Barcelona, Spain – July 29, 2025 – Grifols (MCE:GRF, MCE:GRF.P, NASDAQ:GRFS), a global healthcare company and leader in plasma-derived medicines, today announced results for the first half of 2025, driven by a second quarter marked by continued improvements across key operational and financial metrics. These results reflect the ongoing execution of Grifols’ Value Creation Plan.

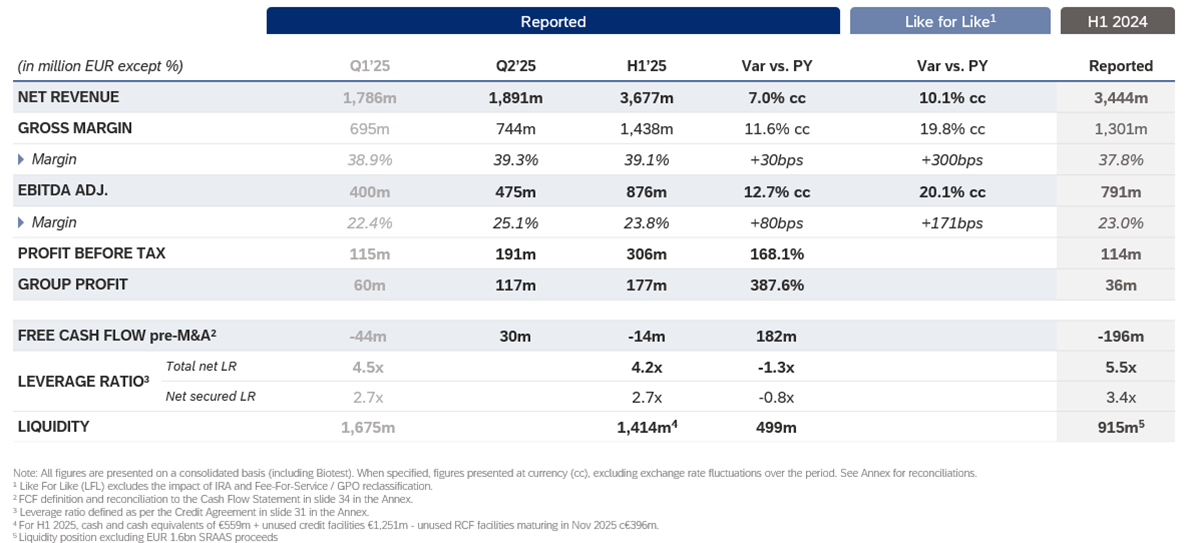

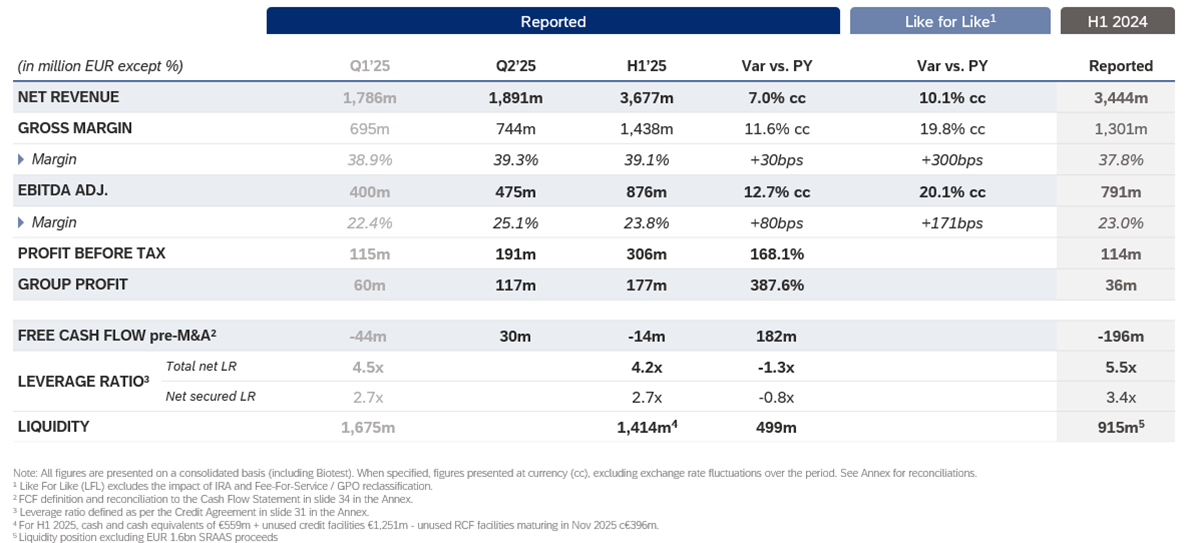

Revenues for the first half of the year grew by 7.0% cc to EUR 3,677 million, driven by the performance of the Biopharma business, which increased by 8.2% cc. Adjusted EBITDA reached EUR 876 million, up by 12.7% cc year-over-year, representing a 23.8% margin, supported by product mix, continuous improvement initiatives and operational leverage. Net profit surged to EUR 177 million, reflecting a 387.6% increase compared to the same period of 2024.

