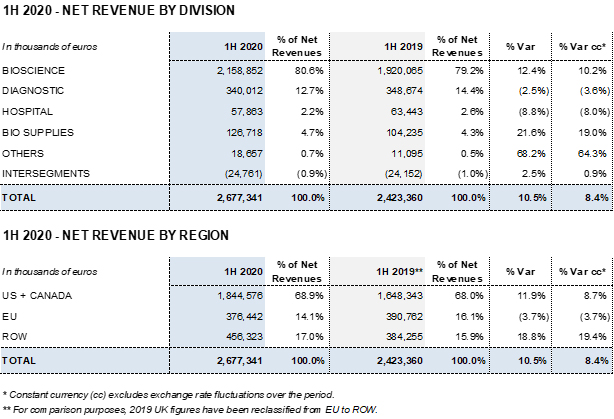

- Revenues increase 10.5% (8.4% cc1) to EUR 2,677 million led by the Bioscience Division’s solid growth, which increased by 12.4% (10.2% cc) to EUR 2,159 million

- The Diagnostic Division’s revenues declined by 2.5% (-3.6% cc) to EUR 340 million and the Hospital Division’s revenues by 8.8% (-8.0% cc) to EUR 58 million. Both divisions were impacted by COVID-19

- The Bio Supplies Division recorded EUR 127 million in sales, a 21.6%

(19.0% cc) increase

- As of June 30, 2020, the profit and loss statement includes a negative net impact of EUR 185 million mainly due to COVID-19

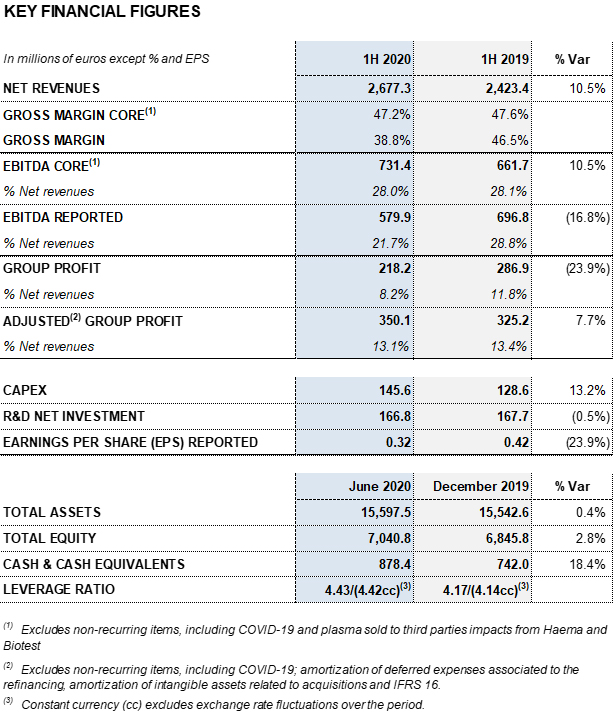

- EBITDA core2 stands at 28.0% on revenues

- Grifols’ liquidity position totals EUR 1,900 million backed by the upsize of the revolving credit facility

- Grifols leads in the production of an anti-SARS-CoV-2 immunoglobulin, the first potential specific drug developed to combat COVID-19

- In alignment with its long-term and sustainable growth plan, Grifols agrees to the strategic acquisition of a plasma fractionation facility in Canada, along with 11 plasma centers in the U.S. for US$ 460 million

Barcelona, July 30, 2020.- Grifols (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS) continues to advance amid the current global crisis caused by COVID-19. In the first half of 2020, revenues grew 10.5% (8.4% cc) to EUR 2,677.3 million, driven by the solid performance of the Bioscience Division, which increased by 12.4% (10.2% cc) to EUR 2,158.9 million.

