Barcelona, Spain – May 12, 2025 – Grifols (MCE:GRF, MCE:GRF.P, NASDAQ:GRFS), a global healthcare company and leading manufacturer of plasma-derived medicines, today confirmed that its reported first quarter 2025 financial results are ahead of plan, contributing to record results across key financial metrics for the last twelve months (LTM). Grifols remains focused on the continued execution of its strategic plan and reaffirms its guidance for FY2025.

Due to the impact of the Inflation Reduction Act on its financial results, Grifols expects to share greater detail in 2025 giving investors and analysts further visibility on its actual performance and underlying momentum. As a result, for 2025, Grifols expects to show both reported figures and LFL2 figures to make them comparable to previous quarters. LFL figures adjust for the impact on Biopharma performance of both the Inflation Reduction Act Medicare Part D Redesign (IRA) and the Fee-for-Services reclassification in Q4’24.

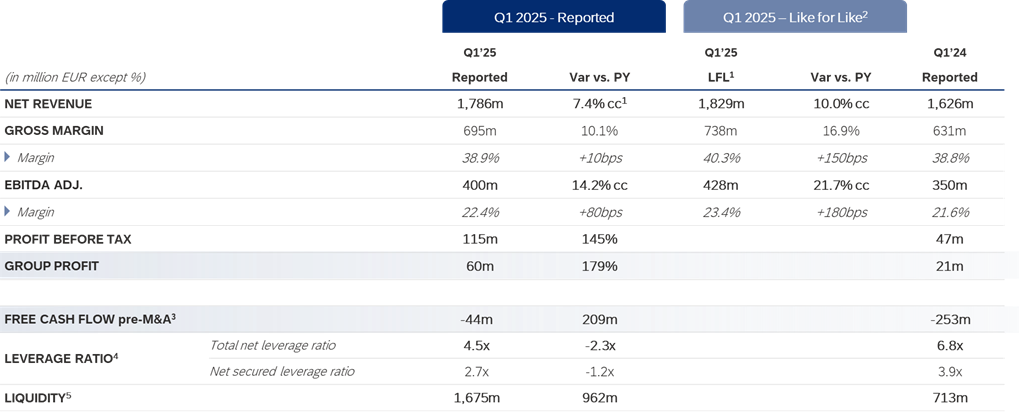

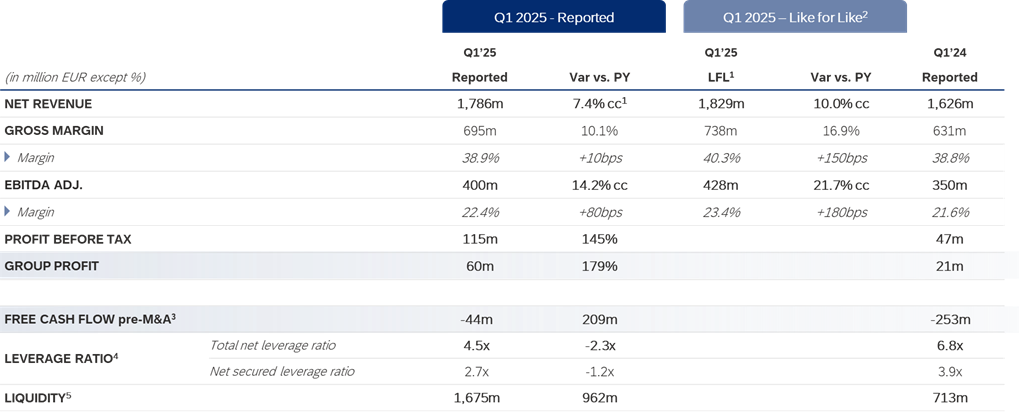

In the first quarter of 2025, total revenue grew to EUR 1,786 million, a year-over-year increase of 7.4% cc and 10.0% cc LFL. Biopharma revenue reached EUR 1,521 million versus the prior year quarter, up 6.6% cc and 9.6% cc LFL. The segment’s growth was largely driven by an increase in immunoglobulin (IG) franchise revenue of 13.2% cc and 17.5% cc LFL, with strong momentum across both IVIG (+13.5% cc LFL) and SCIG (XEMBIFY®) (+98.9% cc LFL).

Albumin revenue decreased by 9.4% cc and 8.9% cc LFL due to a planned imported drug license renewal process in China, impacting phasing in Q1’25. This standard renewal process has been successfully completed, allowing for the resumption of shipments as planned.