Free cash flow pre-M&A significantly improved to positive EUR 30 million in the second quarter, resulting in minus EUR 14 million for the first half of the year. This represents a EUR 182 million year-over-year improvement, mainly driven by EBITDA growth, working capital management and reduced interest costs.

Grifols further strengthened its financial position, reducing its leverage ratio to 4.2x, down from 4.5x in the previous quarter and 5.5x in the first half of 2024, with a liquidity position of EUR 1.4 billion. The company remains focused on continuing to improve its credit profile.

As part of its capital allocation framework, Grifols successfully completed the delisting of Biotest from the Frankfurt Stock Exchange and increased its equity stake to 80.32%. This transaction, with a total cost of EUR 108 million, was fully funded through available financial resources.

The company declared a EUR 0.15 per share dividend payment supported by continued underlying earnings and free cash flow generation momentum. This reflects the company’s strong commitment to shareholder returns.

Nacho Abia, CEO of Grifols, said: “The company’s strong performance in the first six months of 2025 reflects the solid execution of our Value Creation Plan. The momentum of the business is clear: in a context of strong underlying demand, we continue to capitalize on the strength of our Biopharma business unit while advancing on key priorities.”

Nacho Abia added: “While the value creation will ultimately benefit our shareholders, we continue to be fully committed to developing solutions that address patients’ needs - a priority that has defined Grifols for more than 116 years.”

Rahul Srinivasan, CFO of Grifols, said: “The company's strong first-half performance underscores both the attractive fundamentals and resilience of our business. We remain resolutely focused on leveraging the strengths of our business model and disciplined execution, capitalizing on our underlying momentum and operational focus to deliver on our deleveraging and free cash-flow generation priorities, whilst reinforcing the strong confidence in the company’s long-term value.”

On the exposure and potential impact of trade tariffs, the company is well-prepared, thanks to a locally operated and vertically integrated business model. Since its international expansion over 30 years ago, Grifols has invested consistently in a global network of donation, processing, and distribution centers for plasma-derived medicines, allowing it to operate locally in the United States, Europe, Egypt, and Canada. The integration minimizes the need for imports and/or exports within the U.S. market and also strengthens its flexible and resilient structure in the face of regulatory changes or new tariffs.

Biopharma drives strong growth in the first half of 2025

Biopharma revenue grew by 8.2% cc, led by continued momentum in the immunoglobulin (IG) franchise, while Alpha-1 continued to gain traction. Specifically, IG revenues rose by 12.5% cc, with strong growth in both its intravenous form (IVIG), which outpaced market growth, and subcutaneous form (SCIG), which delivered 66% cc in the first part of 2025. Grifols continues to consolidate its leadership in key indications such as primary and secondary immunodeficiencies and CIDP.

Albumin posted sequential improvement in Q2 2025, following license renewal in China. The 1.3% cc growth in this quarter resulted in a first half performance of minus 3.7% cc.

Revenues from Alpha-1 and Specialty proteins continued to perform positively, growing 4.8% cc in the first half of the year. Alpha-1 continues to benefit from the company’s leading 70% global market share. As part of this protein’s commercial growth strategy, the SPARTA study and the subcutaneous formulation trial for Alpha-1 are progressing as planned.

Grifols maintains its plan to launch fibrinogen in Europe in the fourth quarter of 2025 and in the United States in the first half of 2026, following FDA approval.

Diagnostic business maintains positive momentum

Diagnostic revenues reached EUR 332 million, an increase of 2.8% cc, driven by Molecular Donor Screening (MDS) across EMEA and Asia-Pacific, as well as solid performance in Blood Typing Solutions (BTS) in key countries. Noteworthy is the FDA approval to begin manufacturing Gel Cards and reagent Red Blood Cells at Grifols’ San Diego facility.

Grifols reaffirms 2025 guidance and improves the Free Cash Flow pre-M&A guidance

As Grifols enters the second half of 2025 with strong underlying momentum across its core businesses, the company reaffirms its 2025 guidance shared during its Capital Markets Day on February 27, 2025, and improves the guidance for Free Cash Flow pre-M&A guidance to EUR 375-425 million.

While the recent depreciation of the U.S. dollar presents a headwind to reported Revenue and EBITDA in the second half, the impact on Group Profit, leverage and Free Cash Flow pre-M&A is expected to be broadly neutral. The Group expects to largely mitigate this headwind through a combination of the benefit of underlying business momentum and targeted cost levers.

1 Operating or constant currency (cc) excludes changes rate variations reported in the period.

2 Free Cash Flow includes cash from operating activities + cash flow from investing activities, both as per International Financial Reporting Standards (IFRS), and excludes lease payments.

3 Defined as per the Credit Agreement.

4 Cash and cash equivalents of €559m + unused credit facilities €1,251m - unused RCF facilities maturing in Nov 2025 c€396m.

5 Please refer to 2025 Guidance on page 38 of the Capital Markets Day Presentation (27 Feb 2025).