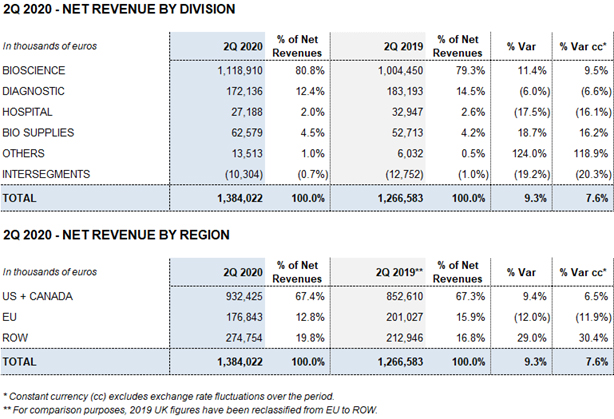

In the second quarter, the Bioscience Division’s revenues grew by 11.4% (9.5% cc) to EUR 1,118.9 million, thanks to robust immunoglobulin sales in the U.S., including hyperimmune immunoglobulins; solid albumin sales, especially in China; and new product launches.

The Diagnostic Division’s revenues totaled EUR 340.0 million in the first six months of 2020, falling 2.5% (-3.6% cc) compared to the EUR 348.7 million reported in the same period last year. The main factor behind this decline is a downturn in the sales of solutions used to screen blood and plasma donations as a consequence of COVID-19.

In this same regard, the Hospital Division’s revenues fell by 8.8% (-8.0% cc) to EUR 57.9 million and were negatively impacted by a slowdown in hospital investments and treatments.

The Bio Supplies Division recorded EUR 126.7 million in sales, denoting a 21.6% (19.0% cc) increase from the previous year thanks to the growth in sales of biological products for non-therapeutic use, which continues to grow significantly.

As anticipated in June and based on the information available to date, Grifols recognized an estimated impact of EUR 205 million in the 2020 fiscal year to adjust its inventory value mainly due to COVID-19. This impact stems primarily from lower-than-expected capacity utilization and has been recognized in the gross margin line in the second-quarter profit and loss account.

Although Grifols has taken every measure necessary to protect the safety of donors and personnel in all of its facilities, the efforts to boost plasma centers during the COVID-19 outbreak, and the fact that plasma industry has been called “essential infrastructure”, collections have been impacted by stay-at-home orders and social-distancing measures, amongst others. The situation is still uncertain and difficult to predict in the long run but, based on the information today, it is estimated that Grifols plasma collection expect to have a net impact of 10% in terms of plasma availability in 2020 compared to 2019.

Grifols will also continue to enhance plasma sourcing and global product distribution to make sure that patients who need its plasma-derived medicines receive them.

Over the last years, Grifols has heavily been investing in plasma capabilities and has added plasma centers, up to 300 today, in the US and Germany. In Germany, Grifols’ plasma centers are witnessing a fast recovery and plasma collected to date exceed plasma volumes for the same period of 2019.

Grifols will continue to monitor any potential impacts on operations and will take all necessary actions to mitigate any potential effect in its supply chain.

Grifols has also implemented an operating expenses containment plan, which is estimated to generate a positive impact of EUR 100 million in the 2020 profit and loss account. In this regard, the company recorded a EUR 20 million reduction in operating expenses in the second quarter of the year. As of June 30, 2020, the net impact before taxes totals EUR 185 million.

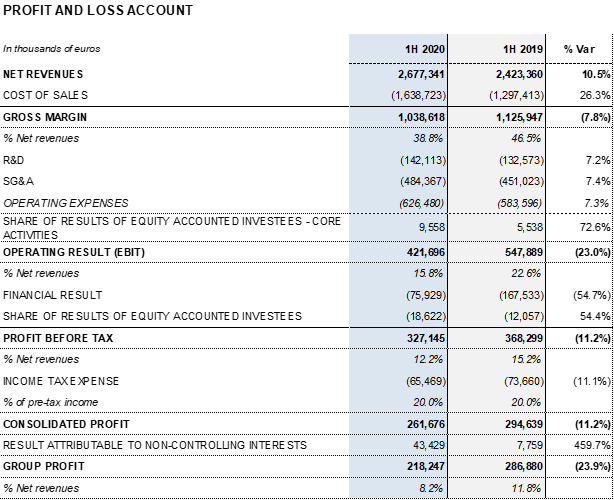

The gross margin reported stands at 38.8% for the first half of the year. The gross margin core2 is 47.2% (47.6% in the same period in 2019). The gross margin core of the second quarter is 47.7%.