Revenues from alpha-1 and the specialty proteins line performed well, with a 1% cc and 2.3% cc LFL growth over the previous year, as alpha-1 growth was partially offset by the phasing of rabies.

Diagnostic revenue grew by 5.2% cc to EUR 170 million. This performance was driven by Molecular Donor Screening (MDS) growth outside the U.S., joint business volume growth of Immunoassay and Blood Typing Solutions (BTS) expansion across Grifols’s core markets.

Gross margin in Q1’25 stood at 38.9% and 40.3% LFL. Reported gross profit reflects the impact of IRA and the Fee-for-Service reclassification, as well as by lower sales of albumin and rabies. Despite the temporary phasing impact of albumin and Rabies, like-for-like, gross profit increased by 150bps compared to Q1’24.

Adjusted EBITDA grew to EUR 400 million (22.4% margin), an increase of 14.2% cc and 21.7% cc LFL. Reported EBITDA grew by 22.6% cc to EUR 381 million, a margin increase of 220 basis points to 21.3%, demonstrating the continuing convergence of reported to adjusted EBITDA.

Group profit grew to EUR 60 million, an increase of 179%.

Free Cash Flow pre-M&A for the first quarter delivered an increase of EUR 209 million versus Q1’24, driven primarily by improved working capital management across the supply chain and EBITDA expansion.

At the end of Q1’25, the leverage ratio and net financial debt, as defined in the Credit Facility, stood at 4.5x and EUR 8,149 million, respectively, with a strong liquidity position of EUR 1,675 million. Unlike prior years where Q1 typically led to a releveraging, in Q1’25 leverage improved versus FY’24 - underscoring the strength and normalisation of Grifols´ business performance.

Nacho Abia, Chief Executive Officer, commented: “Building on our record-setting performances in 2023 and 2024, our first quarter clearly demonstrates continued momentum as we focus on executing our strategic plan. Healthy underlying demand in Biopharma and across all parts of our business, coupled with strong operational execution, positions Grifols for consistent growth throughout 2025. While we continue to monitor evolving macroeconomic and policy developments, the long-established Grifols strategy of being local in our largest markets, where we have established self-sufficient, regional plasma ecosystems with vertically integrated operations, helps to better insulate us from broader marketplace challenges.”

Rahul Srinivasan, Chief Financial Officer, said, “Amid a dynamic macroeconomic environment, our business continues to demonstrate strong momentum, reinforcing our confidence in the full year outlook. We remain focused on disciplined execution – delivering for our patients and customers, capitalizing on the secular growth across our core markets, and translating that strong growth into sustained improvement of free cash flow generation.”

2025 Guidance

Grifols reaffirms its guidance for 2025 as disclosed at its Capital Markets Day on February 27, 20256

Key Financials

Alternative Performance Measures (APMs)

This document contains the following Alternative Performance Measures (APMs): Consolidated EBITDA Reported, Consolidated EBITDA Adjusted, Like-for-Like, Leverage Ratio as per the Credit Facility, Net Debt as per the Credit Facility, Free Cash Flow, Working Capital, and non-recurring items. For further details on the definition, explanation on the use, and reconciliation of APMs, please see the Appendix of the Presentation as well as the “Alternative Performance Measures” document from Grifols website www.grifols.com/en/investors.

CONFERENCE CALL

Grifols will host a conference call today, May 12, 2025, at 6:30pm CET/12:30pm EST to provide review of the company’s business results for the first quarter of 2025. To view and listen to the webcast and view the presentation, click on Grifols Q1 2025 Financial Results or visit the website www.grifols.com/en/investors. Participants are advised to register in advance of the conference call.

----------

1 Operating or constant currency (cc) excludes changes rate variations reported in the period.

2 Like For Like (LFL) excludes the impact of IRA (EUR 28 million) and Fee-For-Service / GPO reclassification (EUR 15 million). See Annex for reconciliations.

3 Free Cash Flow includes cash from operating activities + cash flow from investing activities, both as per International Financial Reporting Standards (IFRS), and excludes lease payments.

4 Defined as per the Credit Agreement.

5 Cash and cash equivalents of €753m + unused credit facilities €1,318m - unused RCF facilities maturing in Nov 2025 c€396m.

6 Please refer to 2025 Guidance (including the impact of IRA) on page 38 of the Capital Markets Day Presentation (27 Feb 2025).