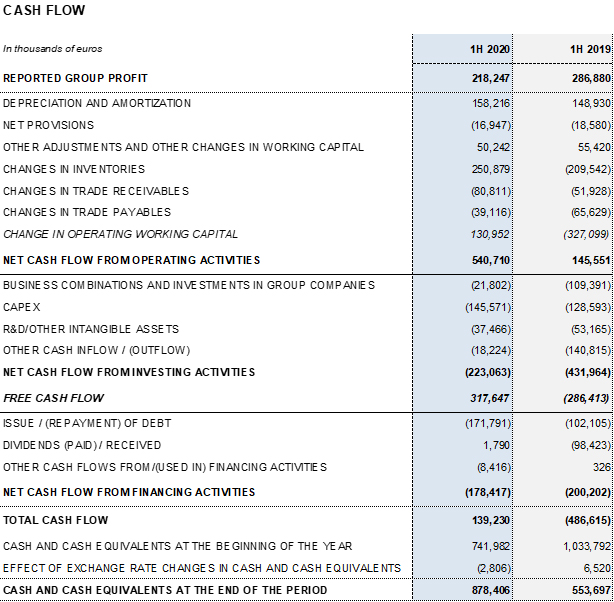

Reported EBITDA amounted to EUR 579.9 million, representing a 21.7% margin. EBITDA core2 totaled EUR 731.4 million (EUR 661.7 million in the first half of 2019), which denotes 28.0% over revenues (28.6% in the second quarter) (28.1% in the first half of 2019; 29.3% in the second quarter of 2019).

R+D+i and CAPEX investments totaled EUR 312.4 million (EUR 296.3 million as of June 30, 2019), underscoring the company’s growth strategy on the basis of a sustainable and long-term business model.

As part of its longstanding social commitment, Grifols continues to promote its research efforts to help combat COVID-19. Total net R+D+i investments amounted to EUR 166.8 million (EUR 167.7 million in the first half of 2019) taking into account in-house, external and investee-led projects.

The company is spearheading a project to develop an immunoglobulin with SARS-CoV-2 antibodies using plasma from recovered COVID-19 patients. The production of a potential passive immunization therapy is already underway in Grifols’ Clayton (North Carolina, USA) facility, which has been specifically designed to process specialty immunoglobulins.

Grifols also continues to advance on a clinical trial in Spain to assess the efficacy of high-dose intravenous immunoglobulin to stabilize or improve the health of COVID-19 patients, as well as several studies on the potential benefits of convalescent plasma.

Furthermore, Grifols has allocated EUR 145.6 million (EUR 128.6 million in the first half of 2019) to capital investments (CAPEX). The start of the validation process of the new fractionation plant in Clayton, with a capacity to fractionate 6 million liters of plasma per year is noteworthy. The company is on schedule with the initial timetable and expects the facilities to be operational by the first quarter of 2021.

The financial result was EUR 75.9 million in the first half of the year. This result includes the EUR 47 million reduction in financial expenses due to the debt refinancing process that was closed in November 2019; the negative impact of EUR 10.8 million due to exchange rate variations; and the positive EUR 56.5 million impact from the accounting recognition related to the investment at the closing of the Shanghai RAAS transaction in the first quarter of 2020.

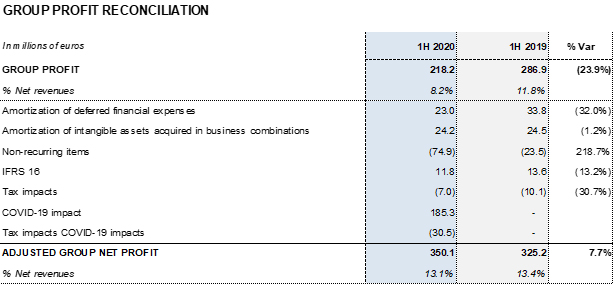

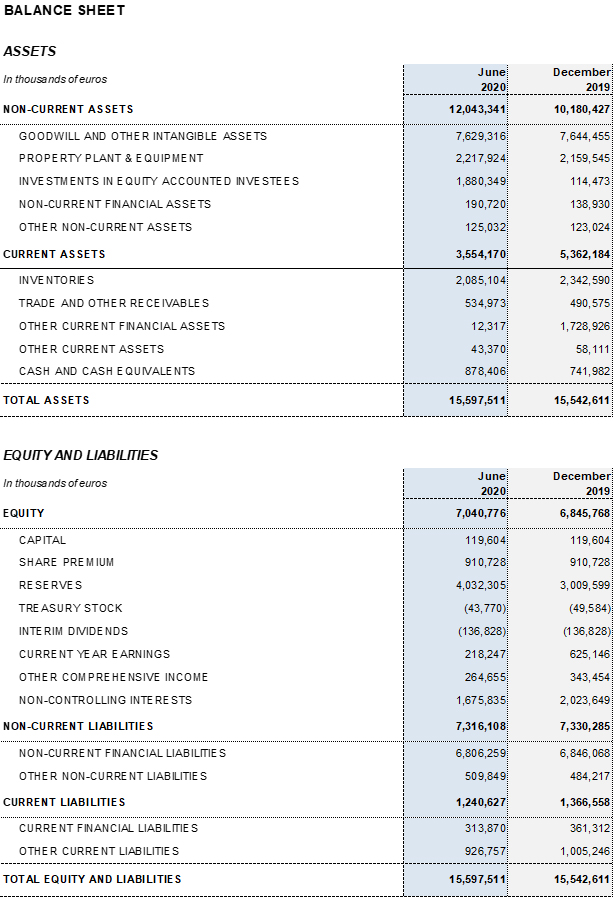

Reported net profit totaled EUR 218.2 million, mainly affected by COVID-19 impacts. As of June 30, 2020, adjusted net profit amounts to EUR 350.1 million (EUR 325.2 million in 2019).

Excluding the impact of IFRS 163, the net financial debt totaled EUR 5,501.9 million and the net financial debt over EBITDA ratio was 4.43 times. Excluding the net impact of COVID-19, the ratio stood at 3.85 times.

In the second quarter of 2020, Grifols took additional measures to strengthen its liquidity position, which includes the upsizing of its multicurrency revolving credit facility from US$ 500 million to US$ 1,000 million, with maturity in November 2025. The expansion of this credit facility will not increase the company’s indebtedness and its terms and conditions are in line with the ones signed in November 2019, when Grifols completed its debt refinancing process.

As of June 30, 2020, Grifols’ cash positions reached EUR 878.4 million which, when added to EUR 1,000 million in undrawn lines of credit, bring its liquidity position to approximately EUR 1,900 million.

After the refinancing process closed in November 2019, Grifols does not face significant maturity repayments or down payments until 2025.

The company is equipped to respond to the demands of the current context and remains committed to its long-term growth strategy.

PERFORMANCE BY DIVISION

Bioscience Division

The Bioscience Division maintained its upward trend in the first half of the year and continued to serve as the company’s main engine for growth, expanding 12.4% (10.2% cc) to

EUR 2,158.9 million. Sales grew by 11.4% (9.5% cc) in the second quarter, fueled by robust demand for the main proteins, especially immunoglobulins and albumin, as well as new product launches such as Xembify® and VISTASEALTM.

Demand for immunoglobulins in markets with the highest consumption per capita remains very solid, with double-digit growth. In recent years, Grifols has made a concerted effort to expand its product portfolio to meet the evolving needs of patients, offering a range of immunoglobulins delivered in both intravenous and subcutaneous administration routes.

Alpha-1 antitrypsin continues as one of the division’s main drivers and maintains positive sales performance in countries such as the U.S. Furthermore, the company continues its efforts to offer new products and presentations. In the second quarter of the year, the FDA approved Prolastin®-C Liquid in 0.5g- and 4g-sized vials. At present, Grifols has three presentations to adapt to patients’ treatment needs.

Albumin sales grew significantly in China, despite the decline in the first two months of the year in the wake of COVID-19.

Also worth mentioning are the sales of biological sealant, developed and manufactured by Grifols as a surgical bleeding-control solution using a combination of two plasma proteins (fibrinogen and thrombin). Launched in the last quarter of 2019, this fibrin sealant is sold and distributed by Ethicon under the trade name VISTASEALTM.

Diagnostic Division

The Diagnostic Division reached EUR 340,0 million in revenues in the first half of 2020, falling 2.5% (-3.6% cc) from the EUR 348.7 million reported in the same period in 2019.

Sales of NAT technology systems (Procleix® NAT Solutions), which uses Transcription Mediated Amplification (TMA) to screen blood and plasma donations, were impacted by the COVID-19 outbreak. This led to a decline in blood and plasma donations, particularly in the U.S.

Nevertheless, Grifols’ unique diagnostic test to detect SARS-CoV-2 is making positive progress. TMA is a commonly used technique in transfusion centers, blood banks and plasma centers around the world due to both its high sensitivity and capacity to automatically manufacture large volumes of samples.

Grifols continues its efforts to offer innovative solutions that optimize the productivity and improve the operations of its blood banks. In the second quarter, its Procleix Panther® system, equipped with Automation Ready Technology (ART), received FDA approval for use in the U.S. with approved screening systems for HIV, Zika, hepatitis C and hepatitis B, among others. As of October 2019, this system will also be available in all markets that accept the European CE mark.

The blood-typing line, which includes both analyzers (Erytra®, Erytra-Eflexis® and Wadiana®) and reagents (DG-Gel® cards, red blood cells and anti-serums), grew in the most important markets in the first half of 2020, especially in China, the United States and Turkey.

Hospital Division

The Hospital Division reported EUR 57.9 million in revenues in the first half of 2020, a reduction of 8.8% (-8.0%) as a result of lower hospital investments observed in the second quarter due to COVID-19. The main lines of businesses that were impacted are Pharmatech, as well as intravenous solutions and medical devices. This decline was partially offset by an upturn in sales of third-party manufacturing services.

Bio Supplies Division

The Bio Supplies Division totaled EUR 126.7 million in the first six months of the year, a 21.6% (19% cc) increase from the same period in the previous year.

The division primarily oversees the sale of biological products for non-therapeutic use, which reported a notable increase in sales. It also includes third-party plasma sales by Haema and Biotest, which totaled EUR 65.7 million in the first half of the year (EUR 28.9 million in the second quarter of 2020).

INVESTMENT OPERATIONS: R+D+I, ACQUISITIONS AND CAPEX

Results of Grifols’ AMBAR clinical trial published in Alzheimer's & Dementia: The Journal of The Alzheimer’s Association

Alzheimer's & Dementia: The Journal of the Alzheimer's Association, the prestigious peer-reviewed scientific journal, has published the results of Grifols’ AMBAR study. This clinical trial was designed to assess the effects of plasma protein replacement therapy in patients experiencing either mild or moderate stages of Alzheimer's disease (AD).

The findings of the AMBAR clinical trial demonstrate a delay in the cognitive and functional decline in AD patients when their plasma is replaced with albumin and immunoglobulin (plasma-derived proteins) following the process of plasma extraction, using the plasmapheresis technique. The results reveal a positive impact in reducing the progression of Alzheimer's symptoms in patients treated over a 14-month period compared to untreated patients.

The publication reflects more than 15 years of Grifols’ research and reinforces the potential for plasma therapies to treat complex diseases.

First manufactured batches of anti-SARS-CoV-2 hyperimmune immunoglobulin for clinical trials

Grifols has completed the first manufactured batches of its anti-SARS-CoV-2 hyperimmune immunoglobulin and they have been delivered to be used in clinical trials. This medicine specifically targets SARS-CoV-2 by providing passive immunity to infected patients and boosting their immune system’s ability to fight the disease. The therapy, which could be used for both prevention and immediate treatment of COVID 19, will undergo clinical trials this summer to test its safety and efficacy. The anti-SARS-CoV-2 hyperimmune immunoglobulin has the potential to be a highly specific, pure and safe medicine that delivers a high and consistent concentration of protective antibodies against the novel coronavirus.

Since April, Grifols has moved quickly to collect COVID-19 convalescent plasma for its anti-SARS-CoV-2 hyperimmune immunoglobulin in more than 245 Grifols U.S. donation centers from donors who have met the highest eligibility criteria. Their plasma, rigorously tested and quality controlled, had high levels of anti-SARS-CoV-2 neutralizing antibodies.

Grifols is applying its vast expertise in epidemic settings to combat the current pandemic. During the last Ebola outbreak in Liberia in 2014, it collected convalescent plasma and activated its special facility in Clayton, North Carolina, purposely built, equipped and staffed to produce medicines for infectious diseases.

The efforts form part of a collaboration agreement with U.S. government entities, including the Food and Drug Administration (FDA), the National Institutes of Health (NIH) and the Biomedical Advanced Research Development Authority (BARDA), among other healthcare agencies.

In addition to controlled clinical trials in the U.S., Grifols is working on a European clinical trial of a hyperimmune immunoglobulin using convalescent plasma collected in Europe.

Strategic agreement to acquire a fractionation facility and two purification facilities in Canada, along with 11 U.S. plasma centers

In July 2020, Grifols agreed to acquire the South Korean GC Pharma Group's plasma fractionation facility and two purification plants in Montreal and 11 U.S. plasma collection centers for a total transaction amount of US$ 460 million.

The transaction is part of Grifols’ sustainable global growth strategy to expand plasma collection and fractionation capacity to ensure patients worldwide have safe and secure access to life-saving plasma-derived medicines. Most importantly, this strategic acquisition will strengthen Grifols’ presence in Canada, building on a legacy of partnership in Canada’s blood system.

For more than three decades, Grifols has been a fractionator of Canadian plasma under contract manufacturing services, providing trusted plasma-derived medicines for Canadian patients and their healthcare providers. Throughout these many years, Grifols has gained firsthand knowledge of the Canadian healthcare system. This transaction further demonstrates Grifols’ commitment to supporting domestic self-sufficiency and security of plasma-protein product supply.

No additional financing will be required for the acquisition. Once the facilities are fully licensed and approved, Grifols will become the only large-scale commercial manufacturer of plasma products in Canada, with a fractionation capacity of 1.5 million liters annually. Grifols plans to be ready to manufacture IVIG and Albumin in these facilities in order to supply the Canadian market starting in 2023.

As part of this transaction, by means of a plasma-supply agreement, Grifols has also committed to supplying a certain output of plasma coming from the Green Cross Collection Centers to GC Pharma (Group) for a 24-month period. The collection centers achieved a collection volume of 350,000 litres of plasma in 2019.

The completion of the transaction is subject to regulatory approvals and is expected to close prior to the end of 2020.

Collaboration and license agreement with Rigel Pharmaceuticals

In line with its strategy to enhance its product portfolio through licensing agreements of complementary medicines, Grifols began distributing TAVLESSE® (fostamatinib) in July 2020 for the treatment of chronic immune thrombocytopenia (ITP) in adult patients refractory to other treatments.

The product is already available in Germany and the United Kingdom, with a phased rollout planned over the next 18 months across the rest of Europe.

Grifols has exclusive commercial rights in Europe and Turkey for ITP and all future indications after signing a collaboration and license agreement with the U.S. biotech firm Rigel Pharmaceuticals in January 2019.

Capital investments to guarantee sustainable growth

Grifols’ R+D+i and CAPEX investments sustain and emphasize the companies’ commitment to growth and long-term vision, as well as its continued efforts to contribute to mitigating the healthcare emergency triggered by COVID-19.

The company announced plans to invest EUR 130 million to the first phase towards expanding its Barcelona plant. It purchased a 47,274 m2 plot to build a Bioscience Division plant and expand the manufacturing, logistical and research capacity of the Diagnostic Division. Moreover, Grifols plans to invest more than US$ 350 million in the Clayton industrial complex for the construction of a new plasma fractionation plant, a logistics warehouse, and service infrastructures.

NON-FINANCIAL INFORMATION: COMMITMENT TO EMPLOYEMENT, ENVIRONMENTAL MANAGEMENT SOCIAL INITIATIVES

Grifols remains committed to employment

Employees have always been a top priority at Grifols. Hence, since the onset of the pandemic, the company adopted all necessary prevention measures recommended by global health authorities to guarantee employees’ safety in all of its facilities.

Grifols’ commitment to its workforce translated into a range of initiatives that allowed the company to continue operations in its centers and manufacturing facilities. Among these initiatives, the flexibility agreements via shifts and teleworking in non-manufacturing roles via the use of video-conferencing platforms and other work-from-home tools are most remarkable. Thanks to these measures, the company has been able to avoid temporary staff lay-offs in all of its operating countries.

A contingency plan and de-escalation “return to normality” plan was also implemented, maintaining the organizational and safety measures. As part of this plan, employees in Spain underwent two rounds of COVID-19 tests, including analyses to detect the virus and antibodies, and a standardized sampling procedure that was rolled out in most of Grifols’ subsidiaries.

Grifols’ workforce grew by 1% in the first half of 2020 compared to the same period in 2019, reaching 24,162 employees. Especially noteworthy are the increases in the rest of the world (ROW), which expanded by 7% to 2,560 employees and Spain, where the workforce grew 6% to 4,383 professionals. In North America, the employee base fell by 1.5% to 17,219 people.

Average seniority at Grifols is 5.9 years and the average employee age is 38 years. The company promotes equal opportunity between men and women. As of June 30, 2020, men make up 40% of the employee base and women, 60%.

Grifols was also able to continue offering employee development and leadership initiatives thanks to its digital transformation process that was implemented in recent years. In this regard, the company reported an average of 47 training hours per employee in the first half of 2020.

Environmental management

Grifols approved its 2020-2022 Environmental Program during the first six months of the year. This plan builds on the corporate commitments established for 2030, which include reducing CO2 emissions by 40%, improving energy efficiency by 15% and obtaining 70% of electricity from renewable energy sources, among other objectives.

Among all of the actions developed in the first half of 2020, two of them stand out: first, the installation and operational launch of a 100 kW photovoltaic plant in Grifols’ industrial complex in Las Torres de Cotillas (Murcia), which will cut CO2 emissions by 39 annual equivalent tons; and second, a feasibility study on the purchase of green energy carried out through a Power Purchasing Agreement (PPA) in Spain.

Energy audits were also conducted in Haema’s installations in Germany, including its donation centers, laboratories and headquarters.

Also important to note in the first half of the year was the conferral of the Green Globes certificate to the new fractionation plant in Clayton, awarded by the Green Building Initiative (GBI). This building emits 1,500 tons less of CO2 equivalent per year than a standard building.

Grifols also signed a collaboration agreement with the RIVUS Foundation for 2020-2022 to protect the biodiversity of the land surrounding the Besòs and Tordera rivers (Barcelona, Spain).

Lastly, Grifols’ facilities in Spain satisfactorily passed the ISO 14001 recertification audits for Environmental Management Systems in the first half of the year. The audit for the Bioscience Division in the Los Angeles (California, USA) facilities had to be postponed until 2021 due to COVID-19 restrictions.

Social initiatives

From the start of the pandemic, Grifols has continuously mobilized human and financial resources to support food campaigns and provide technical and logistical assistance to hospitals for the storage, preparation and dispensing of medicines in addition to offering support to remodel and expand facilities to treat COVID-19 patients. The company also made several donations of personal protective equipment in the countries most afflicted by the pandemic such as Spain and the United States.

At the same time, Grifols’ Probitas Foundation distributed more than 1,000 prepaid grocery cards across 24 municipalities in Cataluña, Madrid and Murcia to families with minors. The initiative was carried out by Grifols’ Probitas Foundation within the framework of its Child Nutrition Support Program to ensure children had access to at least one meal a day while school lunchrooms are closed.

1Constant currency (cc) excludes exchange rate fluctuations over the period.

2Excludes non-recurring items, including COVID-19 and plasma sold to third parties impacts from Haema and Biotest.

3As of June 30, 2020, the impact of IFRS 16 on total debt was EUR 739.9 million.